Alphabet Inc.

Weekly Valuation – Valutico | 21 February 2023

About Alphabet

Alphabet Inc. is an American tech conglomerate, operating in various industries, including technology, advertising, autonomous driving, entertainment, and many more. The company is one of the world’s largest companies with a market capitalization of $1.34 trillion and competes via its famous subsidiary companies Google, Youtube and Waymo, amongst others. Recently the Google search engine was subject to many discussions due to rising perceived threats from Artificial Intelligence (AI) technology.

Recent Financial Performance

Three weeks ago the company released its 2022 annual report, which showed strong revenue figures – growing by 10% to $283 billion compared to 2021. Despite this revenue growth, Alphabet was unable to maintain its healthy net profit margin, as net profit fell by around 5% to $75 billion. During this event, the company also published its fourth quarter results of 2022 showing an increase in revenue by 1% and a worrying decrease in revenues by 8% for the important YouTube segment.

Chat GPT Threatening Traditional Search Engines

AI models like Chat GPT, provided by OpenAI, have the potential to disrupt traditional search engines as these models are able to provide more accurate and efficient information. Google proclaimed code red as this could lead to decreased usage of the company’s search engine, which is its highest revenue producing stream, contributing about 60%. However, Alphabet is also heavily investing in AI and could potentially integrate similar capabilities into its products to remain competitive. Last week, the company held a conference to talk about the threat of Chat GPT. There, Bard A.I., which can be seen as Alphabet’s answer to Chat GPT, was announced, but investors did not seem to be satisfied with Alphabet’s presented approach, as the share price has fallen by 10 % since then.

Share Price Performance

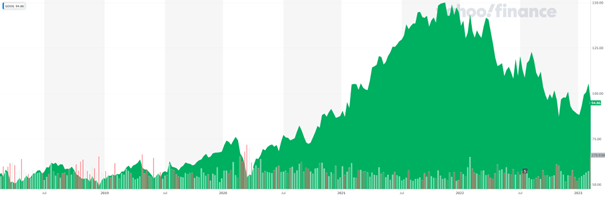

Alphabet was an exceptional performer on the stock exchange over the last 5 years with a total increase of over 100%, even 200% before the recent pull-back. Currently the company is trading at $95 per share. Will Alphabet be able to leverage AI technology and therefore reach new heights soon?

Alphabet’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3jI8z5l

Valutico Analysis

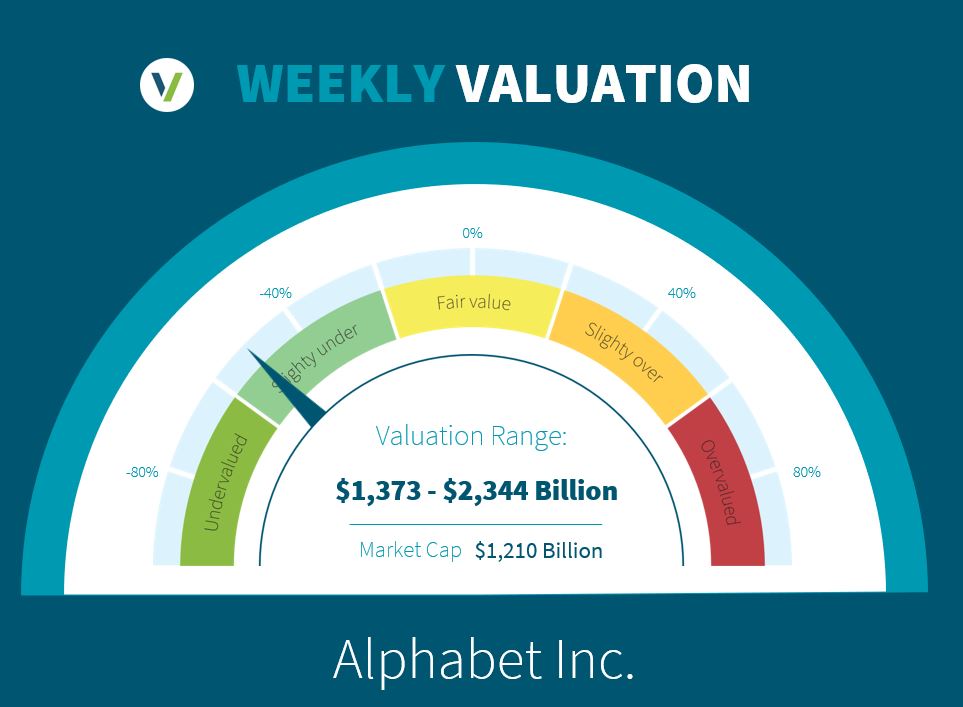

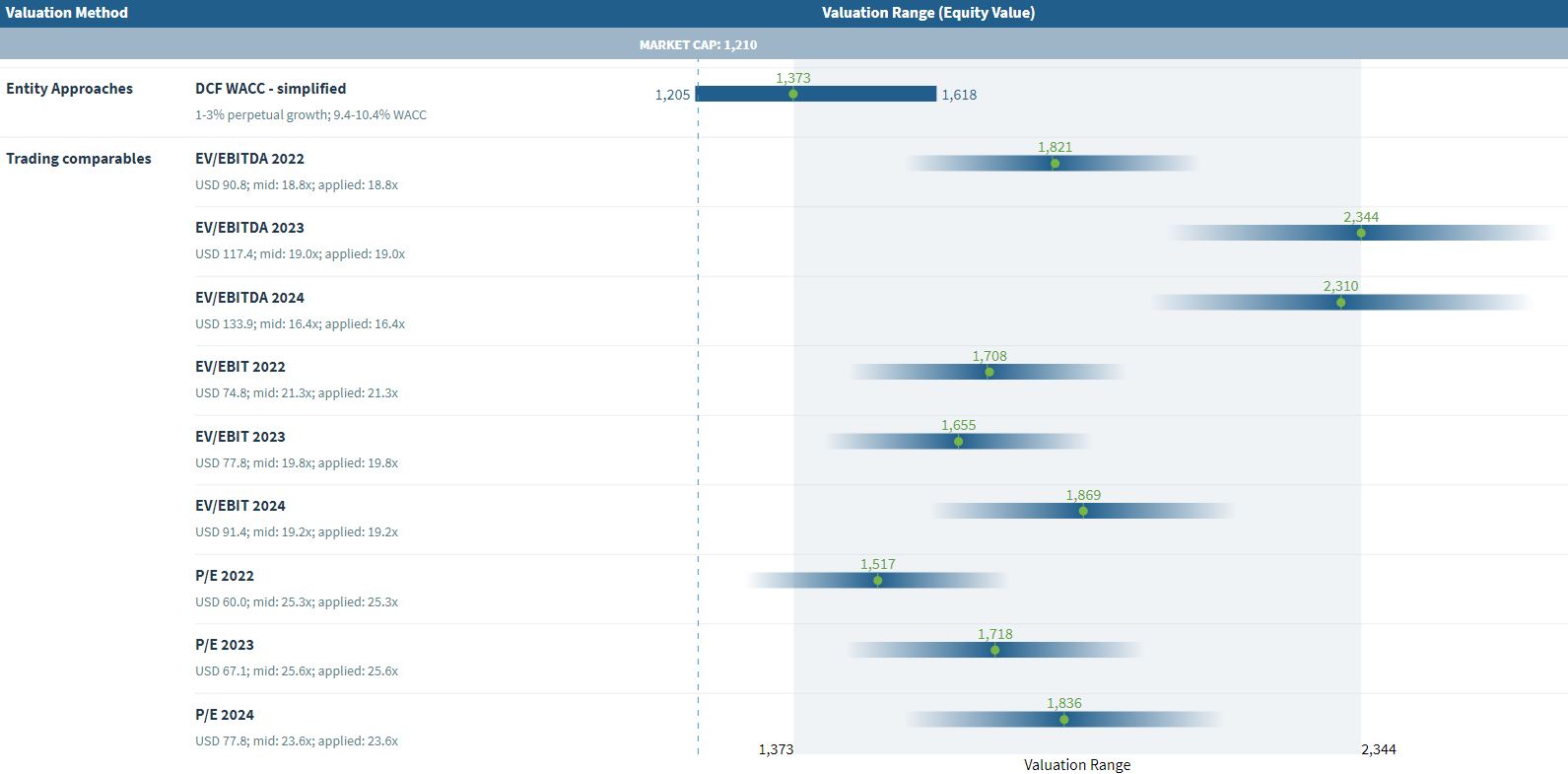

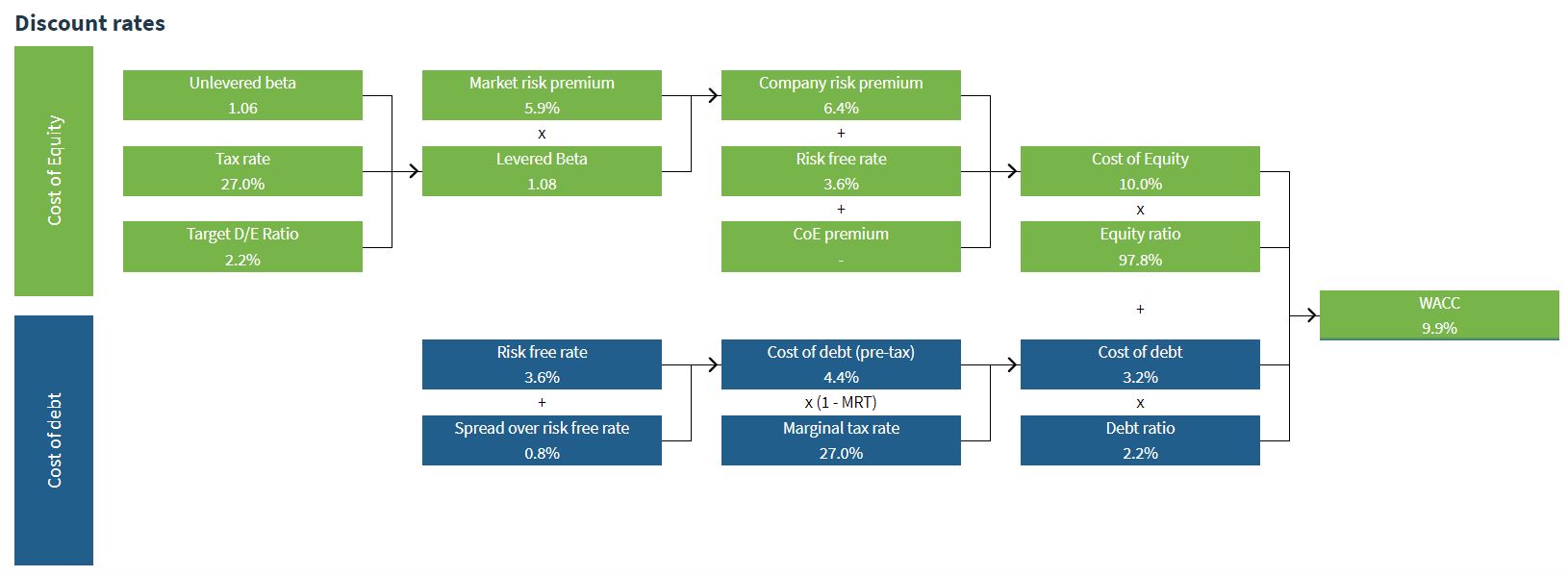

We analyzed Alphabet Inc. by using the Discounted Cash Flow method, specifically our DCF WACC approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of $1,373 billion using a WACC of 9.9%.

The Trading Comparables analysis resulted in a valuation range of $1,517 billion to $2,344 billion by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Meta, Apple and Microsoft.

Combining our DCF WACC and Trading Comparables analysis results in a value range of $1,373 billion to $2,344 billion. In comparison to Alphabet’s market capitalization of $1,210 billion we suggest that the company is undervalued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.