Weekly valuations: Visa

As fintech reaches new heights, and alternatives modes of payments ranging from Square’s Cash App to Cryptocurrencies surge, we take a deeper look at a veteran of the payment industry, Visa, Inc.

Up nearly 200% over 5 years and now valued at $500Bn, the California based credit card and payment technology company has traditionally been compared to MasterCard (Market cap $360Bn), but can Visa and its legacy competitor maintain leadership and grow as fast as their challengers (Square, Dwolla, Stripe, PayPal, etc.)?

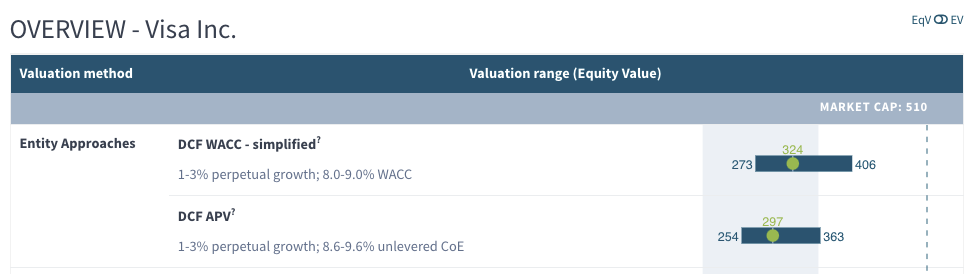

Industry analysts tend to think so, broadly speaking, as the consensus has the incumbents growing between 15% and 20% over the next 5 years, while maintaining incredible margin performance (50% net income margin). That said, much of these expectations are already factored in the share price and our DCF analysis suggests that the company may be overvalued.

Valutico DCF estimate of Visa’s value: $324Bn

Market cap as of August 4th: $510Bn

Weekly valuations: Visa link to the valuation here

Other recent valuations: Peloton | Krispy Kreme |Bumble

About Valutico:

Valutico is the world‘s leading provider of web-based company valuation tools.

Valutico is a web based valuations platform providing the financial services industry and valuation practitioners with data-driven tools to conduct analysis more efficiently. With headquarters in Vienna and subsidiaries in the UK & USA Valutico empowers businesses and experts to perform accurate valuations in minutes while solving the issue of complex tools, lack of data sources and time consuming reporting.

Valutico provides access to reliable market data from leading financial databases, cross-checks business plans and provides useful suggestions to promote consistency and plausibility. With over 15 of the world’s leading valuation methodologies to choose from and saving experts precious time transferring results from spreadsheet to slides, Valutico is carving a new generation in valuations.