HSBC Holdings plc

Weekly Valuation — Valutico | 20 March 2023

Context

The past weeks, the financial market was rattled by the collapse of Silicon Valley Bank, the go-to bank for tech startups, serving half of America’s venture capital-backed tech firms. SVB had been grappling with liquidity concerns in the US, which sparked a massive bank run last week, resulting in its collapse on Friday, March 10th. In response to concerns of contagion, US financial regulators acted quickly over the weekend, assuring customers of the failed bank that they would have access to all their money starting Monday.

HSBC saves the day

HSBC, one of the world’s largest banking and financial services organizations, swiftly acquired the UK division of Silicon Valley Bank in response to the crisis, securing the deposits of numerous British tech firms that had invested their money in the failed bank. This acquisition is expected to strengthen HSBC’s commercial banking franchise and enhance its ability to serve innovative and fast-growing firms, particularly in the technology and life science sectors, both domestically and globally.

About the deal

HSBC Holdings plc announced that its UK ring-fenced subsidiary, HSBC UK Bank plc, was acquiring Silicon Valley Bank UK Limited for GBP 1. As of 10 March 2023, SVB UK had loans of approximately GBP 5.5 (USD 6.7) billion and deposits of around GBP 6.7 (USD 8.1) billion, according to the HSBC statement. It recorded a profit before tax of GBP 88 (USD 106.5) million for the financial year ending 31 December 2022, and its tangible equity is expected to be around GBP 1.4 (USD 1.68) billion. The assets and liabilities of SVB UK’s parent companies were excluded from the transaction, which will be funded from existing resources.

Recent Financial Performance

In late February 2023, HSBC released its 2022 annual results, showing strong financial performance and higher capital distributions. They announced a 50% dividend payout ratio projected for 2023 and 2024 as well as a return to quarterly dividends from Q1 this year. HSBC is also planning a special dividend of $0.21 to be paid in Q1 once the Canada disposal is completed as well as additional share buybacks. Finally, it indicated that it will also bring forward the announcement of buybacks to the Q1’2023 earnings results.

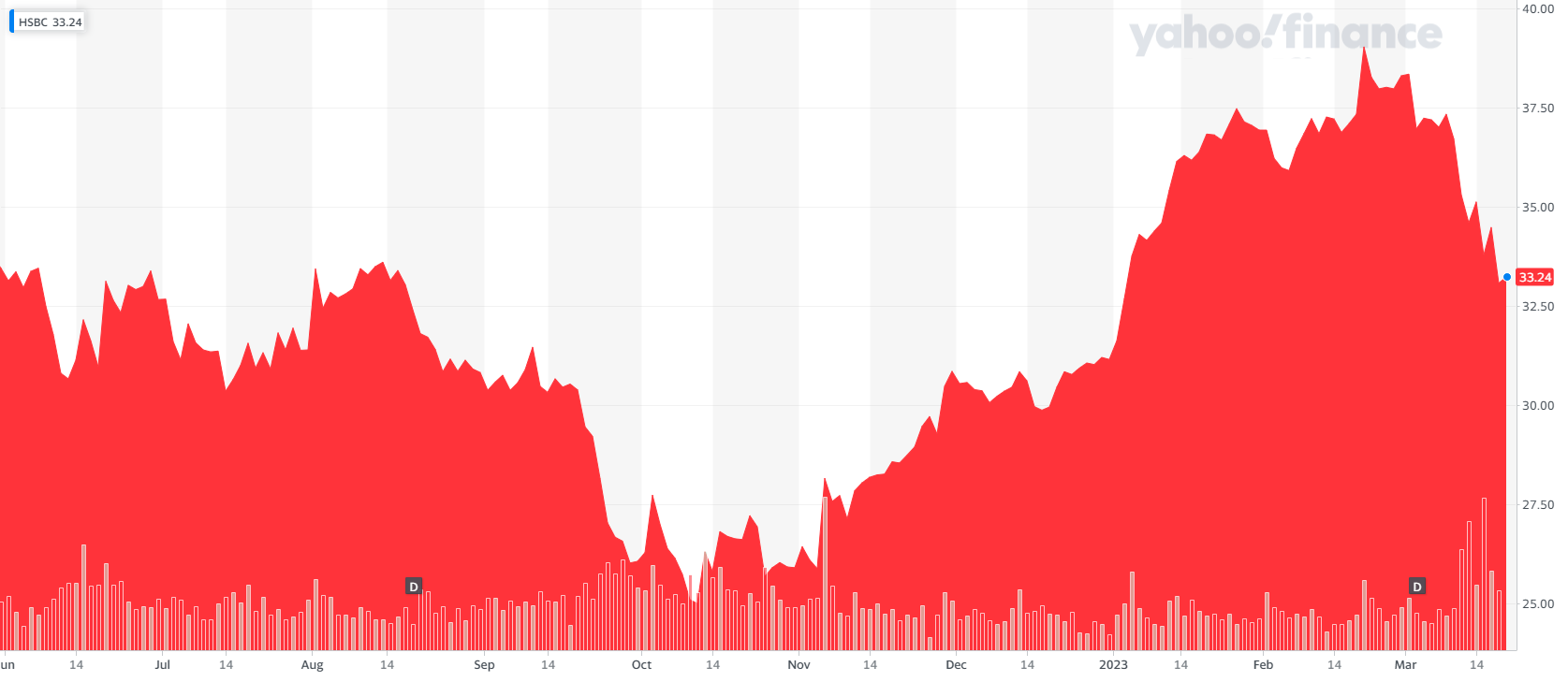

Share Price Performance

Over the last 5 years, investing in the ADR of HSBC Holdings PLC (NYSE:HSBC) has proven to be less than profitable for investors, with only marginal returns realized. Although in 2018, HSBC’s stock was performing well and traded around USD 55, the Covid-19 crisis in 2020 affected the entire market, and HSBC was not the exception, leading to a marked decline in its stock price. This was further exacerbated in September of the same year, because of a leak revealing that HSBC, alongside other banks, had allegedly moved large sums of illicit funds for almost two decades, despite alarms about the money’s origins. This situation resulted in a significant decline in investor confidence. Since then, the stock price of HSBC has fluctuated between USD 25 and USD 37. As of the date of this valuation, the current price stands at USD 33.24.

Five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/42ogu9F

Valutico Analysis

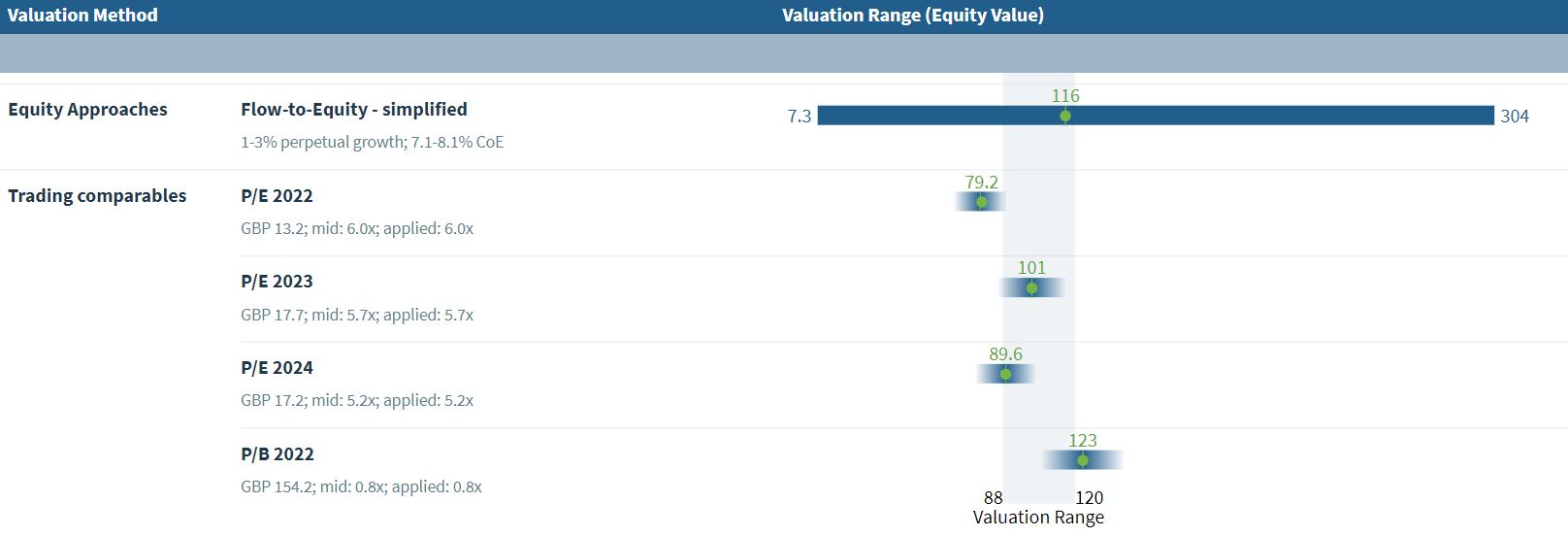

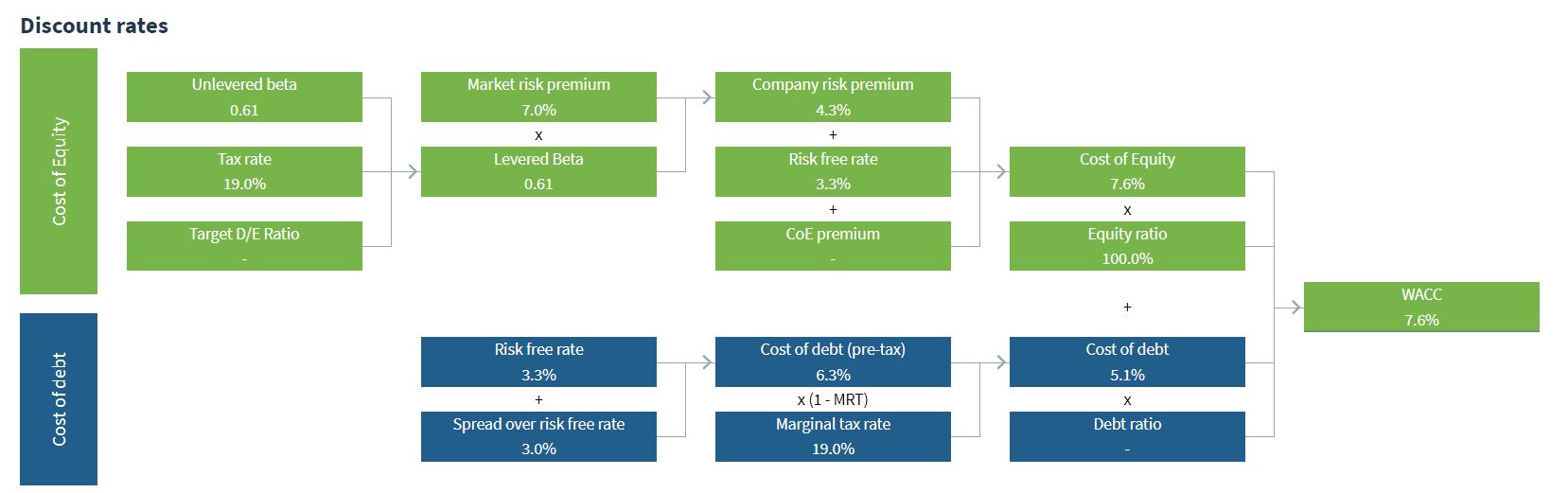

We analyzed HSBC by using our Flow-to-Equity simplified approach, as well as a Trading Comparables analysis. The Flow-to-Equity analysis produced a value of GBP 116(USD 142.07) billion using a Cost of Equity of 7.6%.

The Trading Comparables analysis resulted in a valuation range of GBP 89.6 (USD 109.7) billion to GBP 123 (USD 150.6) billion by applying the median of the observed P/E and P/B multiples of the peer group. For our Trading Comparables we selected similar peers such as AIB Group plc, Lloyds Banking Group plc, NatWest Group plc, Standard Chartered plc.

Combining our Flow-to-Equity and Trading Comparables analysis results in a value range of GBP 88 (USD 107.7) billion to GBP 120 (USD 147) billion. In comparison to BP’s market capitalization of GBP 112 (USD 137.2) billion we suggest that the company is fairly valued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.