The Boeing Company

Weekly Valuation – Valutico | January 12, 2024

Sky Shocker

A routine Alaska Airlines flight escalated into a high-altitude drama when a Boeing 737 Max 9’s cabin panel detached at 16,000 feet. While the incident resulted in no severe injuries, it has renewed the focus on the 737 Max series‘ history of safety issues.

Market Turbulence

Boeing’s shares experienced a significant drop of 10.5% in response to the incident, reflecting deep investor concerns stemming from the 737 Max’s history. Similarly, Spirit AeroSystems, responsible for the jet’s fuselage, also saw a decline in its stock value.

Trouble in the Air

More than just an isolated incident, this event is part of a series of challenges for Boeing, including technical issues and major accidents in the past. This history has led to extended groundings and substantial financial settlements for Boeing, affecting its public image and financial standing.

“We’re gonna approach this, number one, acknowledging our mistake. We are gonna approach it with 100% and complete transparency every step of the way.”

– Dave Calhoun, CEO of Boeing on 737 Max 9 investigations

Valutico’s View

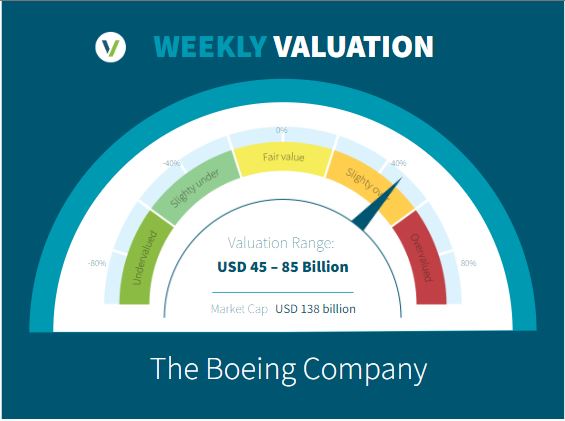

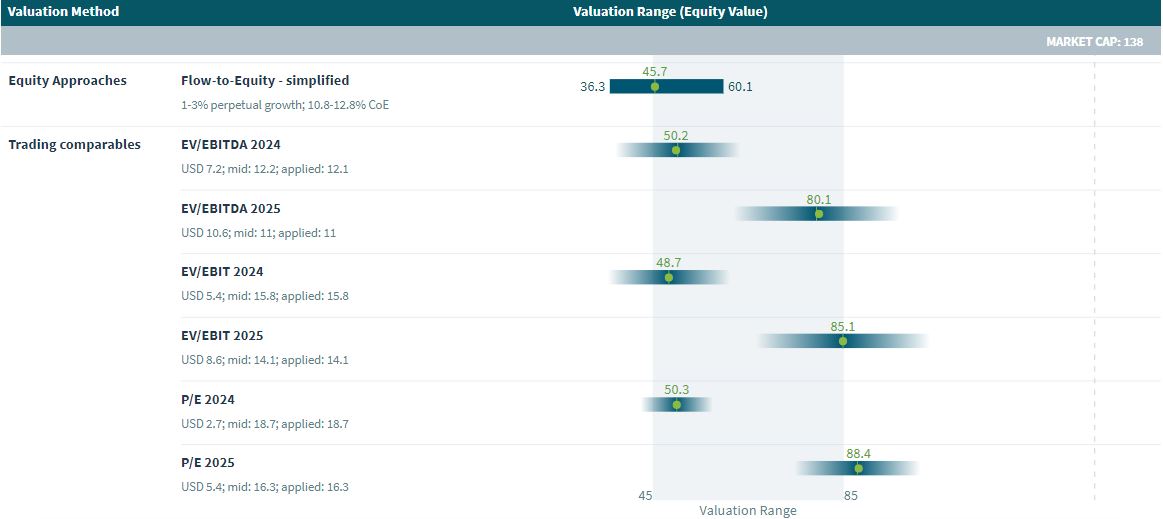

Valutico’s analysis post-incident offers a contrasting picture of Boeing’s valuation. The DCF valuation stands at USD 45 billion, while Trading Comparables suggest a range of USD 50-90 billion, indicating a potential market overvaluation. This variance highlights Boeing’s market share as a significant factor in its market valuation.

Conclusion

The recent incident with the Alaska Airlines Boeing 737 Max 9 goes beyond temporary disruption, posing significant questions about Boeing’s commitment to safety and its long-term market position. The company’s response to this situation, particularly in light of the financial insights provided by Valutico, will be crucial in defining Boeing’s role in the competitive aerospace market.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.