BP p.l.c

Weekly Valuation — Valutico | 1 March 2023

About BP

BP, a multinational oil and gas company, headquartered in London, is one of the largest oil and gas producers in the world. The company recently published extraordinary good financials and also surprised with the announcement of a renewed focus on profit maximization and increased investments in fossil energy.

Recent Financial Performance

In the first week of February 2023, BP released its 2022 annual report, boasting the highest net profit in the company’s history of GBP 22.7 (USD 27.7) billion. Compared with last year’s net income of GBP 10.3 (USD 12.6) billion, profit increased by an unbelievable 120%. Due to these high earnings, the company was able to pay back GBP 7.5 (USD 9.2) billion in net debt, reducing total debt to GBP 17.5 (USD 21.4) billion. Since publishing these figures, BP’s share price has risen by more than 15%. Furthermore, the company increased dividends by 10% and announced that it will buy back GBP 2.3 (USD 2.8) billion worth of shares.

New strategy: more focus on profit maximization

During the presentation of the annual report 2022, BP also announced a shift in its strategy towards profit maximization. In 2019, the company announced that it plans to reduce its oil and gas output by 40% by 2030. At this year’s event this goal was reduced by 15%, meaning fossil fuel output will only decrease by 25% by 2030. The new strategy also includes investing an additional GBP 6.6 (USD 8.0) billion into fossil energy. At least the same amount will also be invested in renewable energy. The CEO expects this dual strategy to add an additional GBP4.9 (USD 6.0) billion to the bottom line by 2030.

Share Price Performance

BP had tumultuous times over the last five years on the London Stock Exchange. In early 2018 the company traded at GBP 4.7 (USD 5.6). After the global drop-off in oil demand due to Covid-19, the share price fell to GBP 2.0 (2.4 USD). Since then the share price has risen steadily, fuelled by higher prices due to supply constraints created by the Ukraine war. The current share price is GBP 5.6 (USD 6.8).

BP’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3Ip05cT

Valutico Analysis

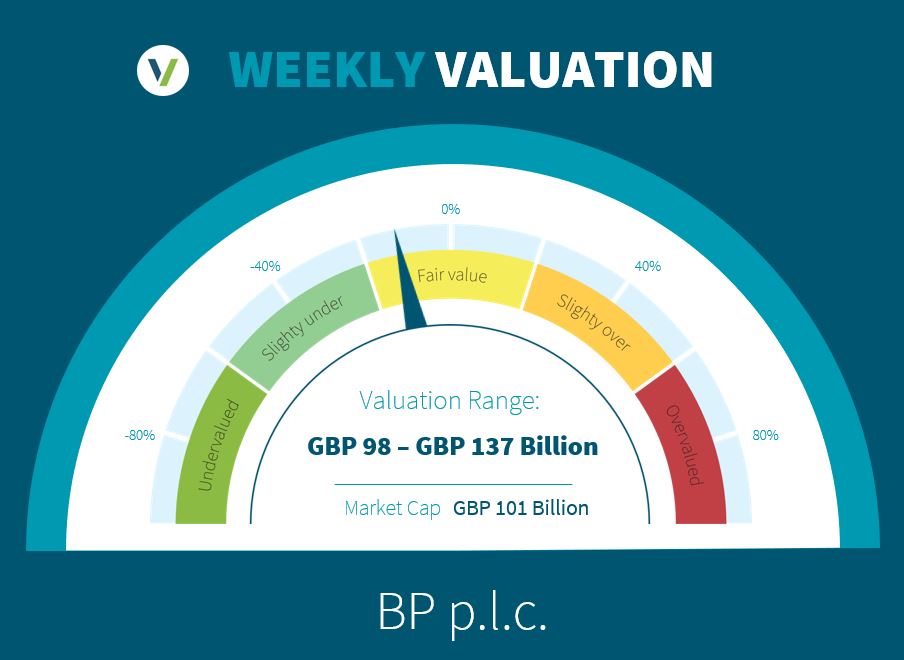

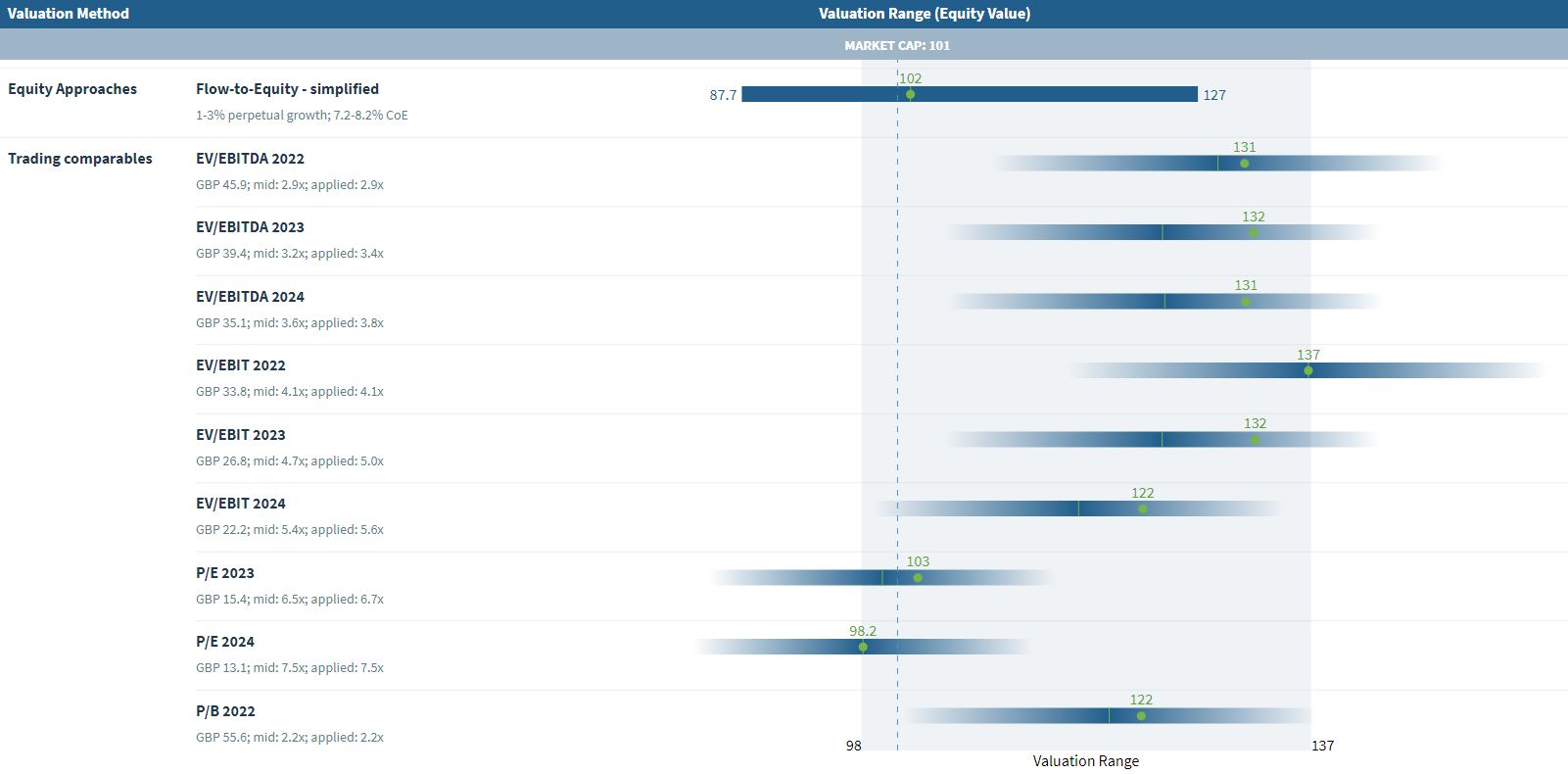

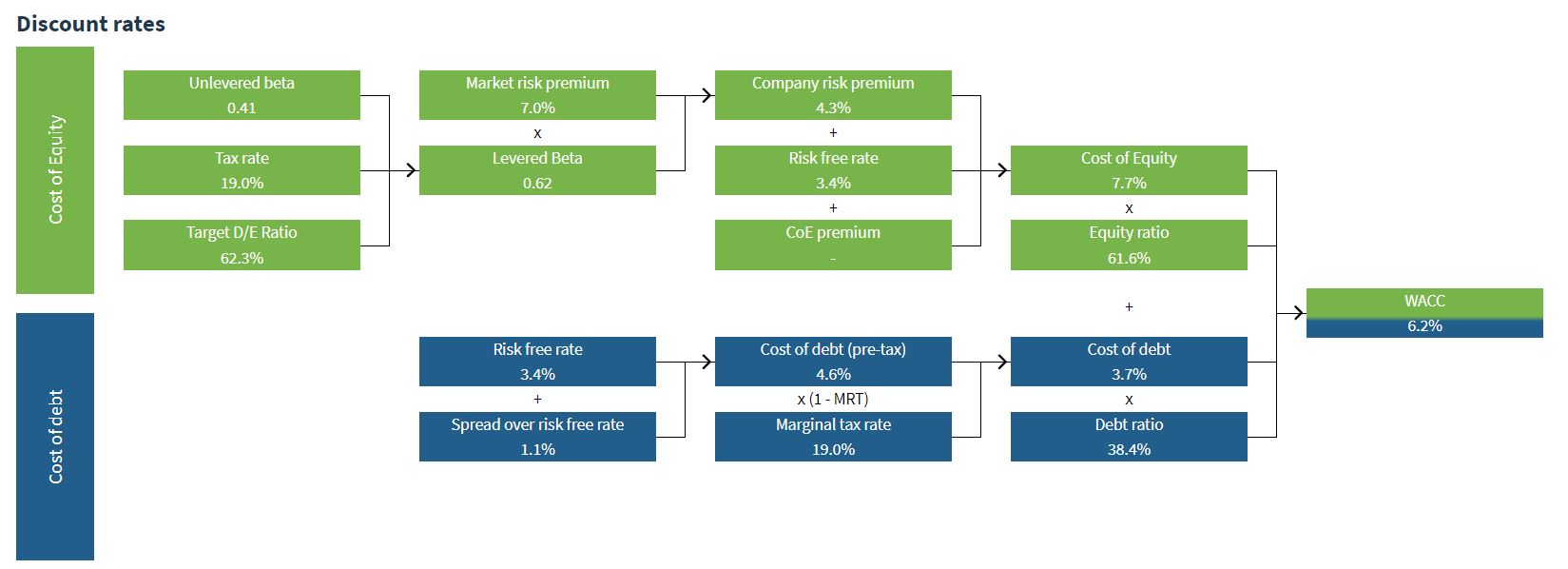

We analyzed BP p.l.c. by using the Discounted Cash Flow method, specifically our Flow-to-Equity approach, as well as a Trading Comparables analysis. The Flow-to-Equity analysis produced a value of GBP 102 (USD 123) billion using a Cost of Equity of 7.7%.

The Trading Comparables analysis resulted in a valuation range of GBP 98 (USD 199) billion to GBP 137 (USD 166) billion by applying the observed trading multiples EV/EBITDA, EV/EBIT, P/E and P/B. For our Trading Comparables we selected similar peers such as Total Energies, Shell, Chevron and Saudi Arabien Oil Company.

Combining our Flow-to-Equity and Trading Comparables analysis results in a value range of GBP 98 (USD 199) billion to GBP 137 (USD 166) billion. In comparison to BP’s market capitalization of GBP 101 (USD 122) billion we suggest that the company is slightly undervalued.

Will bubbling profits keep the share price rising, or will concerns about the new, less environmentally friendly strategy cause the share price to fall again? Let us know in the comments.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.