Alibaba Group Holding Ltd.

Weekly Valuation – Valutico | 28 October 2022

About Alibaba

Alibaba is a Chinese technology company, participating in the local and international e-commerce, cloud and the digital media markets. Alibaba’s share price is currently under heavy pressure, exacerbated by last weekend’s announcement that President Xi Jinping has extended his rule for an unprecedented third term. After this announcement the company’s share price hit a six-year low of HKD 60 ($7.60), an 80% decline from its all-time high of HKD 300 ($38) in October 2020.

Recent Financial Performance

Alibaba surprised analysts by maintaining stable sales figures in the past quarter, despite the recent Covid19 lockdowns in China. Revenues remained at just under CNY 205.6 billion ($28.1 billion) from April to June. Analysts had expected a decline in revenues due to the aforementioned lockdown situation. It is the first time since the company’s founding that there has been no growth – in prior quarters investors enjoyed double-digit growth figures. The next earnings call will be on 11/17/2022 and is eagerly anticipated as it will provide an indication of whether the company can return to growth in the short term..

Political tensions

The extension of President Xi Jinping’s presidency to a third term at the Communist Party Congress this past weekend is interpreted by some as a presidency for life. Hu Jintao, China’s former president who served from 2002 to 2012, was escorted out of the hall by guards. He actually had a seat right next to President Jinping, and was considered one of the last party personalities to potentially compete for power in the Party. Xi’s presidency is currently characterized by tough covid-lockdowns and an economic policy that, in case of doubt, does not take into account the interests of international investors. Tensions and uncertainties have further increased as spy and military experts have joined the new Chinese government, which can be seen as very alarming in regards to the Taiwan conflict. The increased uncertainty has clearly spooked investors, as evidenced by Alibaba’s negative share price movement.

Valutico Analysis

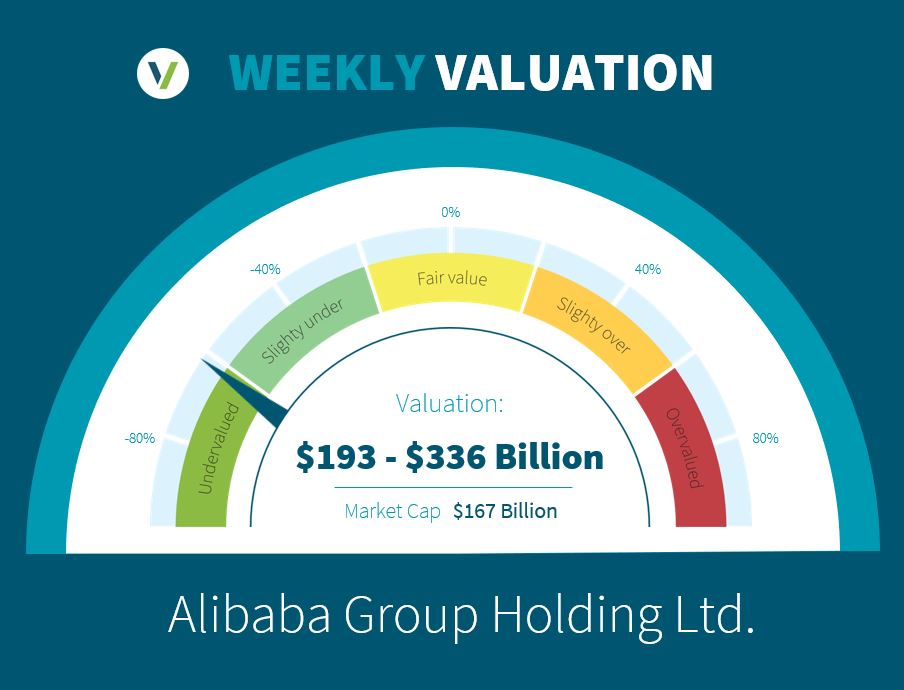

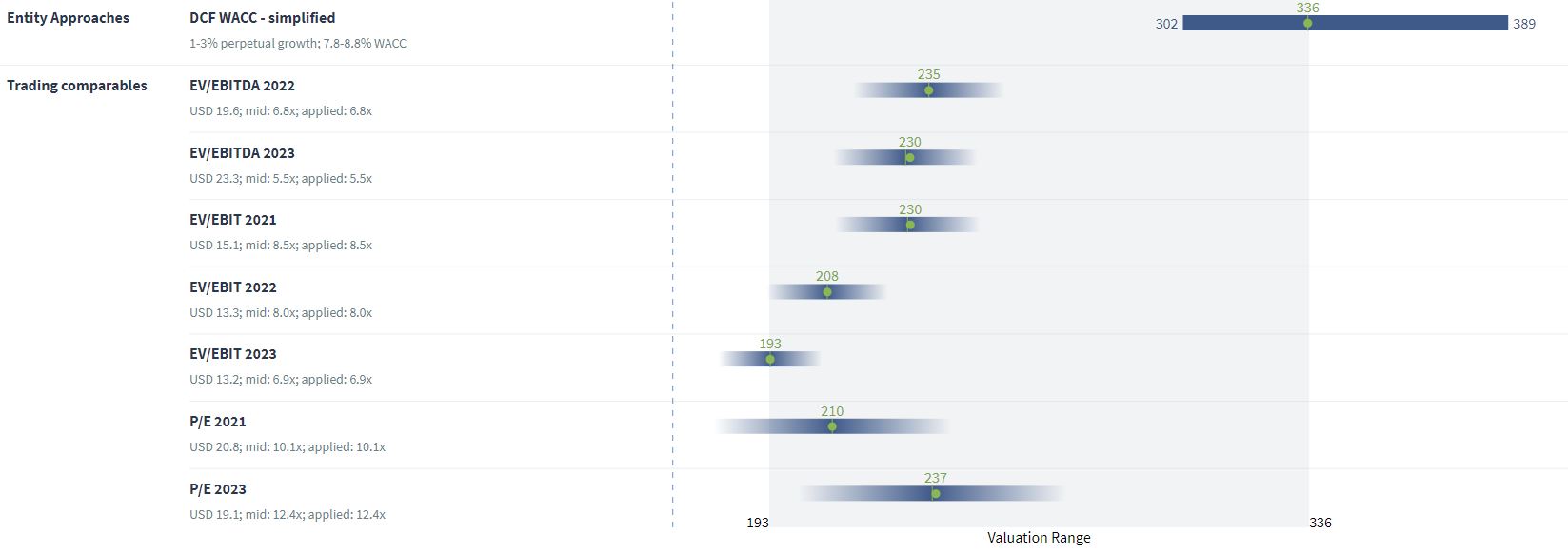

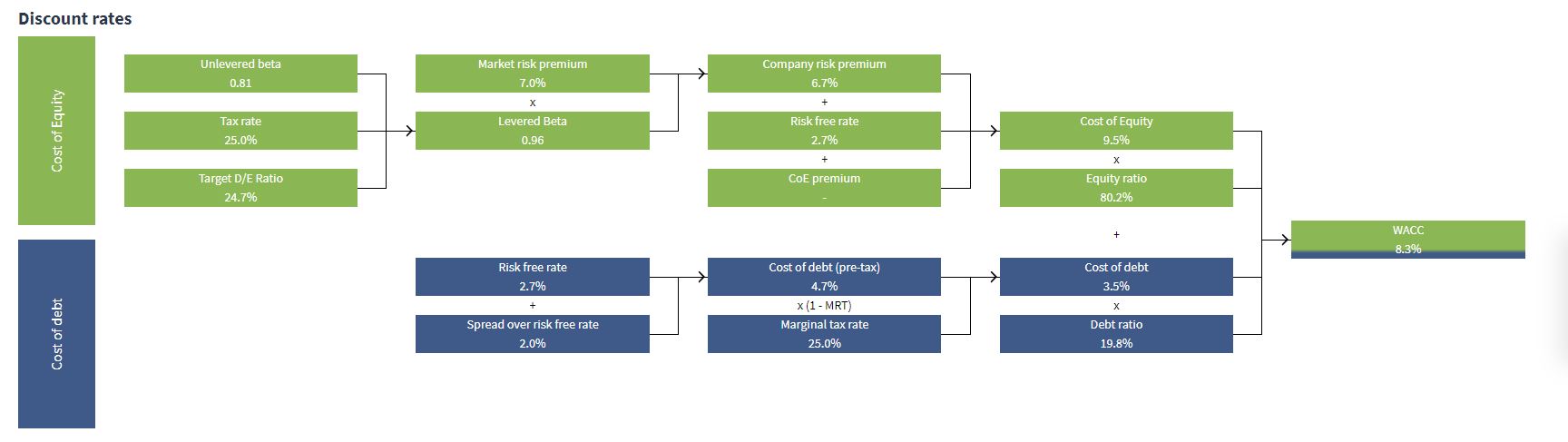

We valued Alibaba using the Discounted Cash Flow method, specifically our DCF WACC approach, as well as a Trading Comparables analysis. The Discounted Cash Flow method resulted in a valuation of $336 billion, using a WACC of 8.3%.

We used the observed trading multiples EV/EBITDA, EV/EBIT and P/E of a group of similar listed peers for our Trading Comparables analysis, arriving at a valuation range of $193 billion to $237 billion. We included companies like Tencent, Amazon, Ebay and JD.com in our peer group. Combining the above two approaches results in our concluded valuation range of $193 billion to $336 billion.

Alibaba’s current market capitalization of $167 billion suggests that the company is undervalued. The analyst forecasts used in the Discounted Cash Flow do not seem particularly aggressive, thus implying that the market is currently adding a hefty premium to the discount rate to justify the current market capitalization (roughly a 15% Cost of Equity premium).

Political tensions are clearly on the mind of most investors. Have they adequately accounted for the recent perceived increase in risk in investing in e-commerce in China, or is it an overreaction resulting in an attractive buying opportunity? Let us know in the comments below.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.