Private Company Valuations

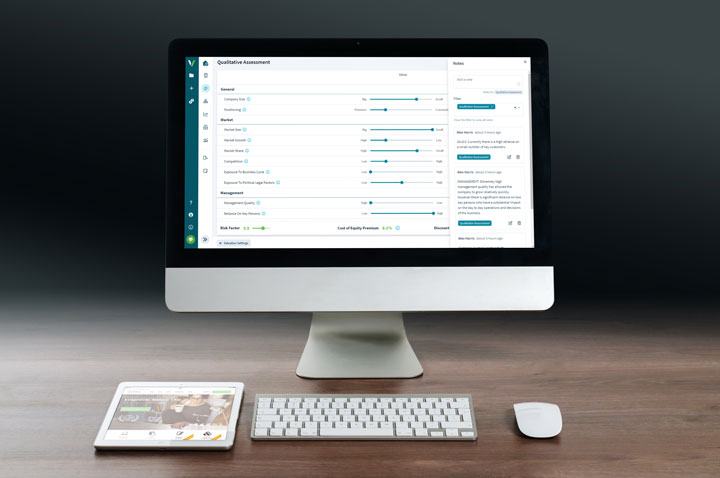

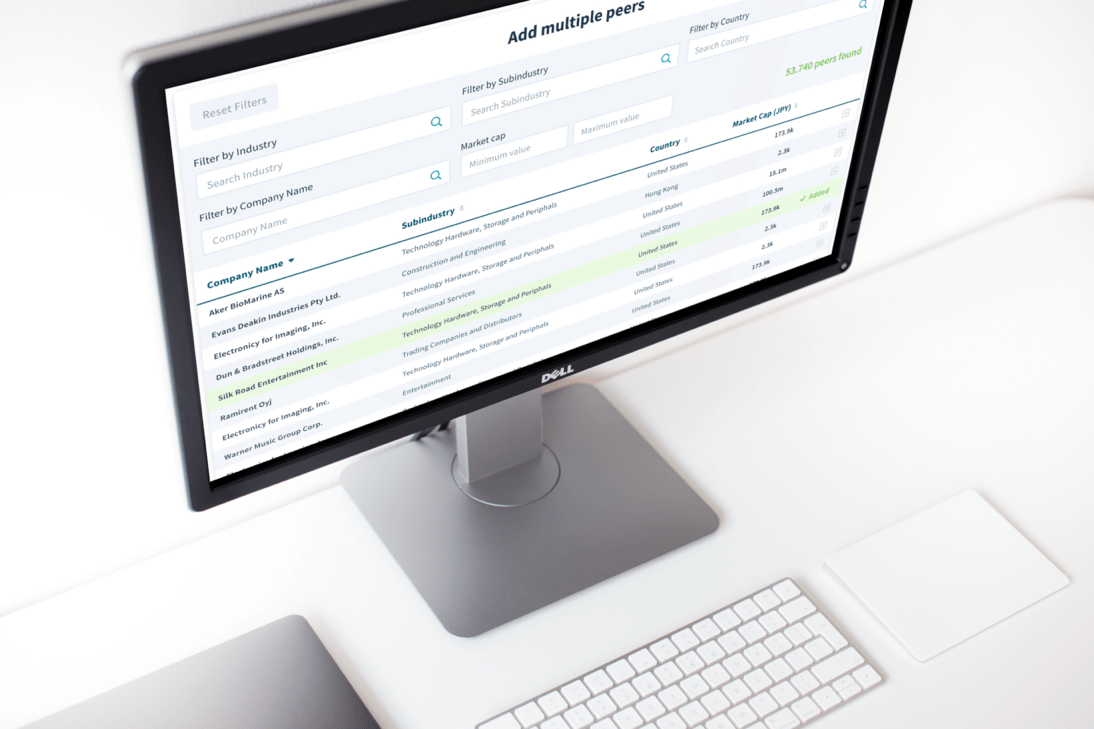

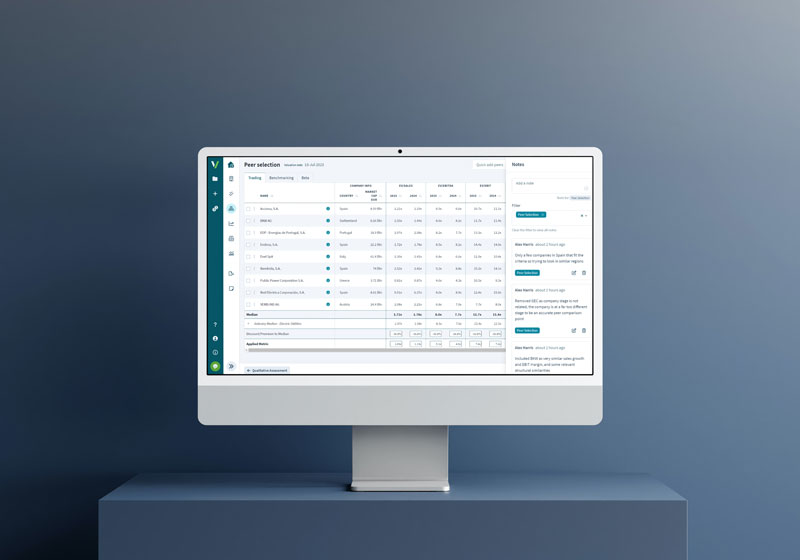

Valuing a private company requires insight into the market across the entire Private Equity, M&A, and even Venture Capital landscape, as well as a lot of supporting data from public markets. The process can take up a lot of valuable time, especially if re-inventing the wheel for every project, relying on spreadsheets, and sourcing data from disparate sources. Valutico speeds up your process by allowing you to:

Measure value with Valutico

Valutico is the world‘s leading provider of web-based company valuation tools.

Best in class financials models with automated or guided assumptions.

Market data refreshed daily and streamed directly into the model.

Single source of truth for your team.

Easily share read-only web views of any business valuation.

Built-in flexibility with easily adjustable global parameters and scenarios.

Collaborative and natively compatible with your existing workflows and tools

Custom Spreadsheet Models

Bespoke time consuming work to start any project.

No audit trail of changes.

File-based sharing with broken dependencies.

Flexibility introduces model-breaking risks.