Devon Energy Corporation

Weekly Valuation – Valutico | June 26, 2023

About the company

Devon Energy Corporation, based in Oklahoma City, is a prominent player in the energy industry known for its commitment to oil and natural gas exploration and production. With a strong track record and a global presence, Devon Energy has positioned itself as a leading company in the energy sector. The company is dedicated to responsibly harnessing natural resources to meet the energy demands of the modern world.

About the deal

This partnership marks a convergence of Devon’s over 50 years of innovation in oil and gas with Fervo’s advanced geothermal capabilities. Fervo is known for being the first geothermal company to successfully implement a horizontal well pair for commercial geothermal production, a technique pioneered by Devon for oil and gas production. Fervo’s innovative approach, including horizontal drilling and multi-stage well completion, makes geothermal power more accessible and reliable. The partnership is aligned with Devon’s new energy ventures strategy.

Recent Financial Performance

In Q1 2023, Devon Energy saw a marginal profit and sales growth with net income of USD 995 million and revenues of USD 3.82 billion. The company reported an 11% rise in production to 641K boe/day, driven by Eagle Ford assets. Despite a decline in realized prices for all commodities, the company upholds steady growth. It sustains its FY 2023 production and capital spending outlook. Based on the first-quarter financial performance, Devon declared a fixed-plus-variable dividend of $0.72 per share.

Share Price Performance

The company has a market capitalization of more than $32 billion, however, its share price is still down roughly 30% from highs set last year. Devon is having a tough year because of the decline in oil prices and related recession fears have caused the stock to fall roughly 13%. Devon shares are 30% below their 52-week high and 20% above their 52-week lows. Devon’s current share price stands at USD 47.15.

Valutico Analysis

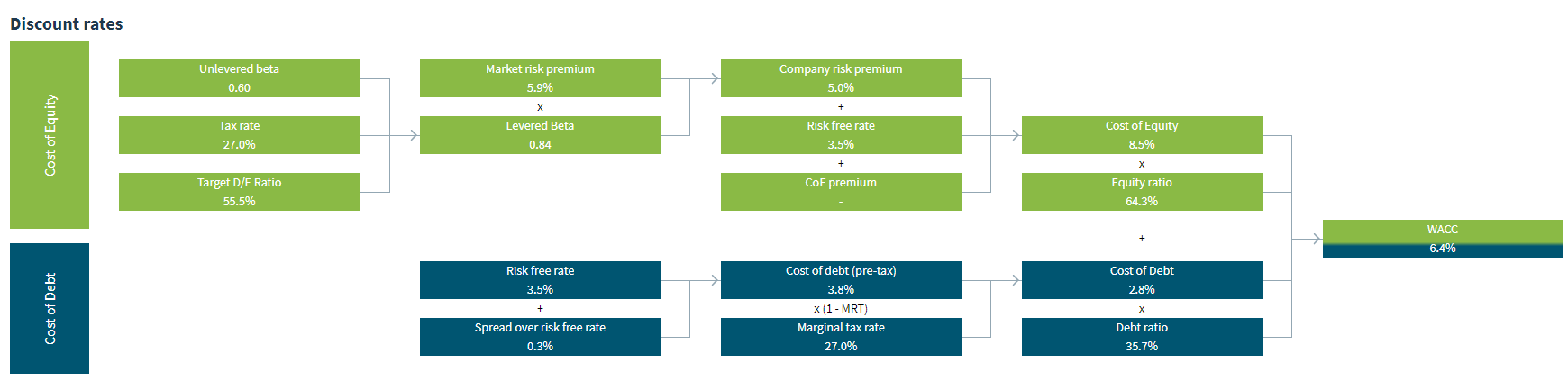

We analyzed Devon Energy Corporation by using the Discounted Cash Flow method, specifically our DCF WACC simplified approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of USD 27.1 billion using a WACC of 11.7%.

The Trading Comparables analysis resulted in a valuation range of USD 27.1 billion to USD 35.4 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Coterra Energy Inc., Earthstone Energy, Inc. and Northern Oil and Gas, Inc.

Combining our DCF WACC and Trading Comparables analysis results in a valuation range of USD 27 billion to USD 33 billion. In comparison to Devon Energy market capitalization of USD 31.7 billion we suggest that the company is fairly valued

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.