Visa Inc.

Weekly Valuation – Valutico | 8 February 2023

About Visa

Visa is an American payment technology company headquartered in California, offering electronic transactions between merchants, financial institutions, and cardholders, facilitating billions of transactions each year. Last week the company was also in the media as it created a loophole with PayPal and the Argentinian peso, resulting in cheaper online shopping for foreigners.

Recent Financial Performance

Last week, Visa published strong first quarter 2023 financial results, increasing revenue by 12% to $7.9 billion and net income by 6% to $4.2 billion, with general payments volume rising by 7%. One of the largest drivers for these good figures was the return of international travel and tourism, as activity in this segment is getting back to pre Covid-19 levels.

Cheaper online shopping with Argentinian peso and Visa

By utilizing PayPal for e-commerce transactions, consumers have been eligible for a discount of up to 40% when using Visa as the payment option. This is due to favorable exchange rates offered by the Central Bank of Argentina for foreign credit cards. The Argentinian government has implemented this initiative to stimulate the economy by making local purchases more affordable for tourists, amidst high inflation rates of around 100%. However, this loophole has now been sealed and it is therefore no longer possible to take advantage of it.

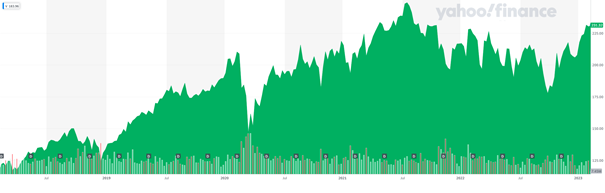

Share Price Performance

Visa showed a great performance in the last 5 years as the share price rose by over 100%. After following the rest of the market down during the early Covid-19 period, the share price steadily increased, achieving an all time high of $250 per share in July 2021. Since then, the share price has sagged to $180 in September 2022. However, over the last four months the ticker performed well, increasing by ~30%to the current level of $230 per share.

Visa’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3XWBIsF

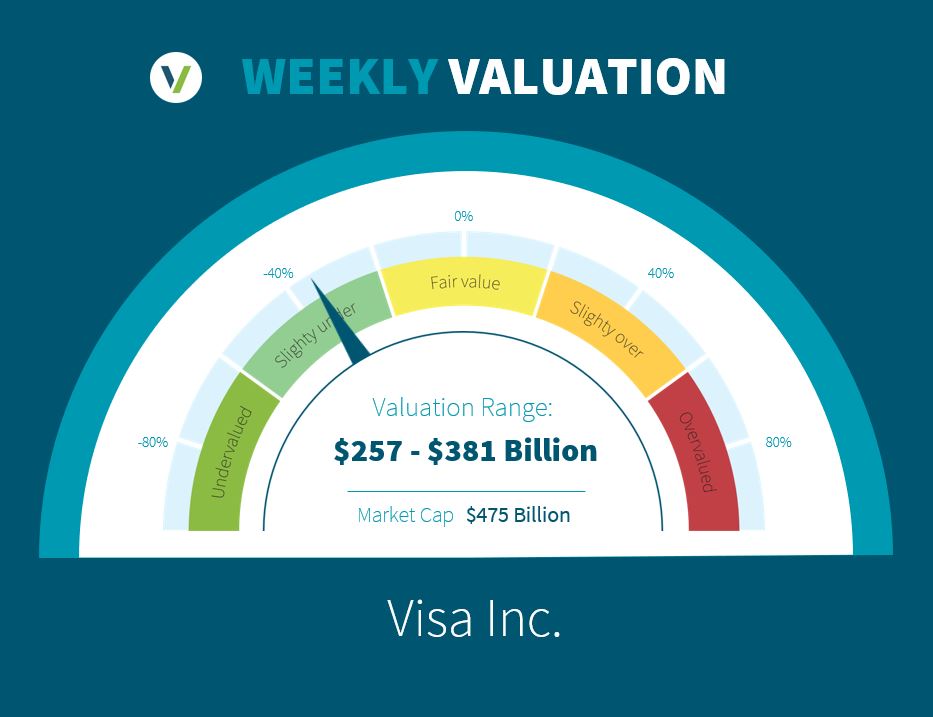

Valutico Analysis

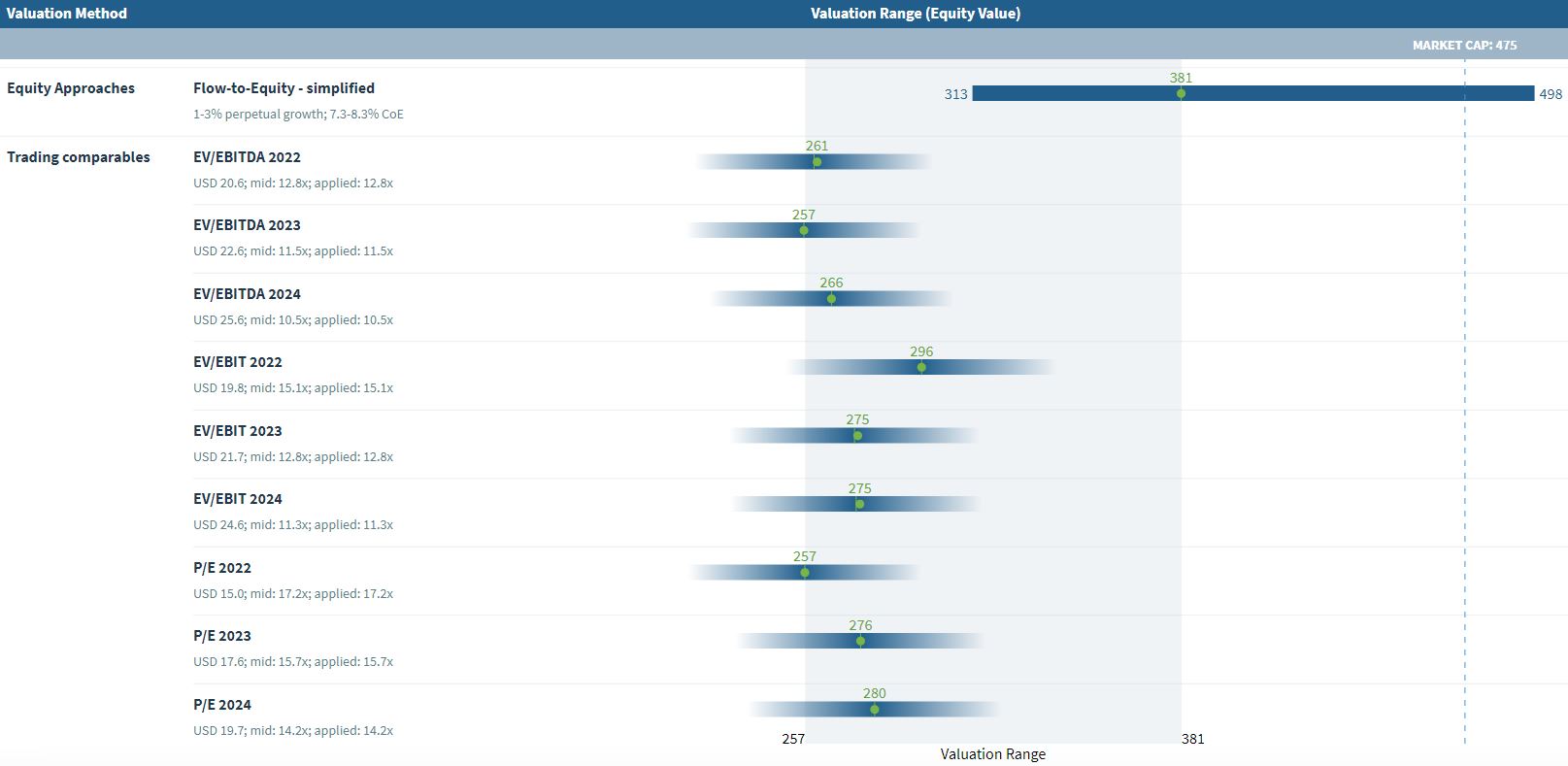

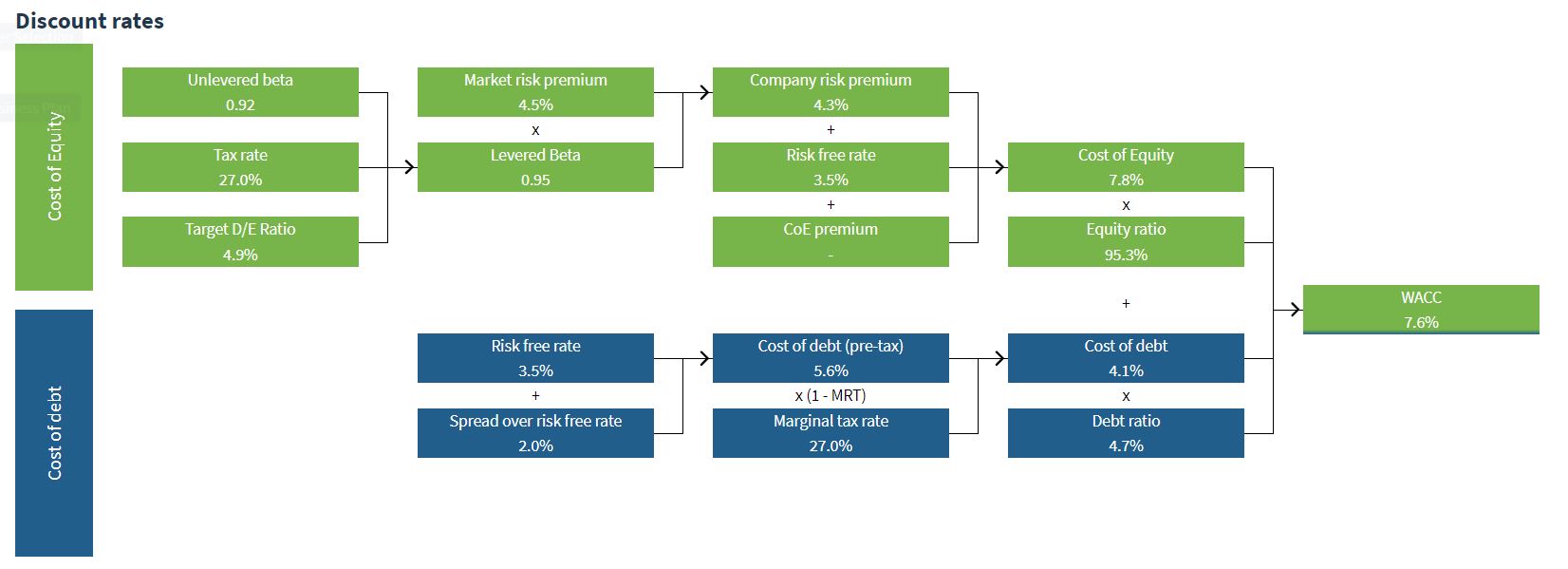

We analyzed Visa Inc. by using the Discounted Cash Flow method, specifically our Flow-to-Equity approach, as well as a Trading Comparables analysis. The Flow-to-Equity analysis produced a value of $308 billion using a Cost of Equity of 9.2%.

The Trading Comparables analysis resulted in a valuation range of $257 billion to $296 billion by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Mastercard, PayPal and American Express.

Combining our Flow-to-Equity and Trading Comparables analysis results in a value range of $257 billion to $308 billion. In comparison to Visa’s market capitalization of $471 billion we suggest that the company is significantly overvalued. Is Visa materially overvalued or will it continue its recent gains and supercede its all time high in the coming months? Let us know in the comments.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.