CD Projekt S.A.

Weekly Valuation – Valutico | 21 October 2022

About CD Projekt

CD Projekt is a polish distributor and publisher of computer games. After multiple delays, the last of which resulted in angry gamers making death threats to some of its employees, it finally published the massively hyped game Cyberpunk 2077 in late 2020. The game had been teased since 2012 and generated an incredible amount of hype, which translated into its share price reaching an all time high of PLN 400 ($82) in August 2020. The game was finally released in December 2020, however suffered from many bugs, often making it unplayable for many players. As a result, the share price tanked to PLN 168 ($35) in May 2021 and slipped further in 2022 to its current level or around PLN 120 ($25).

Recent Financial Performance

CD Projekt is a very cyclical business, with its results dependent on the launch of new video games. This is shown by the fact that the company was able to reach sales of PLN 2.1 billion ($430 million) in 2020 after the release of Cyberpunk 2077, but in the following year, 2021, revenue dropped to PLN 890 million ($180 million). Analysts think that sales will decrease by a further 7% in FY2022. The same applies for the net income of CD Projekt, as the company had a profit of PLN 1.1 billion ($220 million) while only expecting to achieve roughly 25% of that in , PLN 200 million ($41 million).

Product Pipeline

At the beginning of October, CD Projekt provided investors with a strategy update and a long-term product outlook. They announced ten new blockbuster games to be published in the next 15 years. A new Trilogy of the Witcher with two more standalone games related to the Witcher was announced. Furthermore, Cyberpunk 2077 will spawn two new sequels and a completely new franchise called Hardar will also be launched during that time. According to analysts from Barclays, this big product pipeline could lead to an additional increase in sales of 13% from 2023 to 2030. However, this additional workload is likely to have a negative impact on profits and cash flow in the short term.

Valutico Analysis

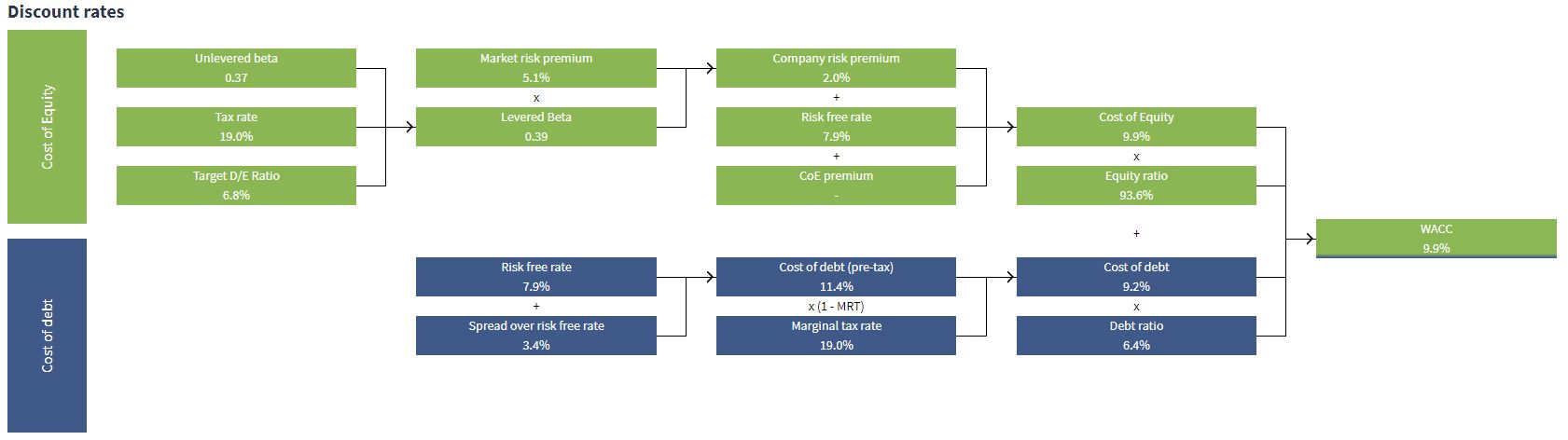

We analyzed CD Projekt by conducting a Discounted Cash Flow analysis using the DCF WACC and a Trading Comparables analysis. Our DCF WACC analysis resulted in a valuation of PLN 10.7 billion ($2.2 billion), by applying a WACC of 9.9 %.

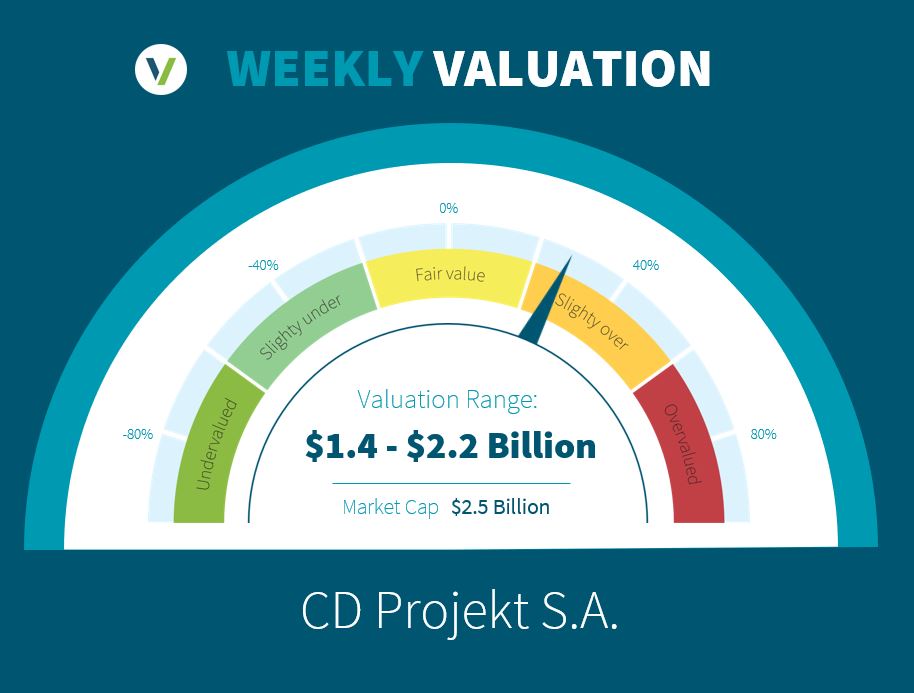

Our Trading Comparables analysis, using the multiples EV/EBITDA, EV/EBIT and P/E, indicates a value range of PLN 5 billion ($1 billion) to PLN 9 ($1.9 billion). For this analysis we used peerssuch as Ubisoft, Electronic Arts, Take Two Interactive Software and Activision Blizzard among others. The discrepancy between the DCF WACC and Trading Comparables analysis can be ascribed to the aggressive sales growth forecast in the medium term (due to the product pipeline), compared to the current performance. Given this discrepancy, we conclude our valuation range with the midpoint of the Trading Comparables analysis (PLN 7 billion/ $1.4 billion) as the low end and the DCF WACC of PLN 10.7 billion ($2.2 billion) as the high end of the range.

With a current market cap of PLN 12.2 billion ($2.5 billion), we conclude that CD Projekt is slightly overvalued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.