Today we study a behemoth of the public markets and a company only recently holding the spot as the largest company in the world (by revenue and at one point market cap), Exxon Mobil.

In the past week, investors and courts alike have struck the oil and gas industry with mandates to decrease their reliance on fossil fuel. The landmark boardroom and courtroom defeats show growing pressure on international oil and gas companies to set targets that are consistent with the Paris Agreement.

“It is not often that three of the supermajors are prominently in the headlines within a 24-hour period, but that was certainly the case yesterday,” analysts at Raymond James said last week.

Having said that, Exxon’s market cap is hovering around $250Bn and its stock at a 52 week high, so the company seems to be recovering from the pandemic.

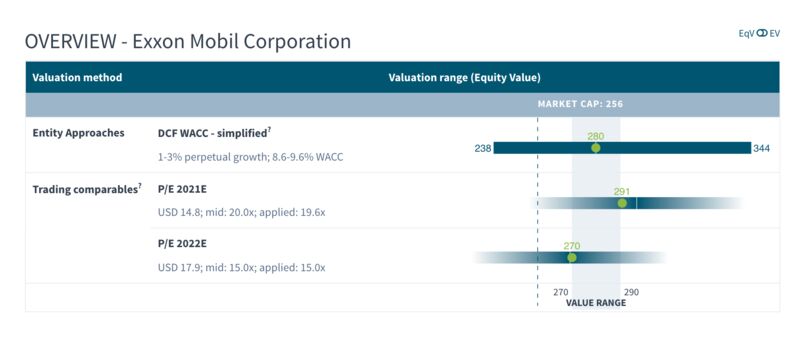

Let’s look at how this current market cap compares to our estimates of enterprise value using a simple DCF method and based on a PE multiple approach:

Market cap: $256Bn

Valutico range: $270bn to $290bn

Exxon Mobil may be undervalued at the moment, or its stock price may be reflecting of upcoming challenges that haven’t yet been represented in all analysts’ estimates (Valutico based its forecasts on consensus estimates), what’s your take? #valuations #exxon