Nike Inc

Weekly Valuation – Valutico | 13 September 2022

About Nike

NIKE Inc. is a US sports equipment manufacturer that is one of the world’s best-known suppliers in the industry. Its business activities focus on the design, development and distribution of high-quality sports equipment.

How is Nike Performing?

With a turnover of $46.7 billion, Nike most recently generated an annual net profit of $6.05 billion. Nike will publish its latest quarterly results on 3 October 2022.

These figures show an improvement from the dip experienced during the COVID pandemic, however the company is facing severe macroeconomic headwinds. Inventory levels are at historically high levels due to the consumer environment for discretionary spending on athletic footwear and apparel being severely constrained. Factors such as skyrocketing inflation, increasing interest rates and a strengthening USD are putting pressure on earnings. In addition, the general economic slowdown in Europe, teetering on the brink of recession, will continue to deteriorate Nike’s earnings due to its large exposure to the region.

P/E

The current price-earnings ratio (P/E) is 28.8x, which means, for every dollar of Nike’s profit, the stock market pays 28.8 dollars to own a share. To give this some context, the global «Textiles, Apparel and Luxury Goods» sector currently trades at a 12.8x P/E. Furthermore, competitors such as Adidas (21.2x) and Puma (23.4x) are trading at lower multiples which suggests that Nike is overvalued.

Valutico Analysis

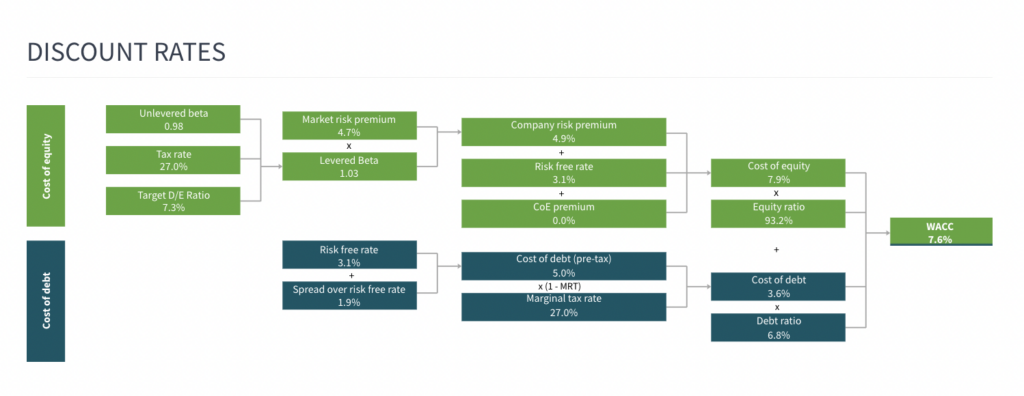

Nike currently has a market cap of $174 billion. We have performed a discounted cash flow analysis, based on analyst expectations and with a WACC of 7.6%, which produced a valuation result of $122 billion.

Applying the observed trading multiples of the list of comparable peers, produced a valuation range of $75 to $113 billion, resulting in our concluded valuation range of $85 to $120 billion. The high end of this range is 32% below the current market cap, and we therefore conclude that Nike is overvalued.

Click here for the detailed valuation