The Valutico Blog

Keep up with Valutico and read about the latest developments on the product, team, and company here.

Valuation Using Multiples—What Is It and How Does It Work? Core Ideas Explained

Valuation Using Multiples – What Is It and How Does It Work? Core Ideas Explained Valuing a business using ‘multiples’ is a common method for determining how much a business is worth. Below, we outline what this method is, the different ways it works [...]

Can Salesforce return to its former lofty heights, after slumping 50% from its all time high?

Salesforce Inc. Weekly Valuation - Valutico | 6 December 2022 Link to detailed valuation. About Salesforce Salesforce is a US-based software company, specializing in customer relationship management technologies. The market leader for CRM software is currently trading at around $133 per share, down more than [...]

Will the IPO of ABB’s E-Mobility division give the share price a new boost?

ABB Ltd. Weekly Valuation - Valutico | 28 November 2022 Link to valuation About ABB ABB is a Swiss-based technology company, active in the fields of electrification, robotics, automation and motion with software. The company has now been in existence for more than 130 years [...]

Will Home Depot continue to benefit from the COVID-era high DIY demand?

Home Depot Inc. Weekly Valuation - Valutico | 21 November 2022 Link to valuation About Home Depot Home Depot is a US-based home improvement retailer, with over 2,300 stores across North America. The firm employs roughly 500,000 people and had sales of $151.2 billion [...]

Will TotalEnergies keep on outperforming all indices this year?

TotalEnergies SE Weekly Valuation - Valutico | 14 November 2022 Link to detailed valuation About TotalEnergies TotalEnergies is a French company covering the total oil and gas supply chain, as well as operating as a chemicals manufacturer and a builder of solar plants and [...]

How will bruised Adidas cope with additional bad publicity?

Adidas AG Weekly Valuation - Valutico | 7 November 2022 Link to detailed valuation About Adidas Adidas AG, is a German sports and lifestyle apparel company, specializing in designing, developing and manufacturing footwear, sports apparel and accessories. Two weeks ago the firm announced that [...]

How low will the former Chinese highflyer, Alibaba, go?

Alibaba Group Holding Ltd. Weekly Valuation - Valutico | 28 October 2022 Link to detailed valuation About Alibaba Alibaba is a Chinese technology company, participating in the local and international e-commerce, cloud and the digital media markets. Alibaba's share price is currently under heavy pressure, [...]

Can CD Projekt bounce back to anywhere near its all time highs?

CD Projekt S.A. Weekly Valuation - Valutico | 21 October 2022 Link to detailed valuation About CD Projekt CD Projekt is a polish distributor and publisher of computer games. After multiple delays, the last of which resulted in angry gamers making death threats to some [...]

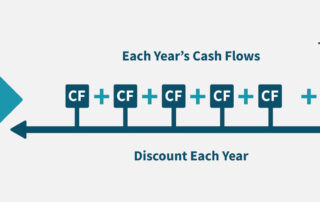

Discounted Cash Flow Analysis—Your Complete Guide with Examples

Discounted Cash Flow Analysis—Your Complete Guide This complete guide to the discounted cash flow (DCF) method is broken down into small and simple steps to help you understand the main ideas. We’ll walk you through what a discounted cash flow analysis is, what it [...]

Capitalized Earnings Method Launches

Valutico Launches Method to Value Companies with Stable Earnings Popular Valuation platform announces launch of new method for valuing businesses with stable earnings Favored by business brokers, the capitalized earnings method is often used to help determine a valuation in the selling and buying of [...]

Porsche AG – worth an investment after the recent IPO?

Dr. Ing. H.C.F. Porsche AG Weekly Valuation - Valutico | 17 October 2022 Link to detailed valuation About Porsche The Dr. Ing. H.C.F. Porsche AG is well known all over the globe for its sports and luxury cars, especially for its legendary Porsche 911. The [...]

Will HP shape the way of remote working with a new merger?

HP Inc. Weekly Valuation - Valutico | 7 October 2022 Link to the detailed valuation About HP HP Inc. is a US-based computer technology firm that develops PCs, laptops, and printers. The company also offers 3D printing solutions and sells related hardware products. [...]

Lockheed Martin – cheapest gun in the West

Lockheed Martin Corporation Weekly Valuation - Valutico | 30 September 2022 Link to the detailed valuation Lockheed Martin Corp. is a US defense contractor. The company researches, develops, designs, manufactures, integrates, and operates technology systems, products, and services in the defense industry. Founded in 1995, [...]

5 Simple Sense-Checks That Vastly Improve Your Business Valuation (According to The Experts)

5 Simple Sense-Checks That Vastly Improve Your Business Valuation (According to Our Experts) It’s easy to get tripped up by assumptions when valuing a business, especially if you’re in a hurry to produce results. That’s why performing the right sense-checks can help you determine [...]

Is Adobe’s $20 billion acquisition of Figma good for shareholders?

Adobe Inc. Weekly Valuation - Valutico | 19 September 2022 We valued Adobe in March this year, at a time when it reported disappointing Q1 earnings and its share price had been down 25% year-to-date. We commented at the time that Adobe was experiencing [...]