Valutico Launches Method to Value Companies with Stable Earnings

- Popular Valuation platform announces launch of new method for valuing businesses with stable earnings

- Favored by business brokers, the capitalized earnings method is often used to help determine a valuation in the selling and buying of businesses

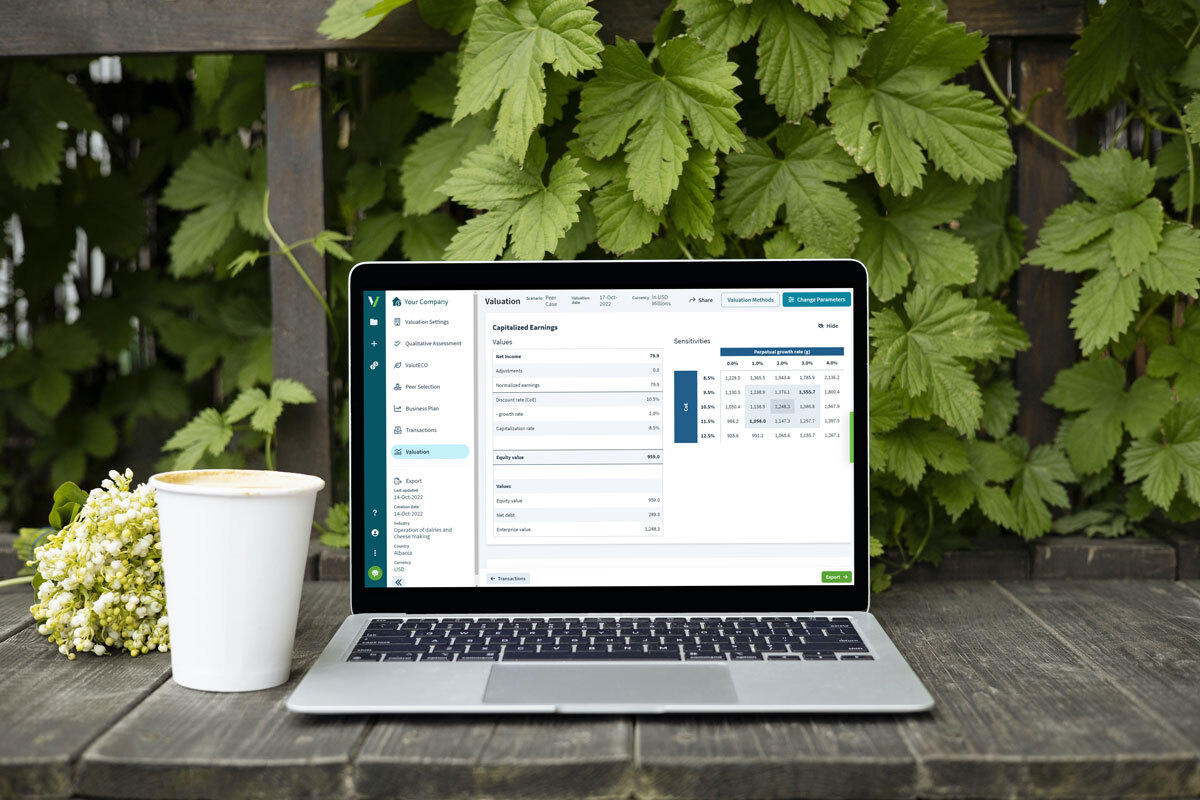

Valutico has today launched has today launched its latest product offering: the Capitalized Earnings Method, developed to value companies with stable earnings. This new announcement means financial professionals can now adopt this method within Valutico’s streamlined digital tool.

Following increasing demand, Valutico’s adoption of the Capitalized Earnings Method is expected to be especially welcomed in the US, Canada and Australia, where the method is particularly popular, and the announcement may prove compelling for business brokers who often use this assessment in support of the sale of sole proprietor businesses.

The Capitalized Earnings approach is a so-called ‘intrinsic’ valuation method, and is sometimes considered a simplified version of the common Discounted Cash Flow (DCF) analysis, involving fewer assumptions about the future cash flows of the business. In particular, it relies more on historical earnings to help determine a value, rather than the analyst’s subjective financial projections. It is widely used by valuation practitioners across the US and Canada, as well as in Australia, India and other regions of the world.

Following Valutico’s announcement, a once highly labor-intensive and complex process has been significantly simplified for Valutico’s users, meaning a real impact for the finance firms relying on the platform in more than 70 countries around the world.

The Capitalized Earnings Method is featured alongside eight other leading valuation techniques within Valutico, including different variations of the aforementioned DCF, as well as trading and transaction comparables, and the recently released Venture Capital (VC) method for valuing startups.

Paul Resch, Founder & CEO, states:

«We’re once again thrilled to announce yet another valuation method in our platform, with our integration of the popular Capitalized Earnings Method. We are proud to add this approach to our growing selection, and we know that this new feature, alongside many other recent developments, is going to serve our growing user base well. This expansion is a great example of us listening closely to our customer’s demands, to create a powerful product the market needs.»