First Citizens BancShares, Inc.

Weekly Valuation – Valutico | April 7 2023

Interior Empty Modern Loft Office open space modern office footage.Modern open concept Lobby and reception area meeting room design.4k . 3d Rendering and drawing line sketch.

Context

First Citizens BancShares, Inc announced on March 27, 2023 that it has entered into an agreement with the Federal Deposit Insurance Corporation (FDIC) to purchase Silicon Valley Bank after a wave of withdrawals that caused the largest banking collapse in the US in over ten years. The agreement is expected to alleviate some of the chaos that has been shaking the financial system, and the announcement has caused local bank stocks to rise significantly.

About the buyer

First Citizens Bank, is a US-based North Carolina state-chartered commercial bank that was founded in 1898. With over USD 218 billion in total assets, the bank has expanded its presence across 23 states, operating a network of more than 500 branches as well as a nationwide direct bank. Its growth strategy has included the acquisition of distressed banks, having purchased 12 banks out of receivership since the global financial crisis. In its most recent acquisition, the bank acquired CIT Group in a highly accretive deal, combining CIT’s specialized commercial lending portfolio with First Citizens Bank’s strength as a deposit-gathering franchise.

Recent Financial Performance

First Citizens BancShares, saw significant growth in net interest income after the recent merger, with net interest income jumping from USD 1.39 billion to USD 2.95 billion in the past year. While the bank serves small and medium businesses, it has less exposure to vulnerable businesses than Silicon Valley Bank. However, the bank carries risks, particularly with its USD 29.1 billion in uninsured deposits. To strengthen its financial position, First Citizens Bank increased its borrowings from the Federal Home Loan Bank to USD 9 billion, effectively increasing its pre-acquisition cash position from USD 4 billion to USD 10 billion. The bank has also made other moves to enhance its financial position and has seen a USD 1.3 billion increase in deposits since the end of last year.

About the deal

First Citizens Bank acquired Silicon Valley Bank’s branches, loans, and deposits in a complete purchase and assumption agreement with loss share coverage. The FDIC retained about USD 90 billion of SVB securities and agreed to share any potential losses or gains on SVB’s commercial loans with First Citizens. The FDIC will provide a USD 35 billion loan over five years to finance the deal and a USD 70 billion line of credit to cover potential deposit flight. The estimated cost of the bank’s failure to the Deposit Insurance Fund is about USD 20 billion, and the FDIC will receive equity appreciation rights in First Citizens with a potential value of USD 500 million. First Citizens will assume USD 56 billion in deposits, and 17 branches will operate as Silicon Valley Bank, a division of First Citizens, with no immediate changes to customer accounts.

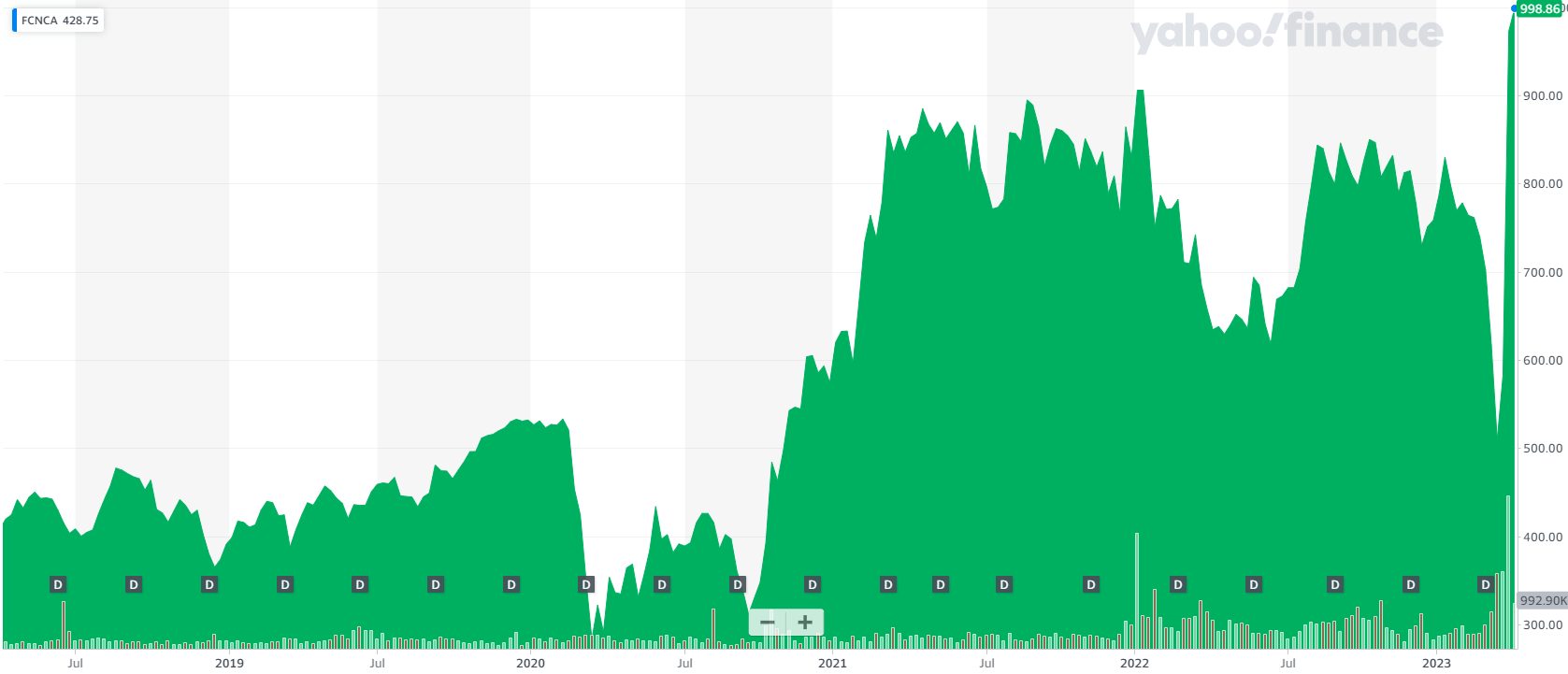

Share Price Performance

In the last five years, investing in First Citizens stocks, like other banks, has been unprofitable for investors with only marginal returns. The Covid-19 crisis in 2020 led to a marked decline in the stock price, but financial stimuli from the FED helped to reverse this situation in 2021. However, the bank faced challenges in 2022 due to the same monetary policy and high interest rates. Despite this, the bank’s stock price has rallied to as high as 49%, with shares gaining 13.3% over the past six months, outpacing the industry’s decline of 15.1%. The recent acquisition of the failed SVB has boosted investor confidence in the North Carolina-based bank, and as of April 7 their stocks are trading around USD 998.

Five-year share price chart is shown below:

Valutico Analysis

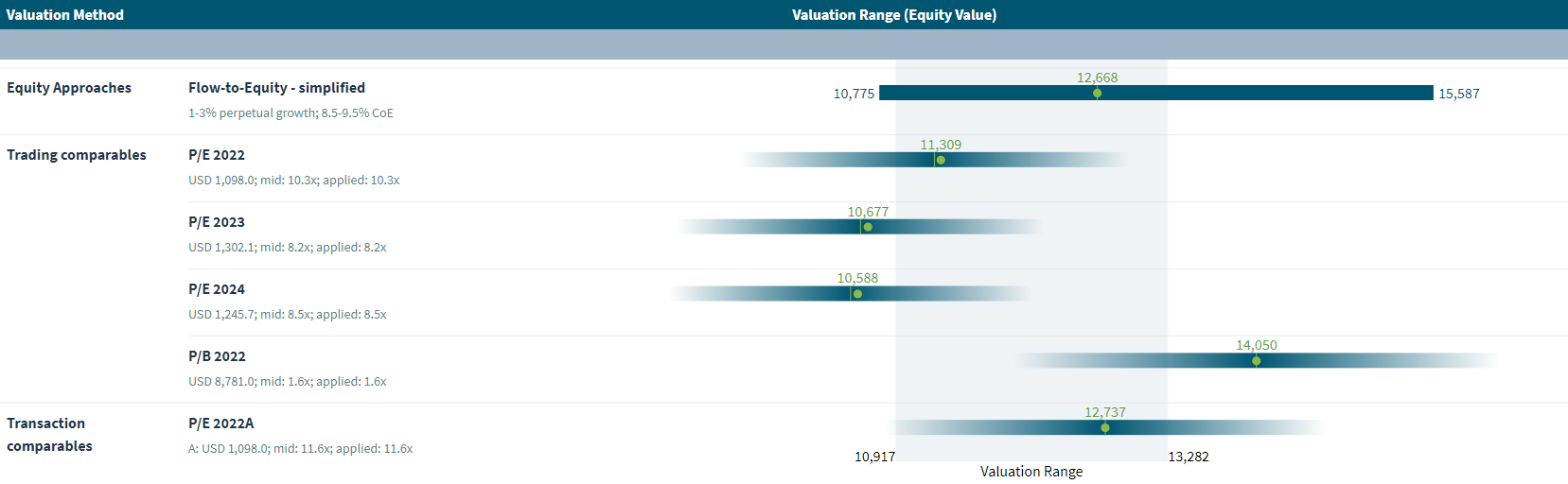

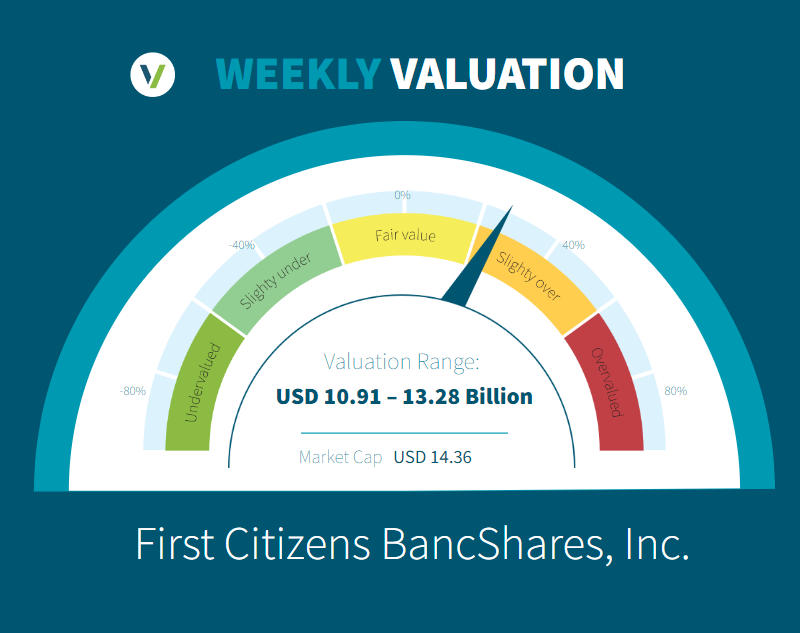

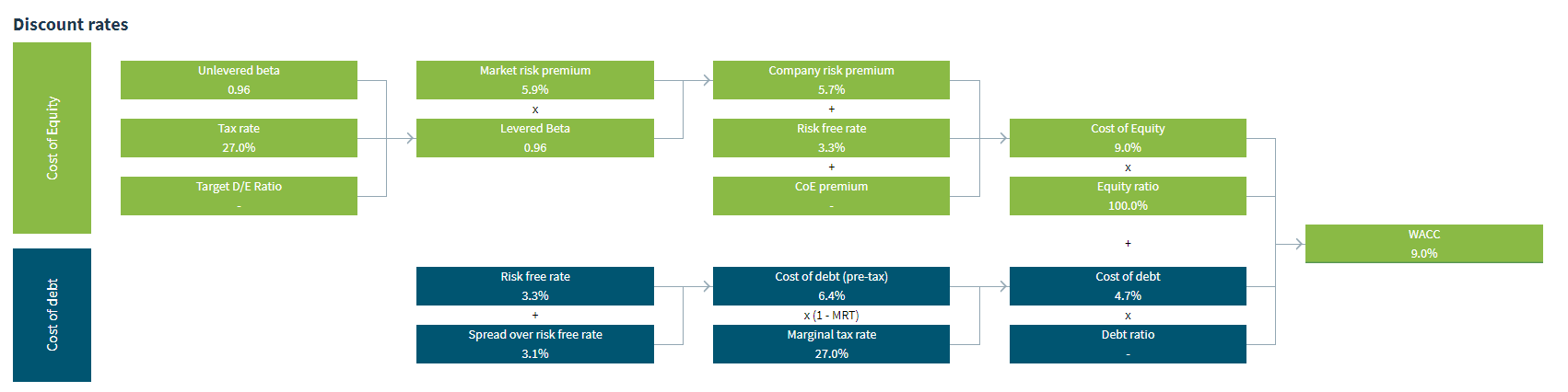

We analyzed First Citizens BancShares, Inc. by using our Flow-to-Equity simplified approach, as well as a Trading Comparables analysis. The Flow-to-Equity analysis produced a value of USD 12.66 billion using a Cost of Equity of 9.0%.

The Trading Comparables analysis resulted in a valuation range of USD 10.58 billion to USD 14,05 billion by applying the median of the observed P/E and P/B multiples of the peer group. For our Trading Comparables we selected similar peers such as M&T Bank Corporation, Huntington Bancshares, Inc. and Commerce Bancshares, Inc.

Combining our Flow-to-Equity and Trading Comparables analysis results in a value range of USD 10.91 billion to USD 13.28 billion. In comparison to BP’s market capitalization of 14.36 billion we suggest that the company is slighty over valued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.