Adobe Inc.

Weekly Valuation – Valutico | 19 September 2022

We valued Adobe in March this year, at a time when it reported disappointing Q1 earnings and its share price had been down 25% year-to-date. We commented at the time that Adobe was experiencing slowing growth and management’s guidance was for a tame 13% revenue growth in the second quarter.

Since then, the company has broadly met these expectations and the share price was trading at a stable level. That is until last week’s announcement of Adobe’s biggest ever investment, a cool $20 billion cash-and-stock deal for Figma, a little-known software startup that helps creatives collaborate, spooked investors and resulted in a 25% share price drop in one week. The stock is now 47% down year-to-date.

To put the acquisition in context, the deal values Figma, a ten-year old company, at just over 10% of what Adobe’s pre-announcement market cap was ($174 billion). Figma’s annual recurring revenue (ARR) is expected to hit $400 million in 2022. That puts its valuation at an effective Price to Sales multiple of 50x (!). Figma is clearly an excellent business, with gross margins of ~90%, net retention rates of greater than 150% and ARR growth of more than 100% expected for the next year. Should it achieve these growth levels, then the valuation multiples, while still not cheap, would start to make a little more sense.

In the context of Adobe’s 13% annual growth, one can see the appeal of acquiring such a high-growth company, whilst also removing a competitor from the market. The timing is also opportune for Adobe because in a more normal macroeconomic environment, Figma would likely have been able to go public at an even higher valuation. However, given the dearth of IPOs in 2022, selling to a major player like Adobe was likely one of the few liquidity options available to the backers of Figma.

Valutico Analysis

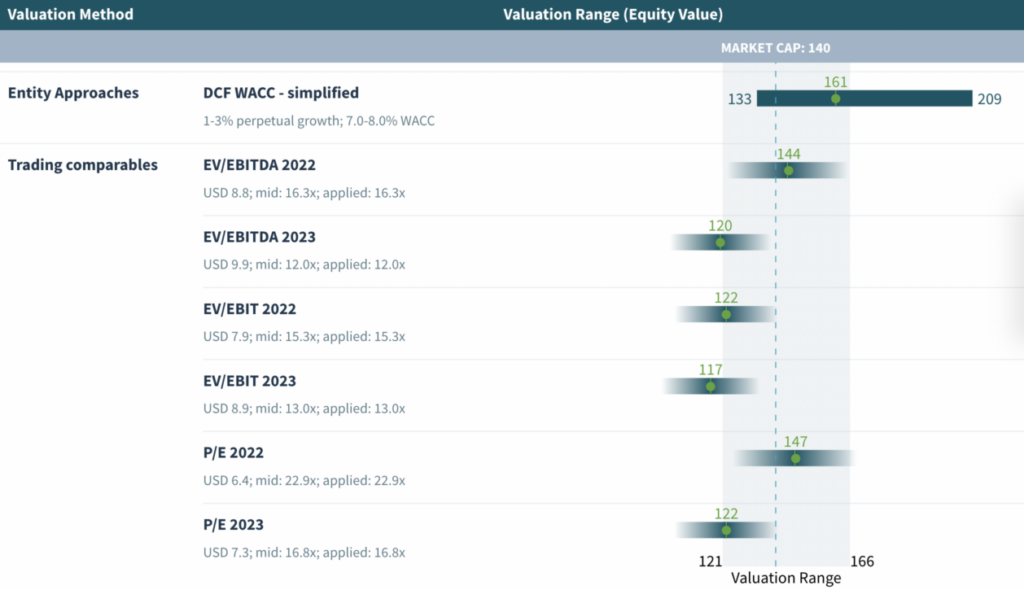

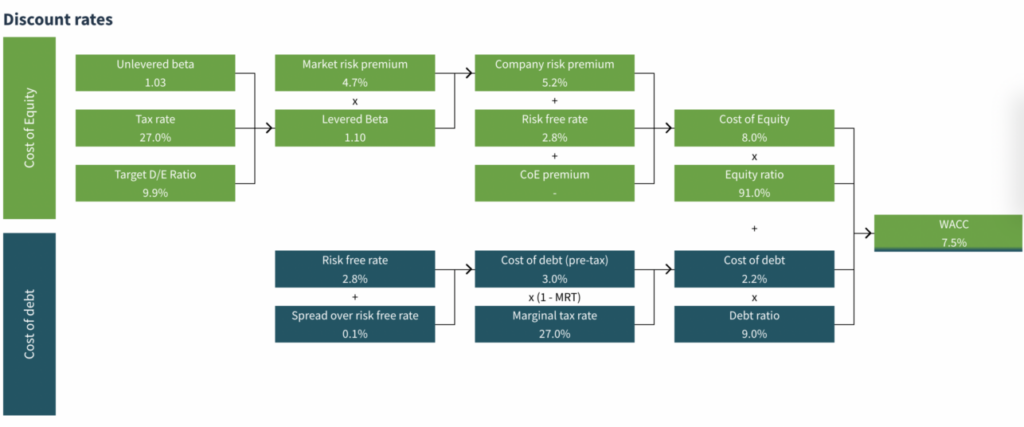

At the time of our analysis, Adobe’s market cap was $140 billion. Our DCF analysis is based on analyst forecasts which, at the time, had not yet been updated to reflect the potential positive impact of the absorption of Figma’s business. The pre-Figma analyst forecasts anticipate a stable sales growth rate at ~13%. Our DCF analysis, based on these conservative forecasts and a WACC of 7.5%, delivers a valuation of $161 billion. Applying the observed trading multiples of Adobe’s peers to its financial results, delivers a valuation range of $120 – $145 billion. We therefore conclude with a valuation range of $120 billion to $165 billion.

Adobe is therefore likely fairly valued in light of its existing operations, however the Figma acquisition presents significant upside potential and therefore we conclude that Adobe is slightly undervalued.

Click here for the detailed valuation