Weekly Valuation: Bumble

Earlier this year US dating app Bumble went public, making headlines as its CEO became the youngest woman to take a company public and to become a billionaire, at age 31.

Bumble stood out in the dating market for its unique approach, and for its independence, in a market that was largely consolidated by the Match.com, owner of Tinder, Match and many other leading dating apps, but how have investors reacted to the offering.

With the stock down about 25% since its market debut and the market cap just below $6Bn, has Bumble found its floor from which to rebound (dating pun intended)

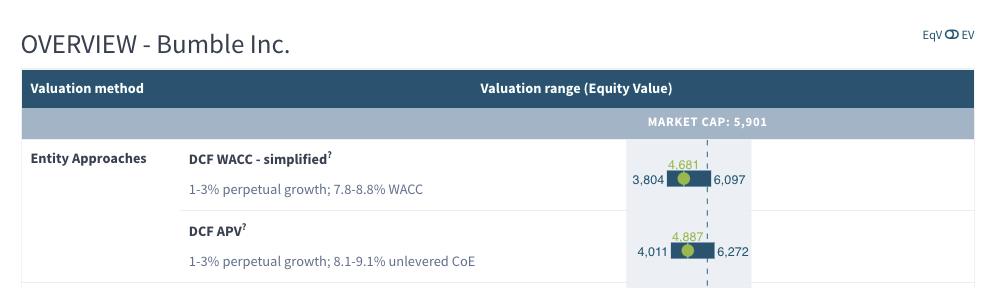

Even assuming a top line growth rate superior to that of Match.com for the next 5 years, averaging over 20% (compared to 35% in 2019 and 19% in 2020, admittedly in adverse conditions due to the Covid lockdowns) the DCF for Bumble doesn’t make the case for much optimism. Our findings suggest a valuation of $4.6Bn may be more adequate.

That said, looking at the company through the perspective of public markets offers a different perspective, and based on Revenue and EBITDA multiples one may argue that Bumble is undervalue and could be worth as much as $7.5Bn.

Find out more and view the valuation at https://valutico.com/companies/bumble-inc-41627c52-8b75-4a61-ba75-b86ba34c4b87/evaluations/3s-alHqc-MHOj74weKxFdFNd_0QdyFAoBnChVAN1bB1q6qZaujNaUFfsyGbESfh1x1d8p6TLVwPL9MpMIkQtWw/share

Other recent valuations: Peloton | Morrisons | Krispy Kreme

About Valutico:

Valutico is the world‘s leading provider of web-based company valuation tools.

Valutico is a web based valuations platform providing the financial services industry and valuation practitioners with data-driven tools to conduct analysis more efficiently. With headquarters in Vienna and subsidiaries in the UK & USA Valutico empowers businesses and experts to perform accurate valuations in minutes while solving the issue of complex tools, lack of data sources and time consuming reporting.

Valutico provides access to reliable market data from leading financial databases, cross-checks business plans and provides useful suggestions to promote consistency and plausibility. With over 15 of the world’s leading valuation methodologies to choose from and saving experts precious time transferring results from spreadsheet to slides, Valutico is carving a new generation in valuations.