The Boeing Company

Weekly Valuation – Valutico | 1 February 2023

About The Boeing Company

The Boeing Company is an American aerospace and defense manufacturer that designs, produces and sells commercial and military aircraft, helicopters, spacecraft and satellites, as well as military equipment such as missile launchers and missile weapons. However, in recent years, Boeing has faced significant challenges, including the grounding of its 737 MAX aircraft following two fatal crashes. Furthermore, the company’s last positive financial result was published four years ago.

Recent Financial Performance

Last week, Boeing released its fourth quarter results which surprised analysts on the downside, as they expected earnings per share of $0.20. In fact, the company missed this number by $1.95 per share, as it reported earnings per share of -$1.75. Revenue was $19.98 billion which increased by 35% compared to last year. Despite this increase in revenue, Boeing reported a financial loss of $635 million, meaning that the anticipated turnaround failed for the fourth year in a row. According to Boeing, these losses are attributable to difficulties caused by the Covid-19 pandemic and their technical problems with models like the 737 MAX.

Problems with development of airplanes

Boeing faces serious challenges not only because of its above-mentioned financial situation, but also due to problems with its developed airplanes. After the fatal crashes of two 737 MAX medium-range aircraft, the model was not allowed to take off anymore for a long time, which resulted in higher development costs and lower sales than expected. In addition, Boeing had to stop delivery of its 787 Dreamliner long-distance aircraft due to production shortcomings and delay its schedule for the revamped 777X jumbo jet by years, also negatively affecting future revenues.

Share Price Performance

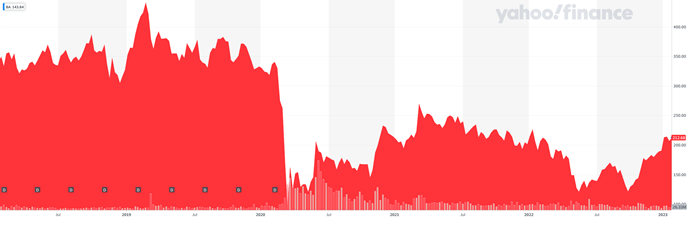

The counter had a very good start to 2019 with a new all time high of $440 per share. However, quickly after the deadly crashes of its 737 MAX in Indonesia, the share price declined to $330 per share. Financial and technological challenges paired with the Covid-19 pandemic led to further declines in value, resulting in a share price of $95 in early 2020. Since then, the price has improved slightly to trade in a range of $150 and $250 per share. Can the company solve its problems and reach former highs again in the near future?

Boeing’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3kMbTNf

Valutico Analysis

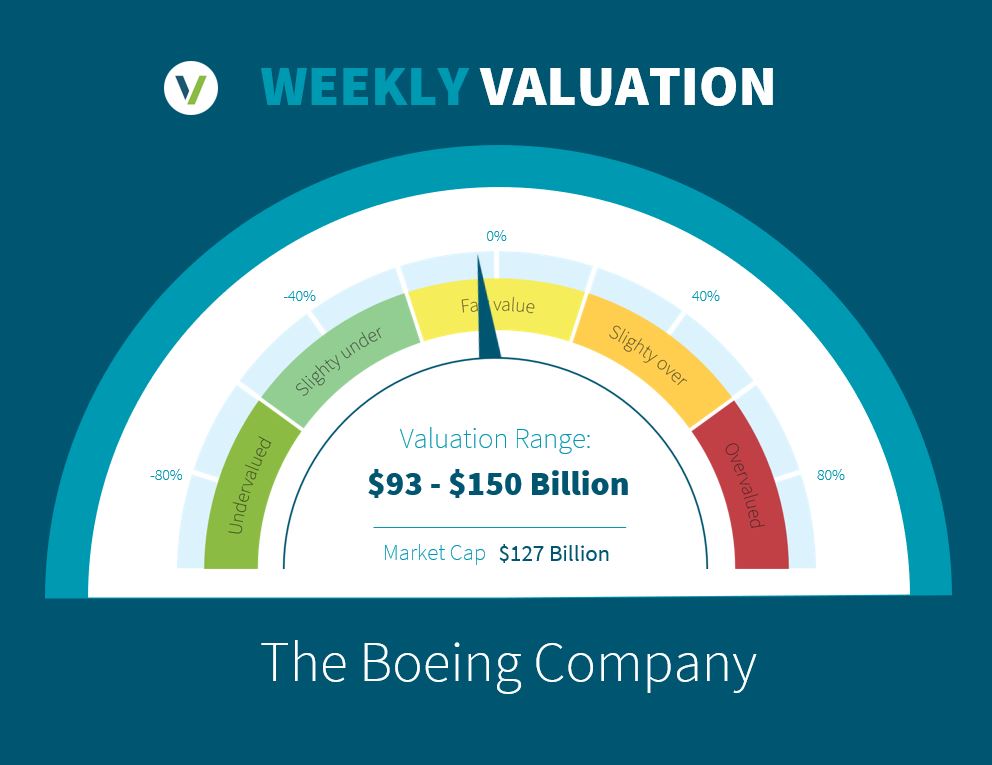

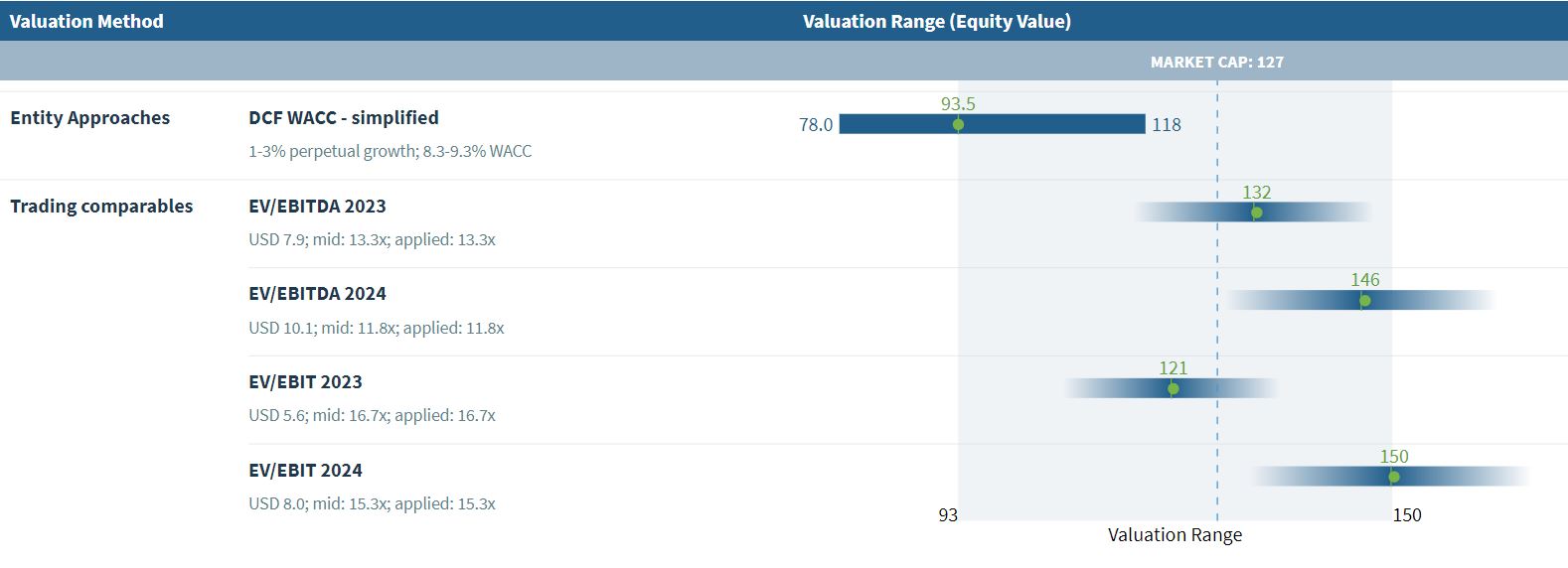

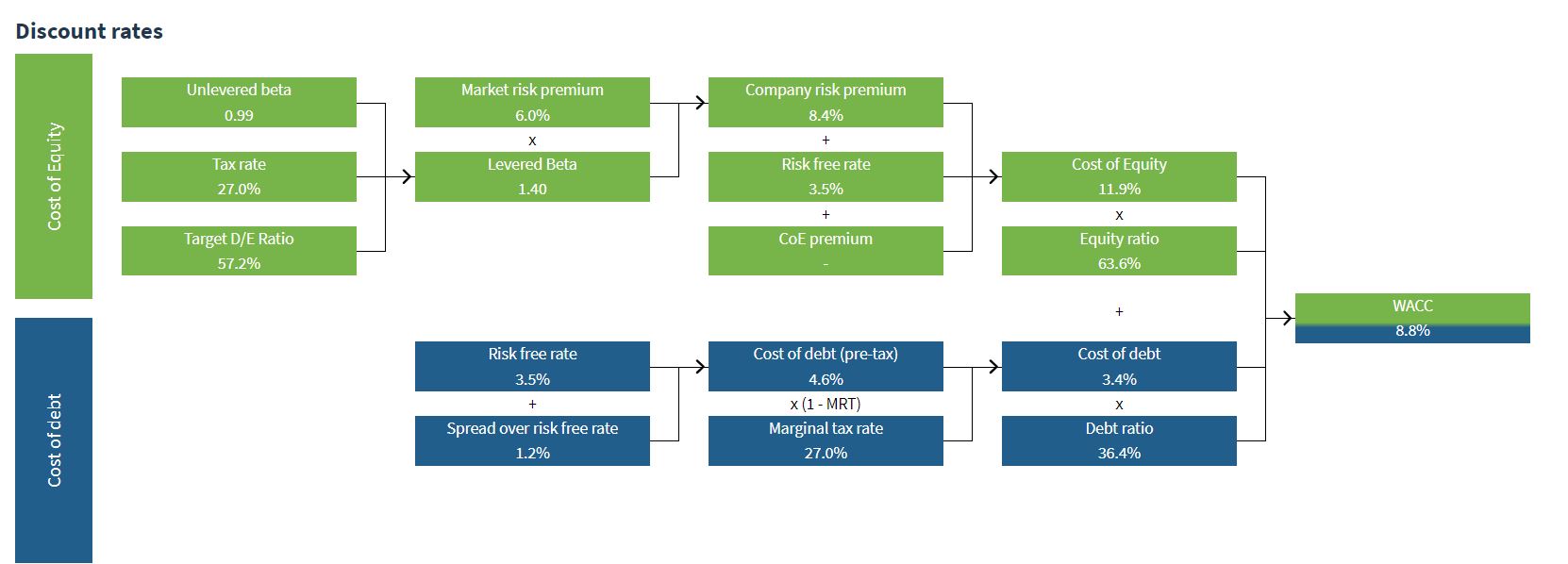

We analyzed The Boeing Company by using the Discounted Cash Flow method, specifically our Simplified DCF WACC approach, as well as a Trading Comparables analysis. The DCF analysis produced a value of $93.5 billion using a WACC of 8.8%.

The Trading Comparables analysis resulted in a valuation range of $121 billion to $150 billion by applying the observed trading multiples EV/EBITDA and EV/EBIT. For our Trading Comparables we selected similar peers such as Airbus, Lockheed Martin and General Dynamics.

Combining our DCF and Trading Comparables analysis results in a value range of $93.5 billion to $150 billion. In comparison to Boeing’s market capitalization of $127 billion we suggest that the company is fairly valued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.