Lockheed Martin Corporation

Weekly Valuation – Valutico | 30 September 2022

Link to the detailed valuation

Lockheed Martin Corp. is a US defense contractor. The company researches, develops, designs, manufactures, integrates, and operates technology systems, products, and services in the defense industry. Founded in 1995, Lockheed Martin Corporation is a Bethesda, Maryland-based aerospace company with a $106 billion market capitalization.

The company published its Q2 2023 financial results this week. It narrowly missed analysts’ expectations and the market punished it with a 5% drop in the share price within the first two days of publishing its results. The share has slid a further 3% since then to roughly $400 as of the date of publication. .

Lockheed Martin stock has been a strong performer in 2022, gaining 13% compared to the broader S&P which has declined by 23%. This reflects the robust nature of the company, considered one of the stock market’s favorite defensive stocks (stocks that are generally less sensitive to macroeconomic sentiment) to turn to during trying economic times. In the long term, the company’s average annual revenue growth rate is 8%. This is driven by the US government’s ongoing procurement of Sikorsky helicopter programs, AC-3, Long Range Anti Ship Missile, and the Joint Air-to-Surface Standoff Missile program. The company generates strong cash flow, with much of it being returned to shareholders via a healthy 2.6% dividend yield and an ongoing share buyback program.

The company has margin expansion and better-than-expected free cash flow generation, despite the negative impacts of Covid and global supply chain disruptions on its business. Analysts expect the company to continue to grow sales at a slightly faster-than-inflation rate with margins expected to remain stable.

Valutico Analysis

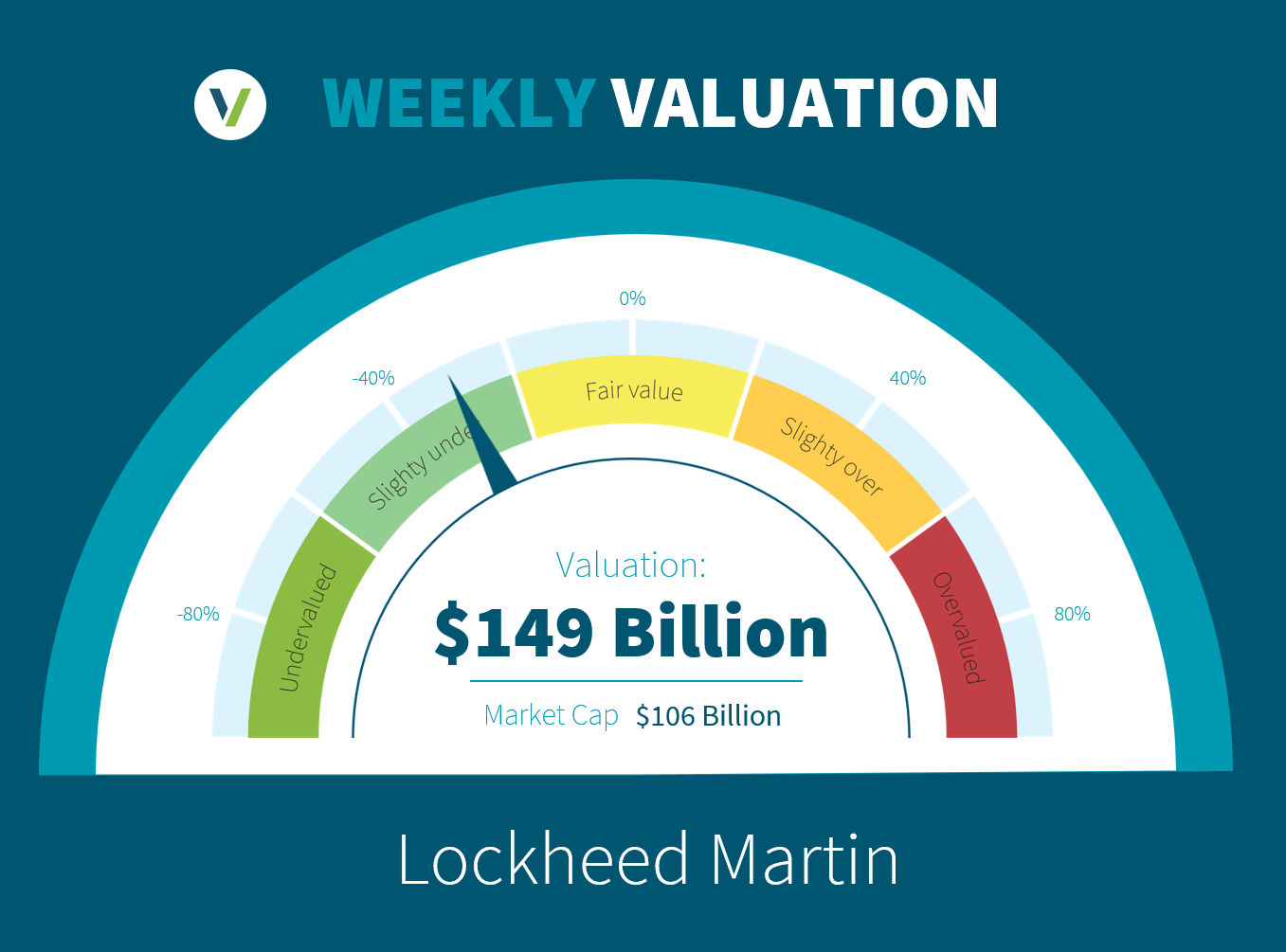

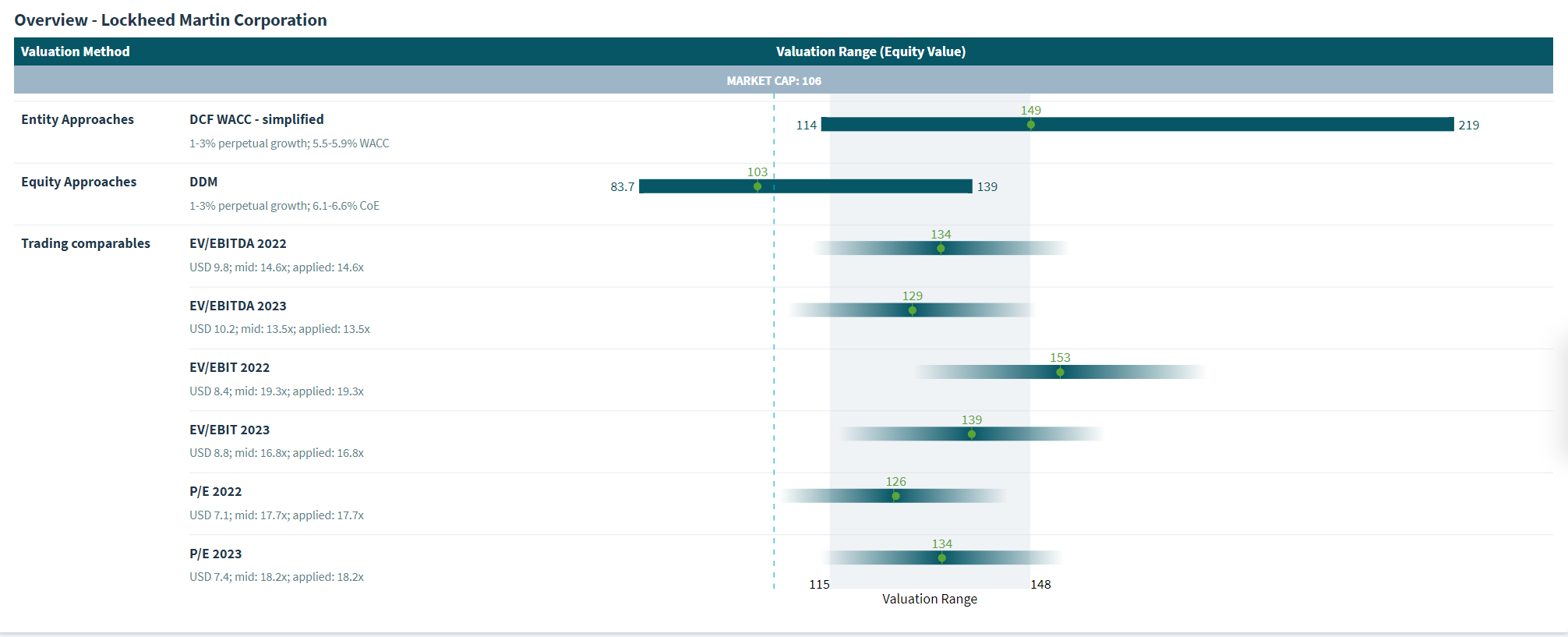

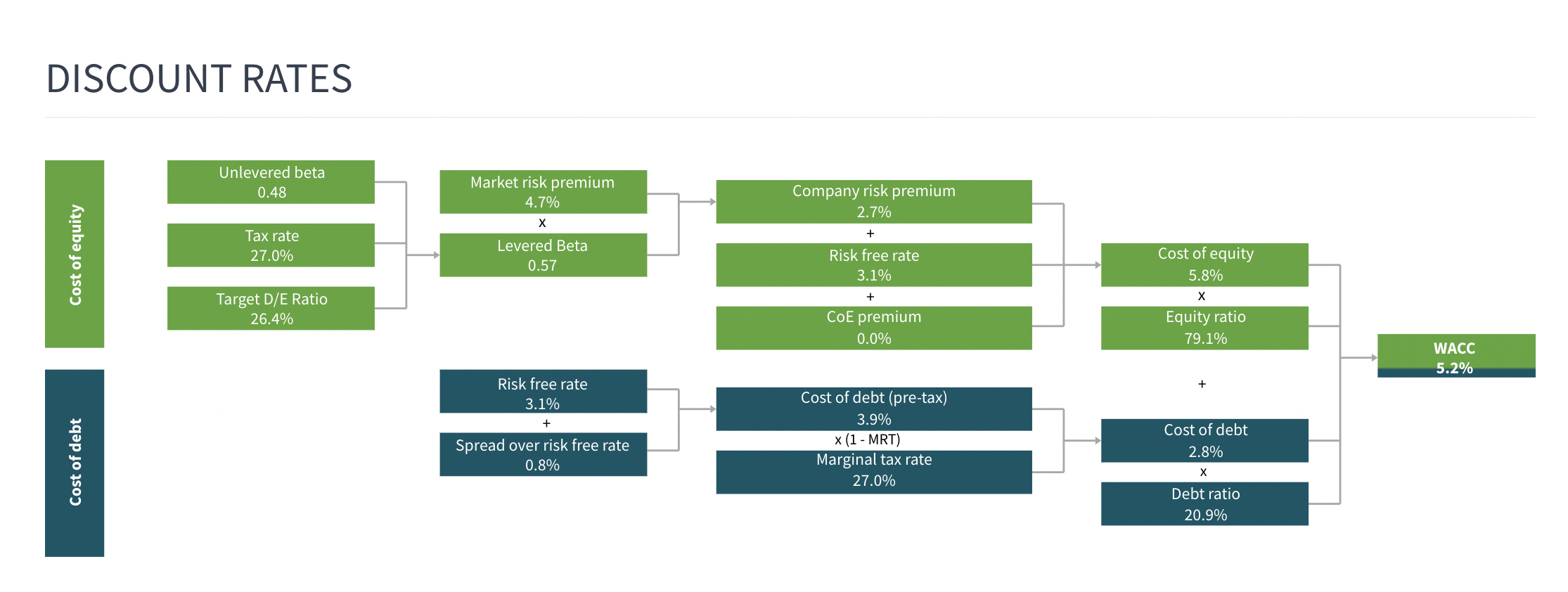

We conducted a fundamental analysis and performed a discounted cash flow (DCF) analysis based on historical data and analyst forecasts. A WACC of 5.7% was used as the discount rate which produced a valuation of $149 billion. Given the stable dividend payout ratio of ~65%, we also performed utilized a Dividend Discount Model with a Cost of Equity of 6.3% to arrive at a valuation of $103 million, almost exactly the current market cap of $106 billion.

Applying the Market Approach, we considered the trading multiples of comparable companies such as Northtrop Grumman, Raytheon and Leidos). These suggest that Lockheed Martin is somewhat undervalued compared to its peers by providing a valuation range of $124 to $150 billion.

Our final valuation range is thus $103 – $150 billion and we conclude that Lockheed Martin is likely undervalued.

Link to the detailed valuation