Home Depot Inc.

Weekly Valuation – Valutico | 21 November 2022

About Home Depot

Home Depot is a US-based home improvement retailer, with over 2,300 stores across North America. The firm employs roughly 500,000 people and had sales of $151.2 billion in 2021. Since the Covid-19 outbreak, the company has performed very well, largely due to increasing demand from do-it-yourselfers.

Recent Financial Performance

The company reported its financial results last week, with revenue in Q3 climbing by 5.6% year-on-year to $39 billion, slightly outperforming analyst expectations of $38 billion. Profit rose by 5% to just over $4.3 billion. Diluted earnings per share were $4.24, which is 8% higher than in the last year.

Home Depot also reaffirmed its positive outlook for the end of the year. The company is targeting a sales increase of about 3%. Operating profit margin is expected to be around 15.4% and management expects diluted earnings per share to grow by a mid-single-digit percentage.

Strategic Outlook

Home Depot wants to extend its position as a low-cost provider for home improvement products. The company has the goal to consistently grow its market share and ultimately reach sales of $200 billion in the next few years. This target should be accomplished by increasing the market share not only in their consumer segment but also by selling more products to professionals.

Share Price Performance

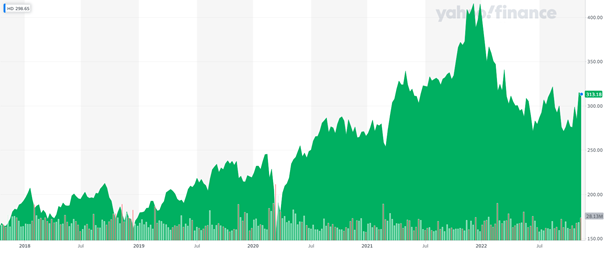

Despite a -21% performance in 2022 to date, Home Depot’s share price gained 64% over the past five years, with particularly good performance during the 2020-2021 COVID years. It achieved an all time high of $415 in December 2021 and is currently trading at $314 per share with a market cap of $319 billion.

The Home Depot five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3Gsb5G4.

Valutico Analysis

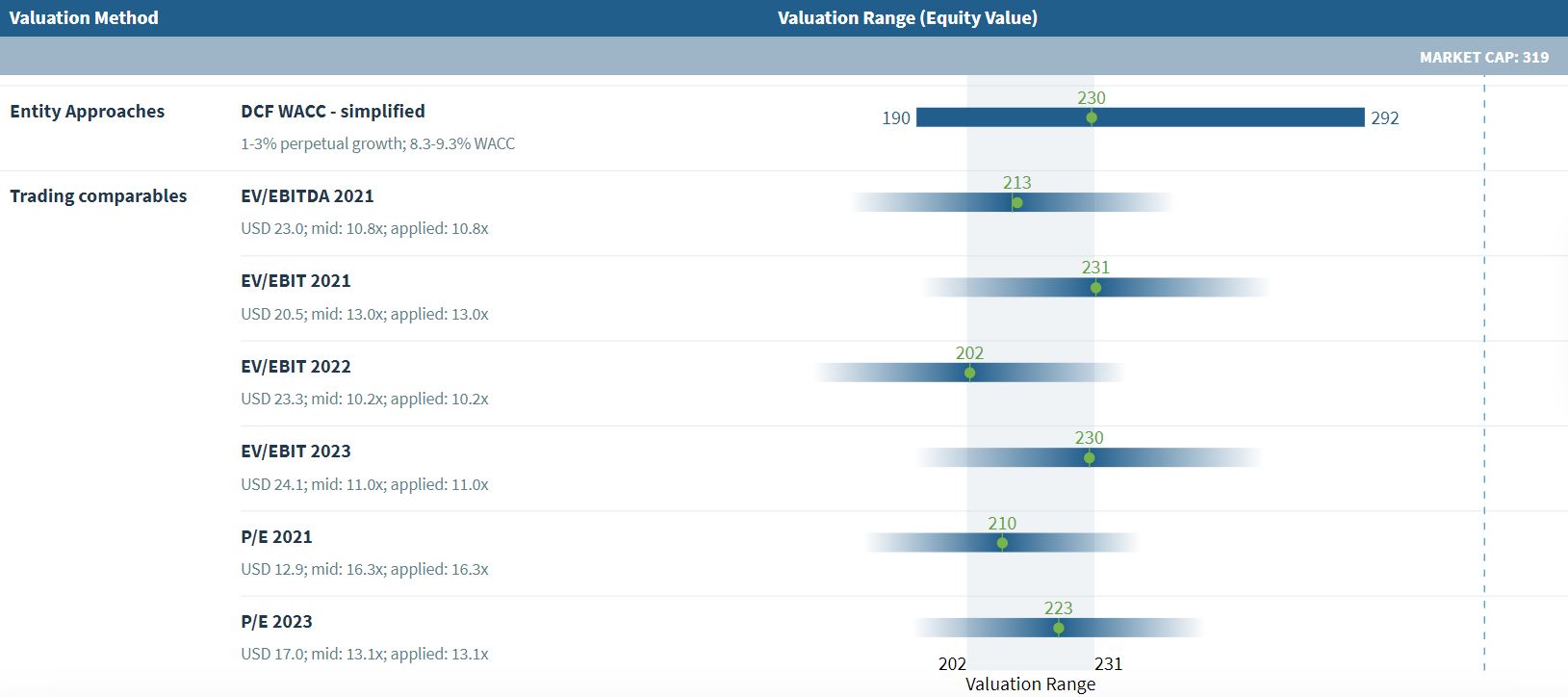

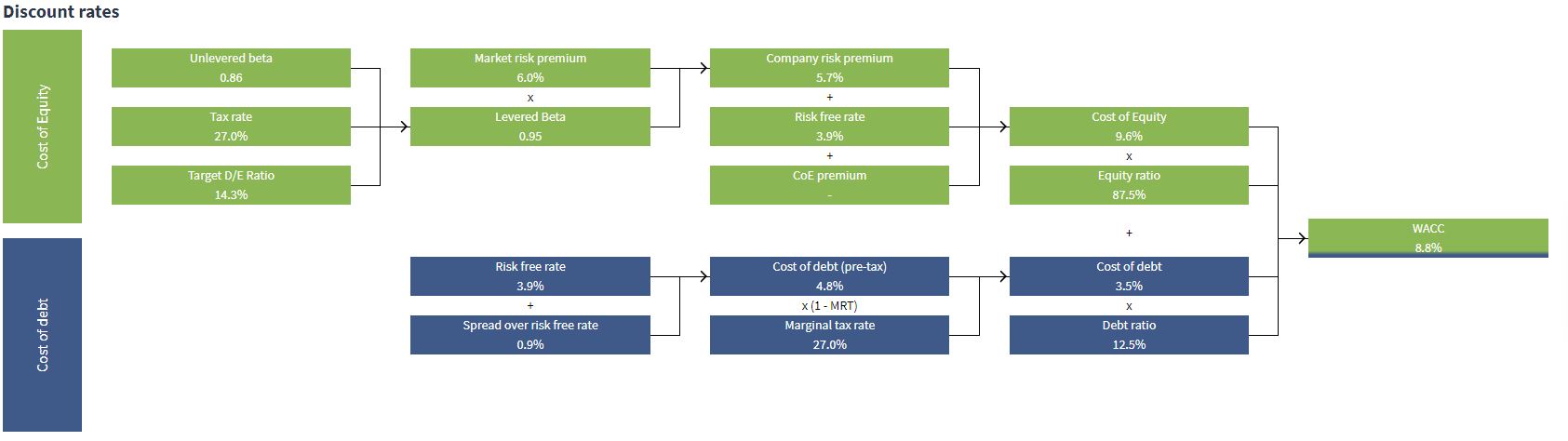

Home Depot was analyzed by using the Discounted Cash Flow method, specifically our DCF WACC approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of $230 billion, with a WACC of 8.8%.

The Trading Comparables analysis resulted in a valuation range of $202 billion to $231 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers in the US and Europe, such as Lowe’s, Kingfisher and LL Flooring.

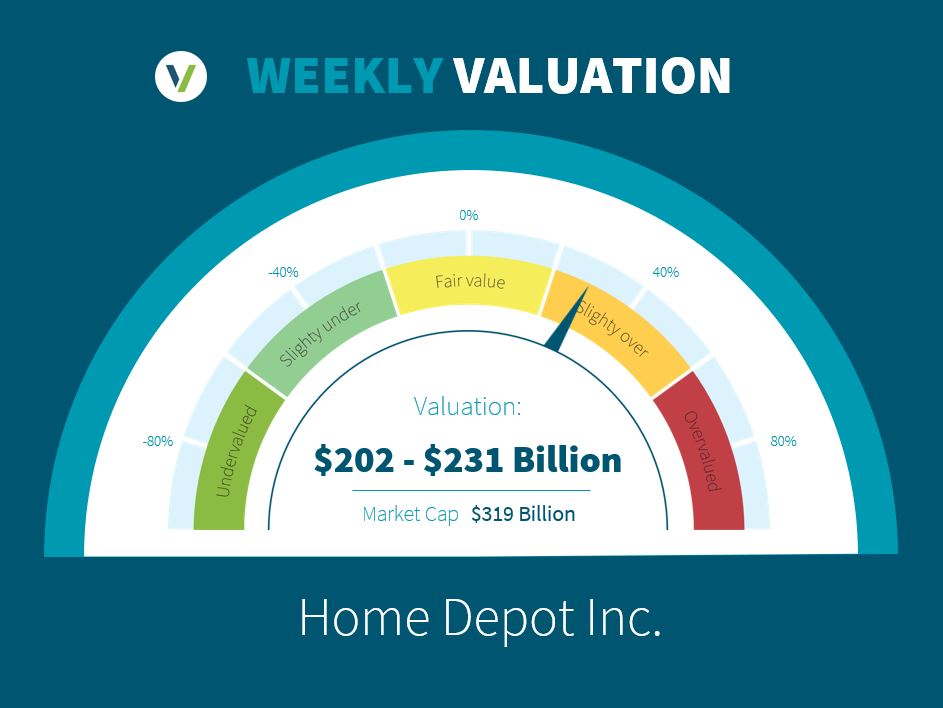

By combining the value of our DCF WACC and Trading Comparables analysis we produced a value range of $202 billion to $231 billion. In comparison to Home Depot’s market capitalization of $319 billion we suggest that the company is overvalued. This pessimistic valuation can be attributed to analysts’ expectations of slowing growth rates (dropping from 14% currently to ~2% over the next three years) .

Will the DIY trend continue and result in continued good performance or will Home Depot’s sales growth slow significantly and analysts be proven correct?

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.