HP Inc.

Weekly Valuation — Valutico | 7 October 2022

Link to the detailed valuation

About HP

HP Inc. is a US-based computer technology firm that develops PCs, laptops, and printers. The company also offers 3D printing solutions and sells related hardware products.

Recent Performance

In terms of earnings, HP was able to meet the expectations of analysts in their third-quarter earnings call. HP reached the expected earnings of USD 1.04 per share. However, the company sold products worth USD 14.66 billion in the third quarter of 2022 and therefore was not able to meet the expectations of the analysts who estimated revenue of USD 15.69 billion.

In their third quarter earnings call, HP also announced that they returned USD 1.3 billion to their shareholders as the company repurchased shares and paid out dividends. In terms of growth of the company’s segments, it was stated that consumer net revenue decreased by 20%, whereas the net revenue for business-to-business activities increased by 7% compared to last year’s third quarter. The net revenue of the printing segment was down 6%. However, HP was able to sell its printers and related products with a margin of 19.9%. This decline of 6% in the printing business is probably attributed to the current worldwide supply-chain problems.

Poly Takeover and Remote Working

High hopes of HP investors are currently pinned on the Poly takeover which was announced on 29th August. Poly is a provider of workplace collaboration solutions with a focus on remote work. At the end of March, an agreement was reached on acquiring Poly for a value of USD 3.3 billion. The target company will receive USD 40 per share from HP. Due to that takeover, the PC and printer manufacturer wants to align its offer with the new trend towards remote working. Therefore, HP is able to offer a smooth integration between hardware and software. HP Inc. expects the acquisition to drive innovation and more robust growth in its peripheral and workforce business.

Warren Buffet

HP Inc. also received attention in the news as star investor Warren Buffet bought USD 4.2 billion worth of the company in April 2022. Back then the price per share amounted to around USD 40. At the start of September, HP was traded at USD 30, which is a discount of 25% to the purchase price of Warren Buffet. HP is also interesting for long-term investors as they are offering an attractive dividend yield of just over 3%.

Valutico Analysis

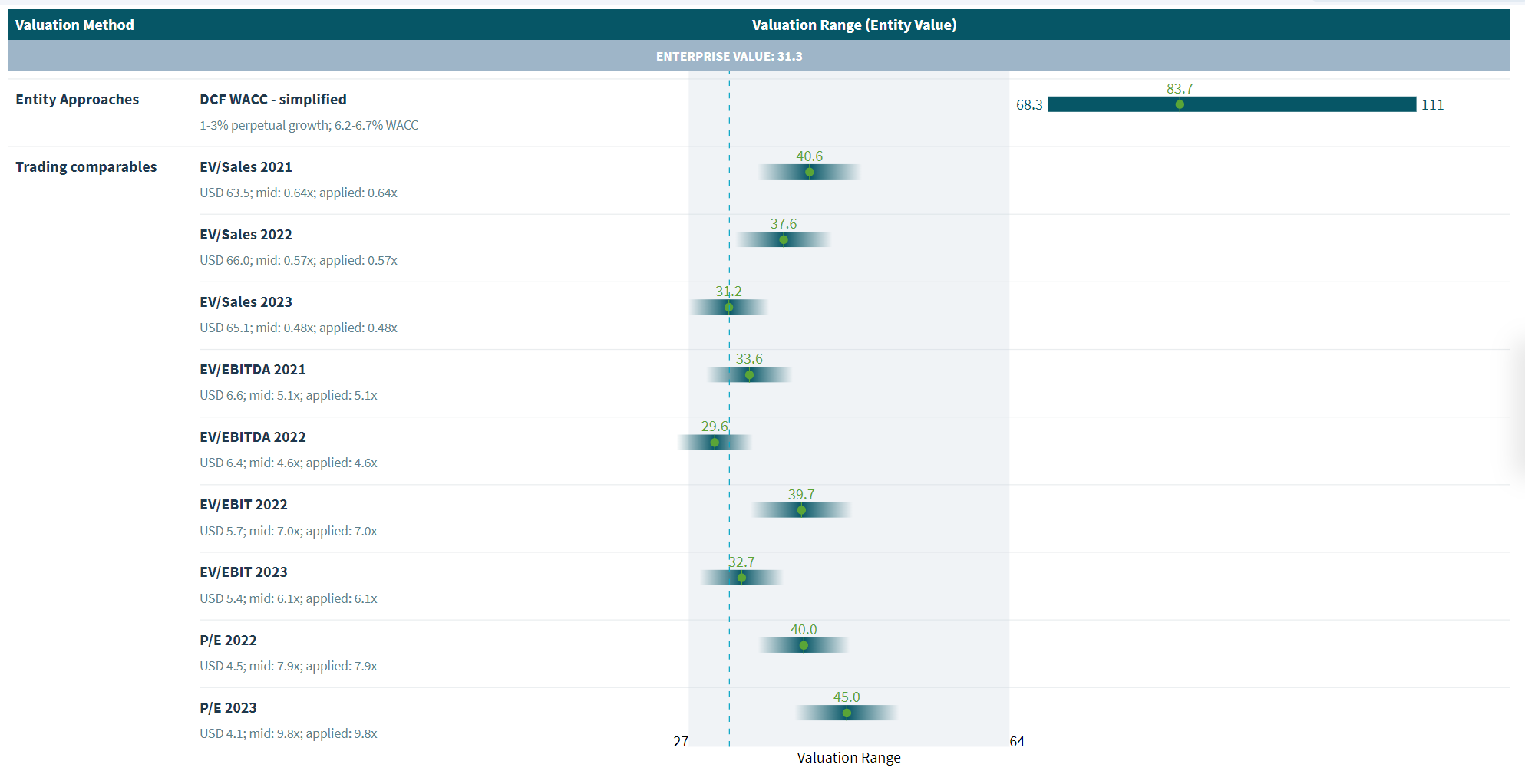

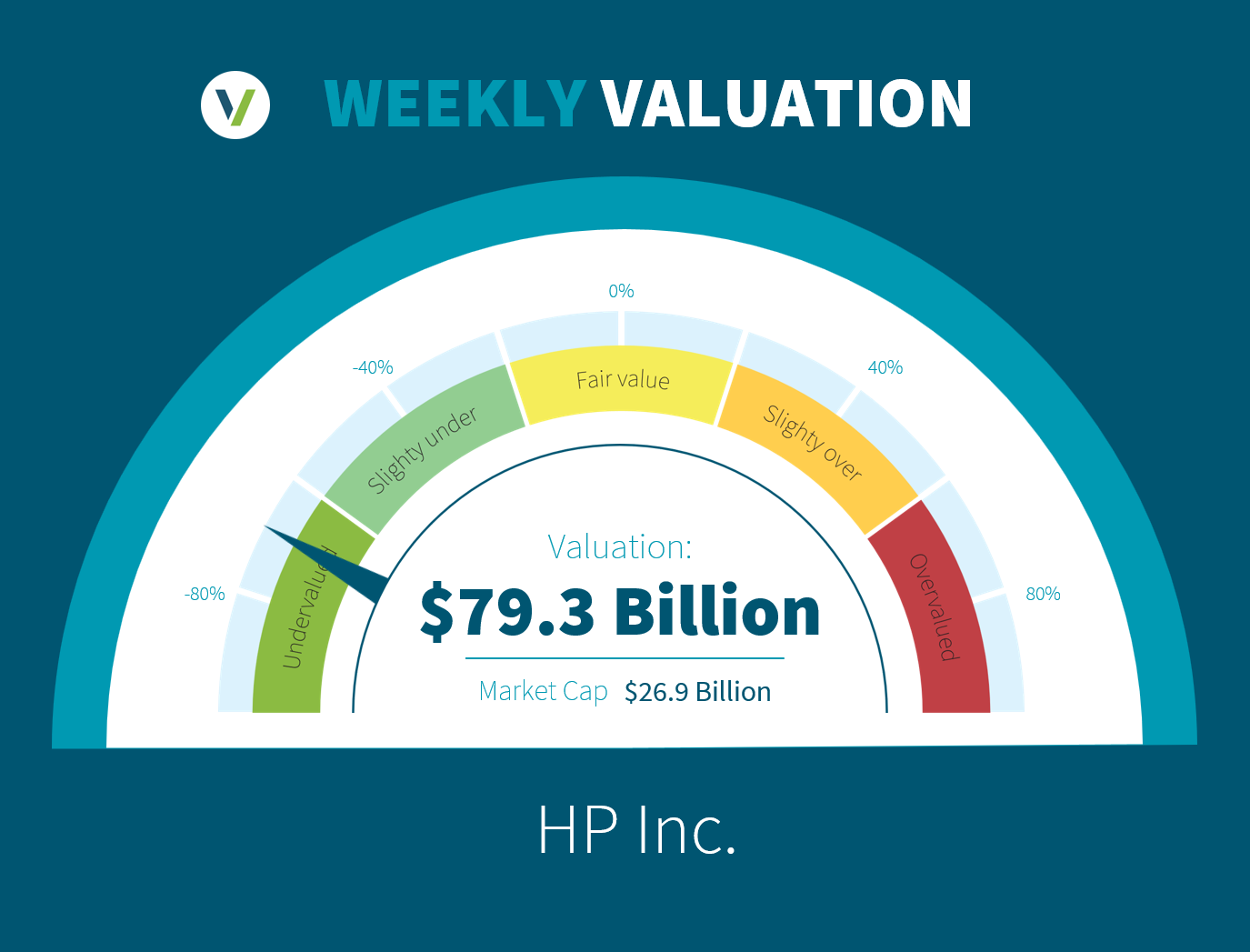

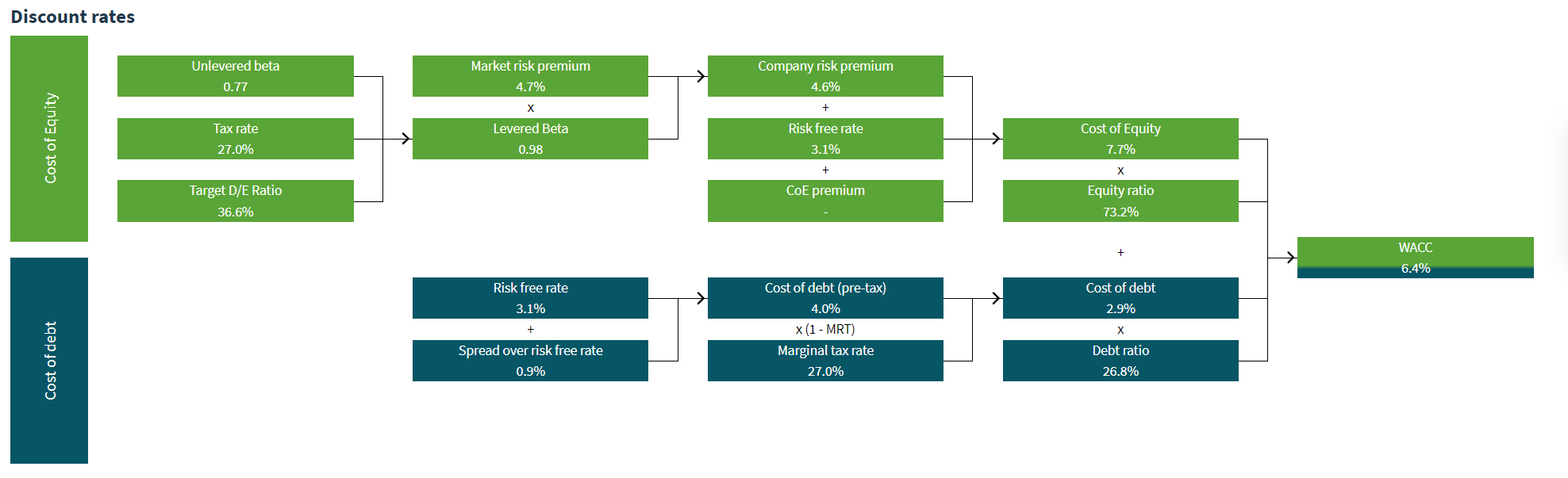

Taking all this interesting information into account, we conducted a discounted cash flow analysis (DCF), which led to an attractive valuation of HP. For this, we calculated a WACC of 6.4

%. With our DCF model–which we discounted with our WACC–we got a value of USD 79.3 billion for the enterprise. Our discounted cash flow analysis indicates a range of USD 63.9 billion to USD 107 billion. The company currently has a market cap of USD 26.9 billion, indicating HP’s strong upside potential. Therefore, we think HP Inc. is undervalued.

Link to the detailed valuation