LVMH Moët Hennessy – Louis Vuitton, Société Européenne

Weekly Valuation – Valutico | 6 March 2023

About LVMH Moët Hennessy – Louis Vuitton

LVMH is a Paris-based luxury goods conglomerate. With a market capitalization of €395 billion, it is the most valuable company in Europe. Several luxury brands like Christian Dior, Givenchy, Fendi, Marc Jacobs and about 71 others are housed under the umbrella of LVMH.

Recent Financial Performance

In late January 2023, LVMH released its 2022 annual report, posting record revenue and income levels. The company made €79.2 billion in revenue and €21.1 billion in profit from recurring operations in 2022, an increase of 23%in both metrics. In terms of business groups, the company increased revenue in the Wine & Spirits segment by 19% year over year and 25% in the Fashion & Leather group. Perfumes & Cosmetics increased by 17% and the Watches & Jewellery segment grew by 18% – an excellent performance across the board..

New Acquisitions and Famous Directors

LVMH has recently been linked with the acquisition of Aesop, an Australian luxury cosmetics, shampoo and body care brand. The acquisition price is roughly €2 billion but the company is facing stiff competition from other bidders, L’Oreal and the Japanese brand Sisheido. There have also been rumors about LVMH making a bid for the Swiss based luxury brand Richemont. Richemont is especially interesting for the conglomerate, as it owns Cartier, which would fit perfectly into the watches and jewelry business group of LVMH. The company has also been in the news lately as the long term CEO Bernard Arnault appointed popstar Pharrell Williams as the new head designer for the core brand LVMH.

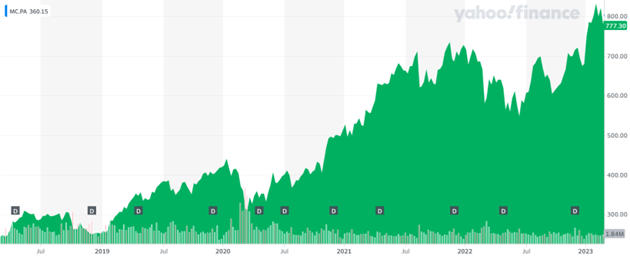

Share Price Performance

LVMH had an exceptional performance over the last five years on the Paris Stock Exchange. In early 2018 the company traded at €250 per share. After reaching new highs in early 2020 of €420 per share, the share price fell due to economic conditions and Covid-19. Since trading at €320 in mid 2020, the share price has more than doubled to its current level of €780 per share.

LVMH’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3Sf5y84

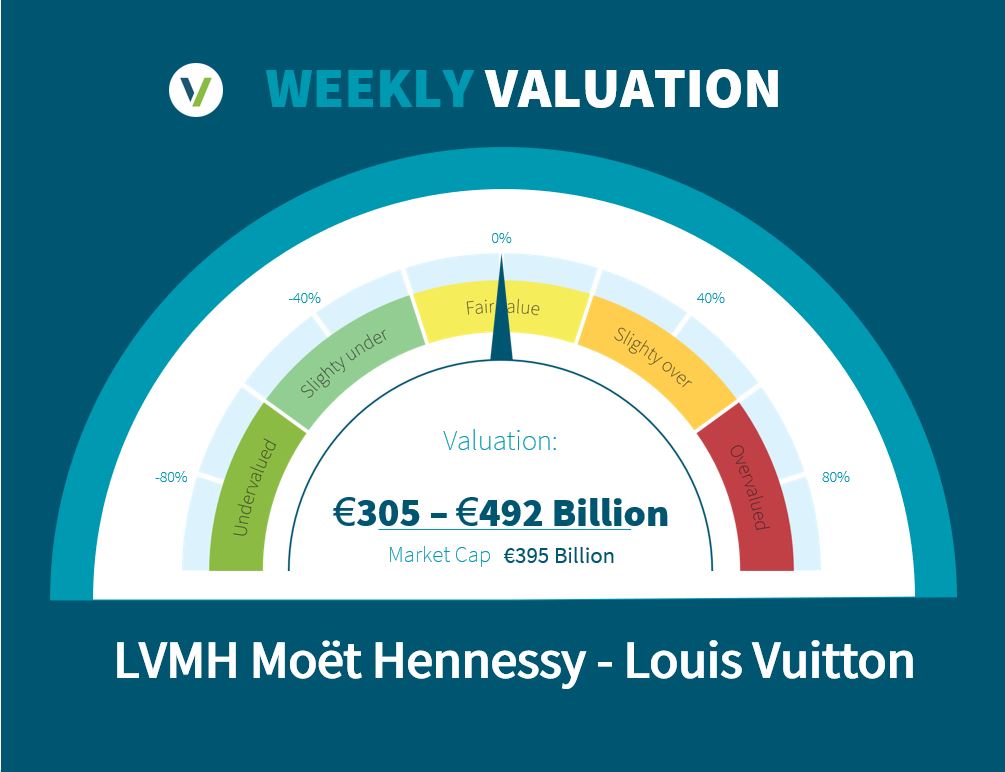

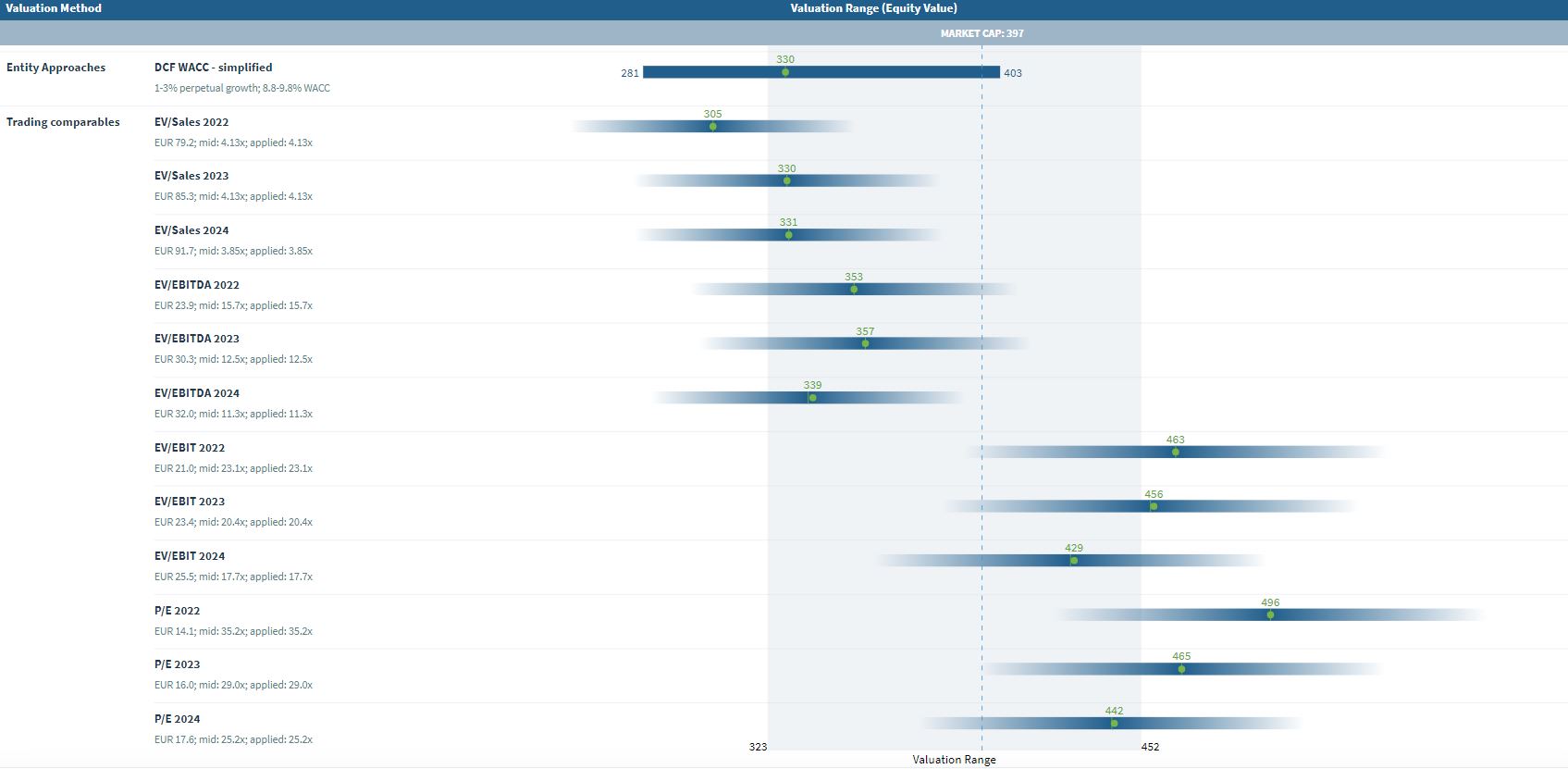

Valutico Analysis

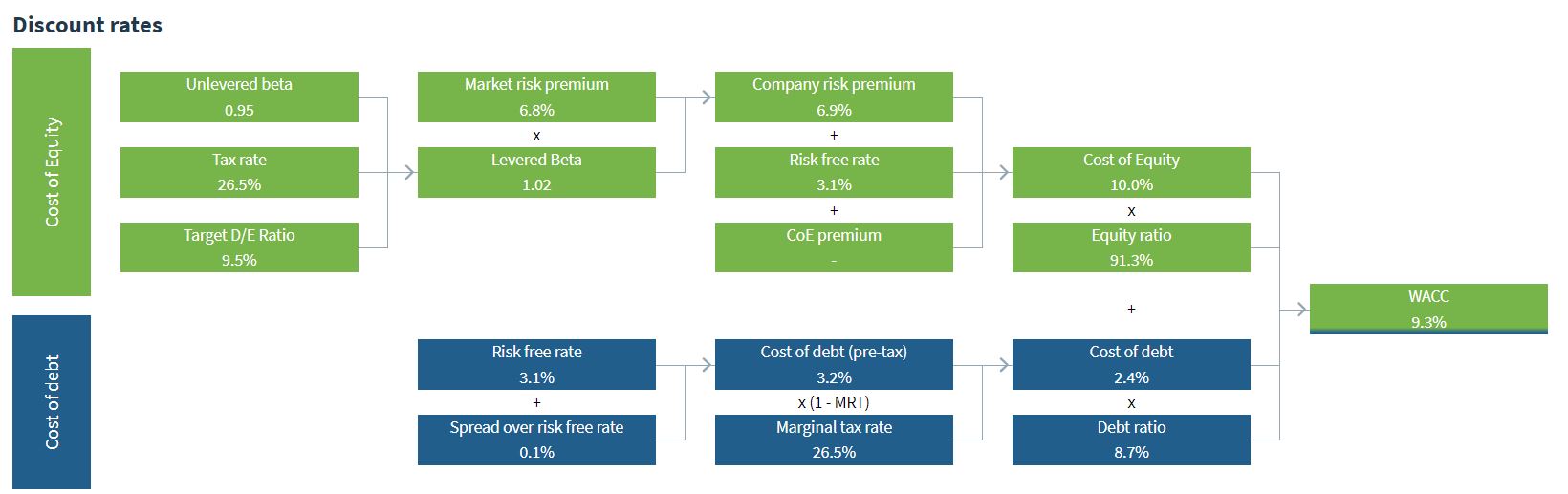

We analyzed LVMH Moët Hennessy – Louis Vuitton by using the Discounted Cash Flow method, specifically our DCF WACC

approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of €330 billion using a WACC of 9.3%.

The Trading Comparables analysis resulted in a valuation range of €305 billion to €492 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Burberry, Kering, Moncler and Hermes.

Combining our DCF WACC and Trading Comparables analysis results in a value range of €305 billion to €492 billion. In comparison to LVMH’s market capitalization of €395 billion we suggest that the company is fairly valued.

Will the strong demand for luxury goods continue and therefore continue LMVH’s strong share price performance? Let us know in the comments.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.