UBS Group AG

Weekly Valuation — Valutico | 28 March 2023

View from the castle with old town, river Aare and Lake Thun in Thun in the Bernese Oberland in Switzerland

Context

In recent days, the financial markets have experienced increased turmoil, causing growing concerns about financial stability. The collapse of SVB had a ripple effect through the banking sector, leading investors to fear that other banks could follow suit. As a result, they have been pouring into money market funds at the highest rate since the COVID pandemic began. Deposit holders are fleeing the banking chaos, and investors are seeking stable havens until the storm passes. However, this has put pressure on banks, including Credit Suisse, a globally systemically important bank. Credit Suisse’s investment banking unit had already been tarnished by a series of high-profile scandals, and its share price took a hit when the leading shareholder ruled out further investment due to regulatory issues.

About the deal

UBS Group AG, a Swiss investment bank, has reached an agreement to purchase Credit Suisse in an all-stock deal, as announced on March 19th, 2023. The acquisition was facilitated by the Swiss government and the Swiss Financial Market Supervisory Authority. To support the deal, the Swiss National Bank provided over CHF 100 (USD 104) billion in liquidity to UBS following its takeover of Credit Suisse’s operations. The Swiss government also offered a guarantee to UBS, covering potential losses of up to CHF 9 (USD 9.6) billion in the short term. As part of the agreement, CHF 16 (USD 17.2) billion worth of Additional Tier 1 bonds were written off completely.

Recent Financial Performance

In January 2023, UBS released its annual results, showing a 14% year-on-year increase in net profits to USD 7.6 billion. The bank also attracted USD 60 billion in net new fee-generating assets in GWM for the full year, USD 25 billion of net new money in AM and CHF 2 billion of net new investment products for Personal Banking, an 8% growth rate. UBS maintained a strong capital position, ending the year 2022 with a CET1 capital ratio of 14.2% and a CET1 leverage ratio of 4.42%. As of now, UBS is offering a dividend of USD 0.55 per common stock, with a dividend yield of 2.70%. The company repurchased USD 5.6 billion of shares in 2022, and expect to repurchase more than USD 5 billion of shares during 2023.

Share Price Performance

Between February 2018 and February 2020, UBS saw a decline of over 35% in its share price due to weaker profits, which worsened during the pandemic. Despite investor concerns over significant financial market disruption, the markets proved resilient thanks to sufficient capital levels and unprecedented government support for companies, which mitigated the pandemic’s economic effects. UBS’s share value rose in the second half of 2020, and by November 2020, it had recovered its pre-pandemic value. The following year saw sustained price growth with UBS shares increasing from USD 14 to USD 18. Currently, UBS stock is trading at USD 19.43, a 1.04% increase from the beginning of the year when it was trading at USD 18.67.

Five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3zf2Gks

Valutico Analysis

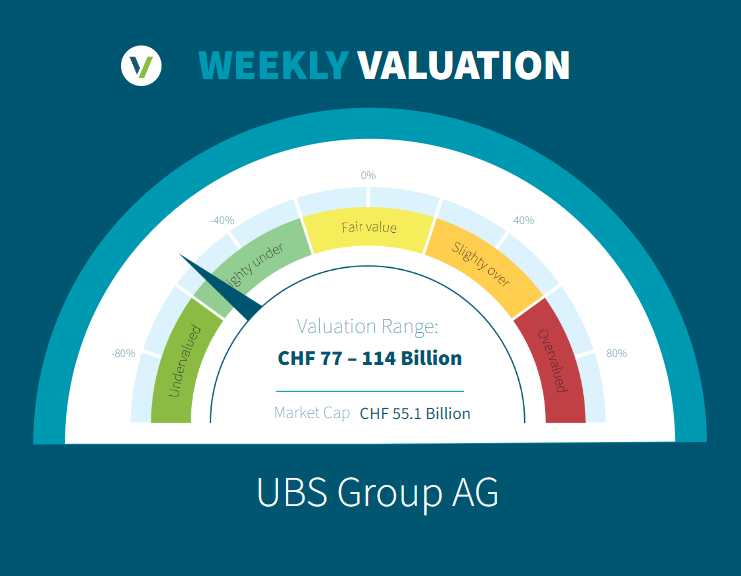

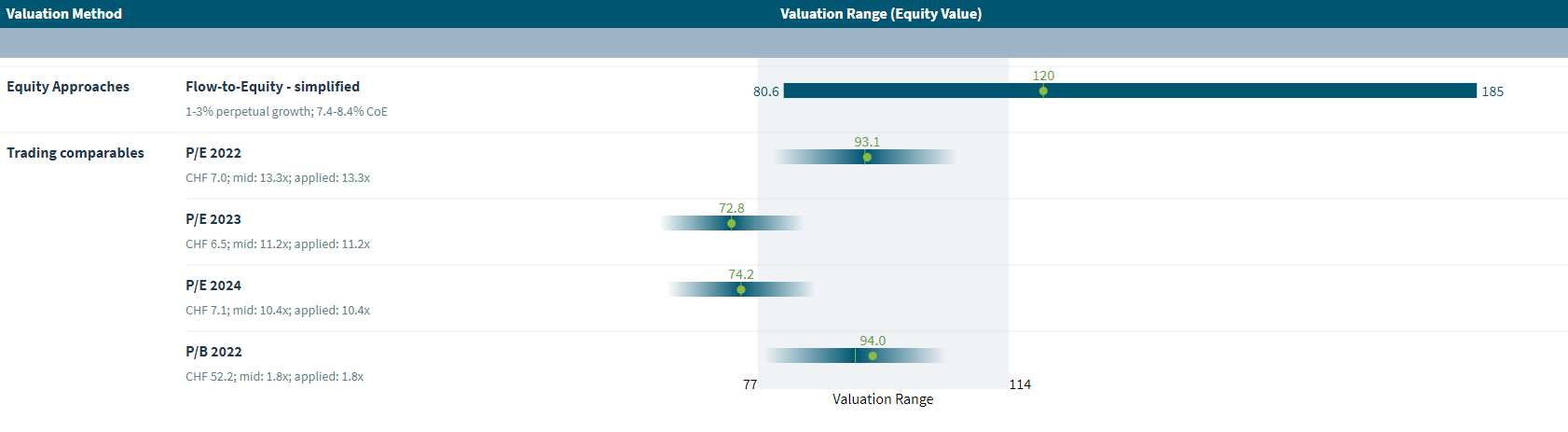

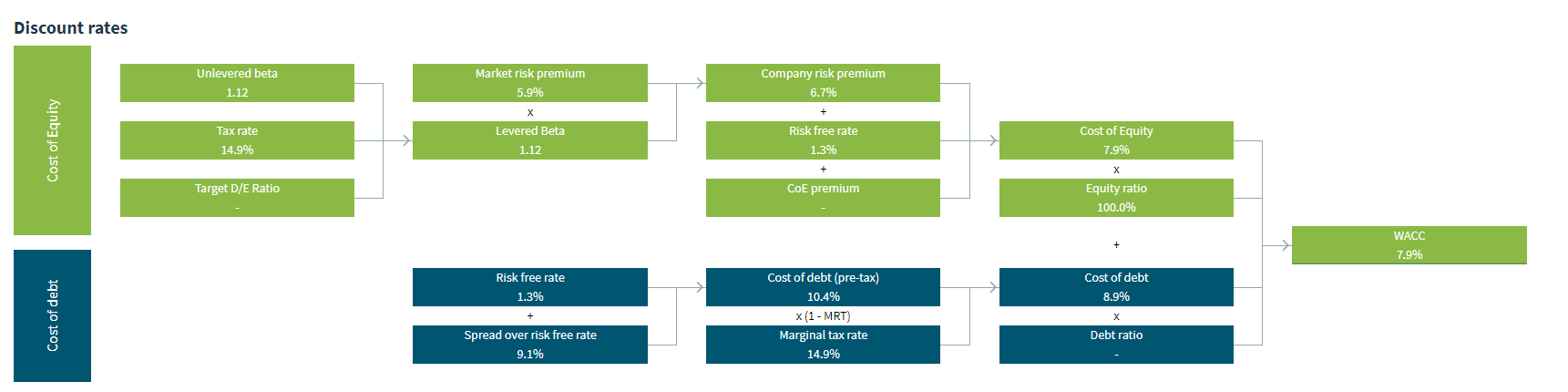

We analyzed UBS Group AG by using our Flow-to-Equity simplified approach, as well as a Trading Comparables analysis. The Flow-to-Equity analysis produced a value of CHF 120 (USD 130.5) billion using a Cost of Equity of 7.9%.

The Trading Comparables analysis resulted in a valuation range of CHF 72.8 (USD 79.1) billion to CHF 94 (USD 102.2) billion by applying the median of the observed P/E and P/B multiples of the peer group. For our Trading Comparables we selected similar peers such as Morgan Stanley, Deutsche Bank Aktiengesellschaft and DWS Group GmbH & Co. KGaA.

Combining our Flow-to-Equity and Trading Comparables analysis results in a value range of CHF 77 (USD 83.7) billion to CHF 114 (USD 124.0) billion. In comparison to BP’s market capitalization of CHF 55.1 (USD 59.9) billion we suggest that the company is slightly undervalued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.