Dr. Ing. H.C.F. Porsche AG

Weekly Valuation – Valutico | 17 October 2022

About Porsche

The Dr. Ing. H.C.F. Porsche AG is well known all over the globe for its sports and luxury cars, especially for its legendary Porsche 911. The company had its IPO just recently where it achieved an issue price of €82.5 per share, the top end of its target range. This led to a market cap of €78 billion after the IPO, which is higher than the current market capitalization of its parent company Volkswagen AG (€72 billion).

Recent Financial Performance

In terms of results Porsche had a very successful financial year. The company achieved sales of €33.1 billion, which was an increase of 16% year-on-year. It sold 301,000 cars in 2021, an 11% improvement compared to the prior year. Profit before tax increased by 30% to €5.7 billion, showing a continuation of the robust performance achieved during the challenging economic conditions of 2020 when it grew profit before tax by 8%.

Porsche’s Future Goals

To remain well positioned for the future, Porsche developed their ‘strategy 2030’. In this paper the company indicated their intention to drive the change for a sustainable world, meaning a CO2 neutral value chain. Furthermore, the firm has the target to preserve its high profitability by maintaining a Return on Sales ratio of more than 15% and a Return on Investment ratio of more than 21%. The recent IPO should help them to reach these ambitious goals as their increased autonomy allows them to make faster decisions to remain competitive.

Valutico Analysis

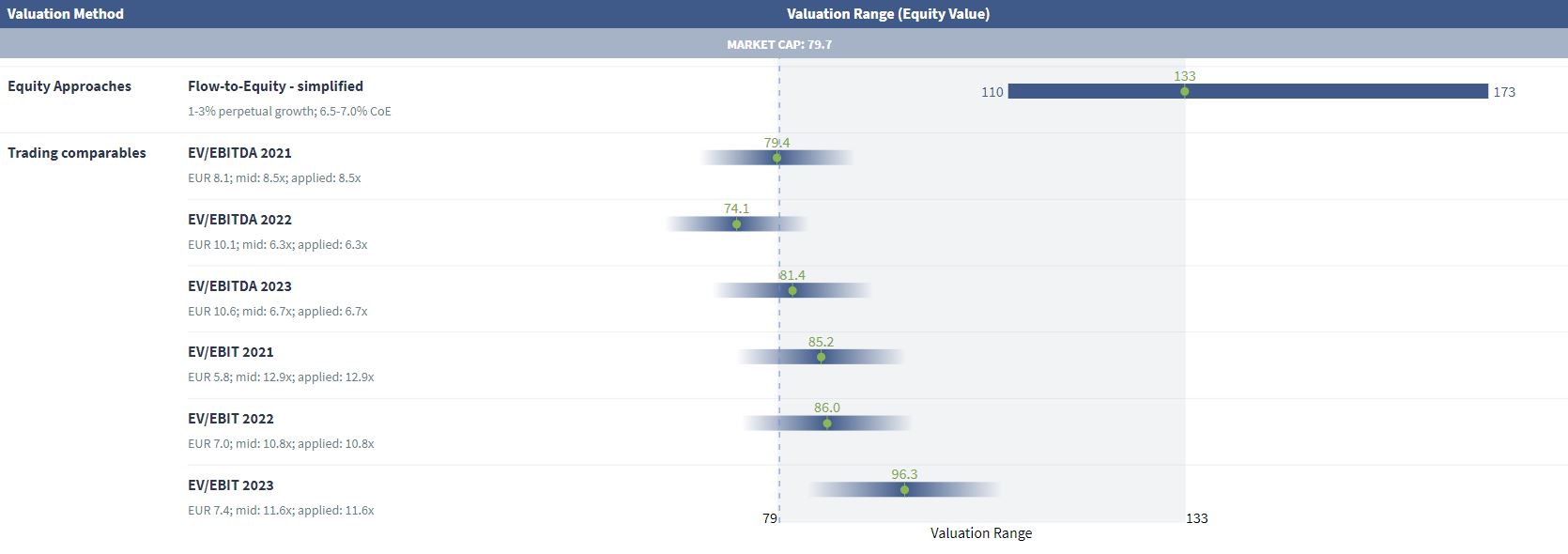

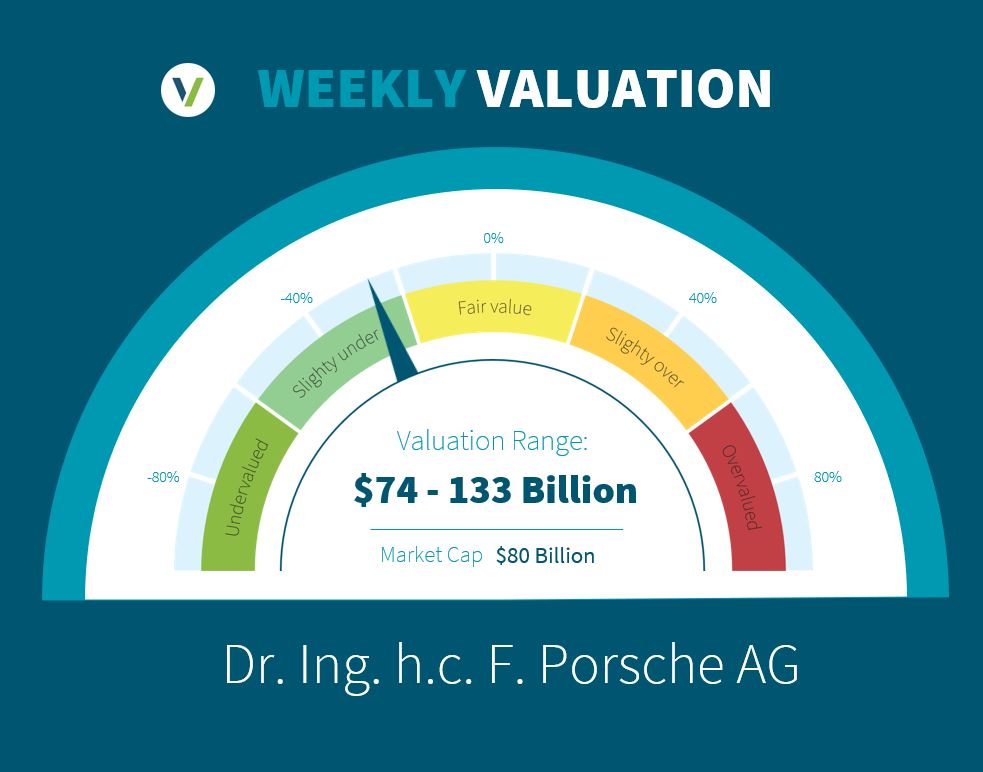

We have performed a Trading Comparables analysis and a discounted cash flow using the Flow to Equity Approach. In the former, we compared Porsche with peers such as BMW, Mercedes-Benz, Ferrari and Ford using the EV/EBITDA and the EV/EBIT multiples. Our result suggests a valuation range of €74 billion to € 96 billion.

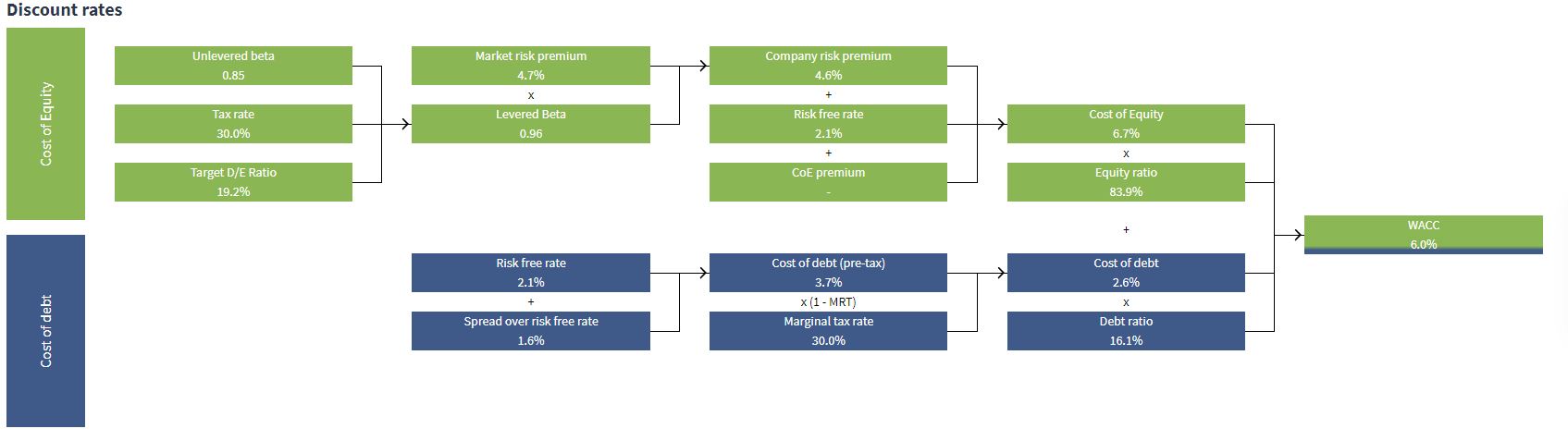

Our Flow to Equity analysis on the other hand suggests that Porsche is undervalued. We arrived at a value of €133 billion using a Cost of Equity of 6.7%.

We conclude at an overall valuation range of €74 billion to €133 billion which, compared to the current market cap of €80 billion, implies that Porsche is slightly undervalued.