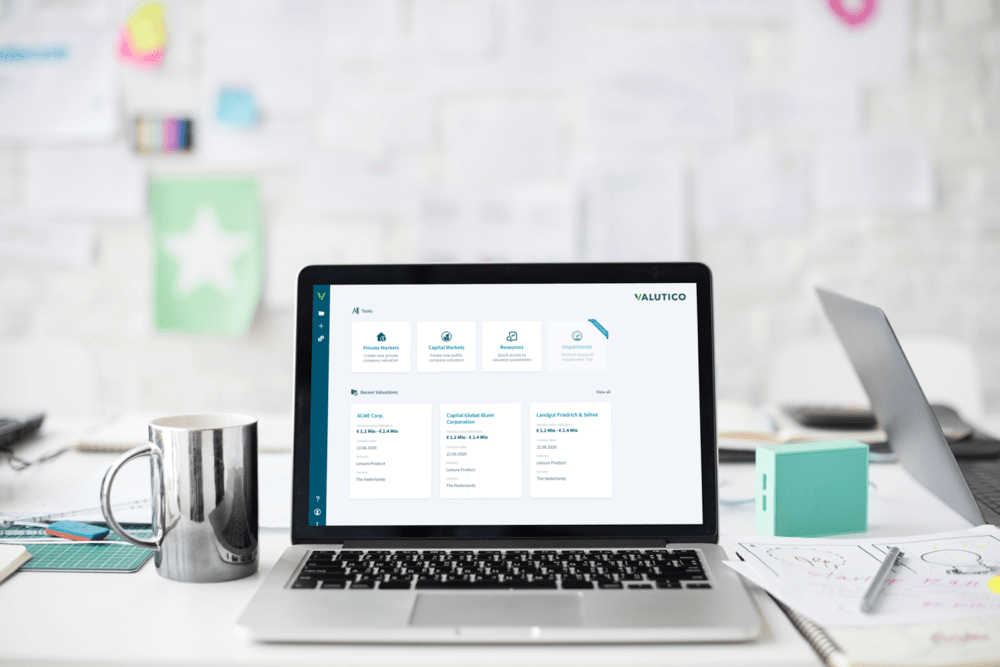

Solutions

We bring you the best possible solutions for your company

Learn about the valuation solutions we deliver for your unique needs:

Industries

We enjoy working with a wide variety of financial services businesses

Check out our “You work in…” section to view how Valutico supports various businesses and see what it could do for you.

How it works

Qualitative Assessment

To calculate the cost of capital (using the CAPM WACC method), Valutico assesses key drivers of the business and recommends appropriate discount rates or premiums to comps multiples and to the risk free rate.

Peers

Valutico’s database of companies provides public comps, and the related revenue, EBIT, or EBITDA mutliples, betas, and other key factors, with data refreshed daily and multiples by industry to guide your decisions.

Financial Projections

The valuation tool provides a seamless experience to create a business plan from as little starting data as a sales projection or as much detail as your own models can provide. With peers benchmarks and analysts estimates, building assumptions is easier than ever.

Transactions

With 800,000+ precedent transactions to search from, Valutico helps you identify the earnings multiples for M&A activity in your industry, or the sales multiples growth companies garner in PE or VC deals.

Valuation

Based on the previous steps, Valutico creates a valuation range in seconds. Producing detailed results from 15+ unique methods, and allowing you to tweak factors such as your risk free rate, CoE premium, or Exit/Entry multiples for LBO scenarios and see their impact instantly.