Adobe Inc. fell over 38% – is the stock now undervalued?

…Tuesday, Nov.5, 2019, in Los Angeles. Jordan Strauss/AP Images for Adobe)

Key Summary

- Because of the war in Ukraine, the company will lose about $75 million of 2022 sales

- Resulting from that, Adobe dipped 38% after earnings

- Adobe looks forward for continued decelerating growth rates in the next quarter, but expects growth to pick up in the second half of this year

Adobe (ASDAQ:ADBE) offers a line of creative, business and mobile software and services used by high-end consumers, creative professionals, designers, knowledge workers, original equipment manufacturers developers and enterprises.

After releasing earnings by the end of Q1, Adobe fell double-digits. The company was seen as one of the stocks that apparently could not fall, but the recent crash proved that differently. While that isn’t nearly as much as the worst of it, the fall may have surprised long term investors who became complacent as the stock just kept going up and up and up. While Adobe’s growth rates were already slowing down heading into 2021, the stock nonetheless kept soaring at a similar pace with high-growth peers because the valuation multiples kept expanding. That made the stock quite dangerous at the peaks, but the valuation reset has helped bring the stock back to legitimately buyable levels. Further, Adobe’s guidance for 13% revenue growth in the second quarter indicates its slowdown will continue even as it rolls out new products. It didn’t directly address that slowdown during its conference call, but a new product launch and a price hike suggest it might be facing tougher competition.

13 years ago, Adobe had already proven itself with well-known products like its Photoshop image editor, Acrobat PDF manager, and Illustrator design software. Yet even Adobe probably didn’t imagine just how much the world would change, with digital transformation having dramatically increased the number of creative professionals who rely on its tools to do their work and get it in front of the largest possible audience.

Adobe also recently shut down its businesses in Russia and Belarus in response to Russia’s invasion of Ukraine. It expects that exit to reduce its annual revenue by about $75 million — but that only represents about 0.4% of its projected revenue this year.

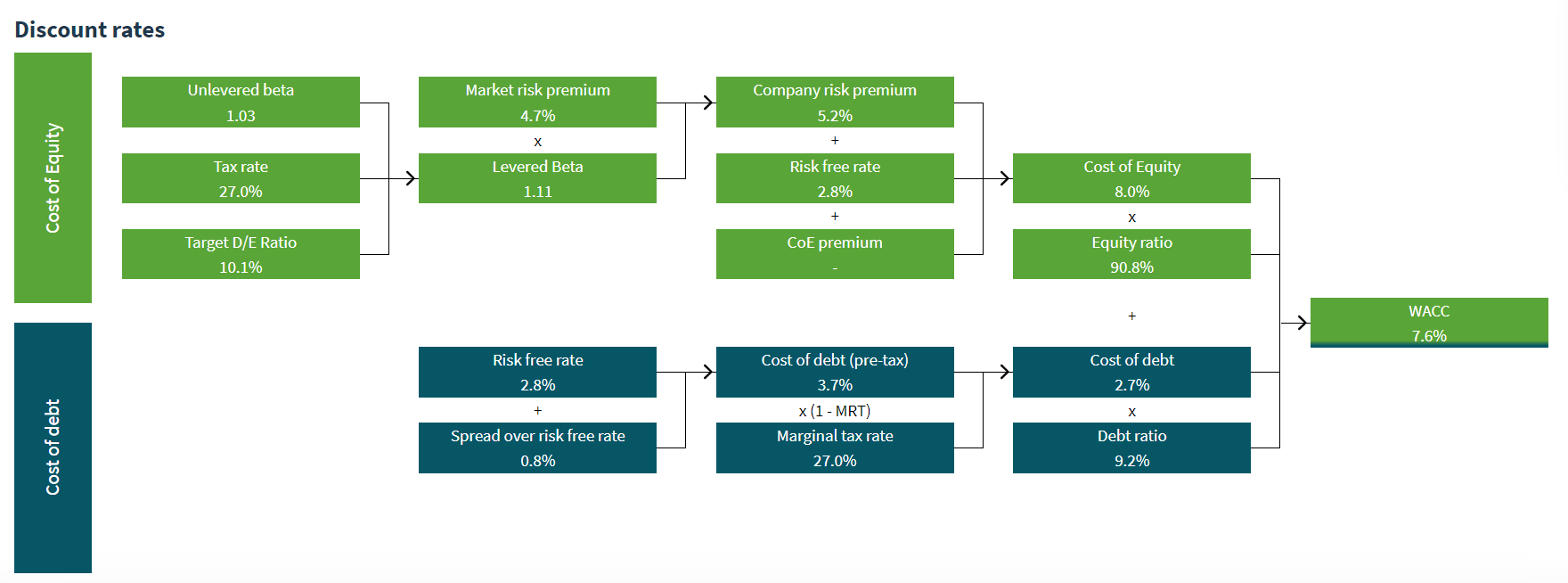

In our Valutico analysis we came up with a value range of USD 150 – 200 billion, using DCF with a WACC of 7.6%. As you can see below, we calculated the discount rate using a levered beta of 1.11 and a risk free rate of 2.8%.

If you want to have a more detailed analysis, please click the link here.