Salesforce Inc.

Weekly Valuation — Valutico | 6 December 2022

About Salesforce

Salesforce is a US-based software company, specializing in customer relationship management technologies. The market leader for CRM software is currently trading at around $133 per share, down more than 50% from its all-time-high of $300 per share, achieved in November 2021.

Recent Financial Performance

Last week’s third quarter earnings call began with a big surprise as the co-CEO Bret Taylor announced that he is departing after just one year in the role. He played a major role in the $27.1 billion acquisition of Slack in 2020. Salesforce announced total revenue of $7.8 billion, an increase of 14% compared to Q3 in 2021. Operating Margins increased and earnings per share exceeded analyst expectations by 14.5% as they reported EPS of $1.40.

Share Price Performance

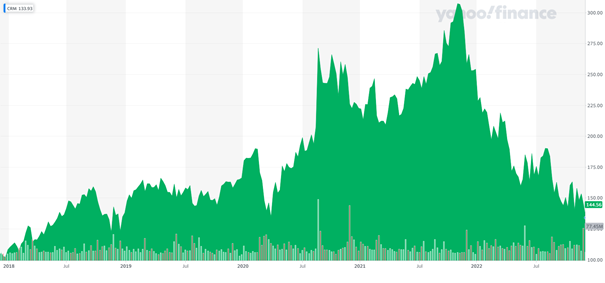

Over the last five years, the Salesforce share price rose dramatically to achieve an all-time-high of $300 per share in November 2021. Over the last twelve months, however, the stock price halved. The current price of $133 represents a market capitalization of $145 billion. At the current level Salesforce has a P/E ratio of 100x and an EV/EBITDA ratio of 47x for 2022. Salesforce experienced a terrible year financially in 2022, which explains these very high multiples. This was mainly driven by operating expenses growth exceeding sales growth and thus putting strain on EBITDA margin. However, analysts think that EBITDA margins will improve drastically next year to exceed 2021 figures and therefore the one-year forward P/E and EV/EBITDA multiples are 29x and 22x respectively. This expected improvement is also in line with the views of investment bank JP Morgan, as they proposed a target price of $200 per share and classified the stock as overweight.

Salesforce’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3F99jHH.

Valutico Analysis

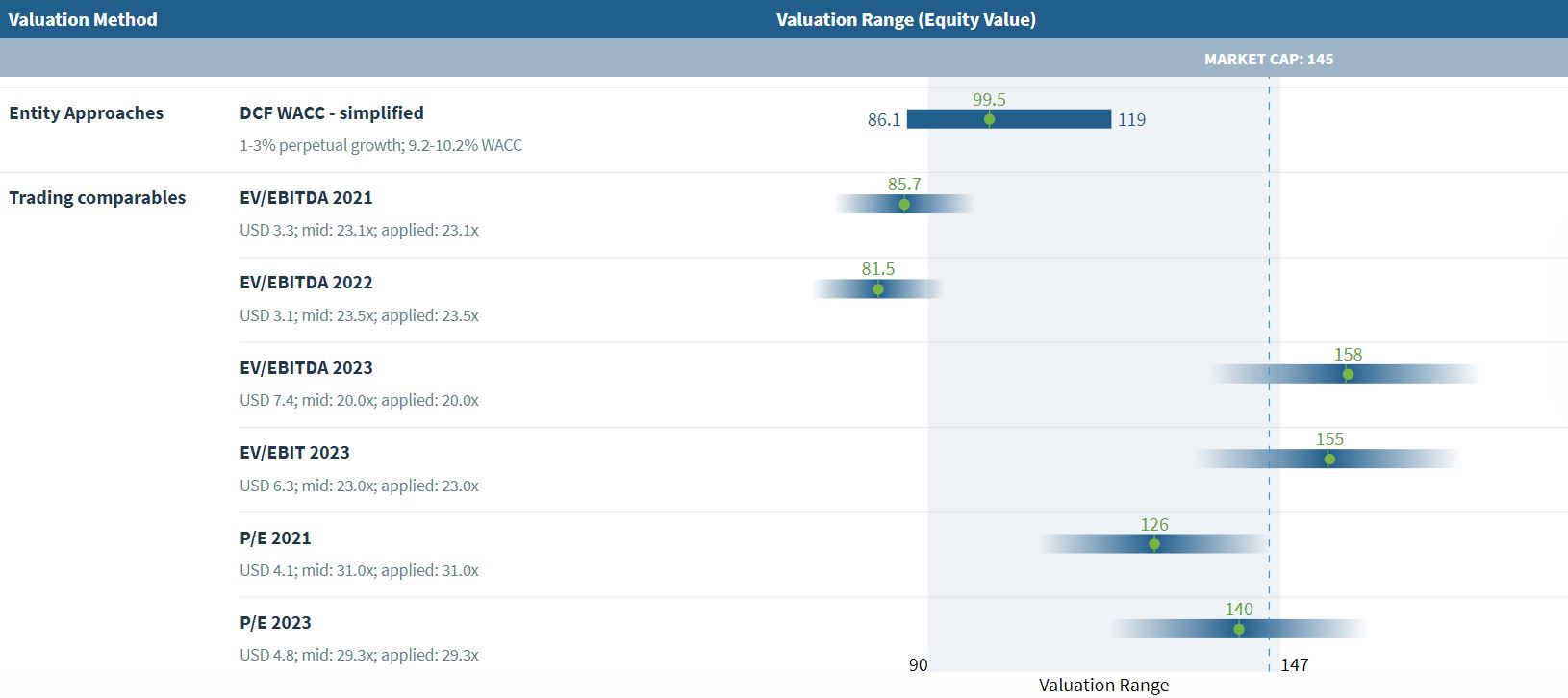

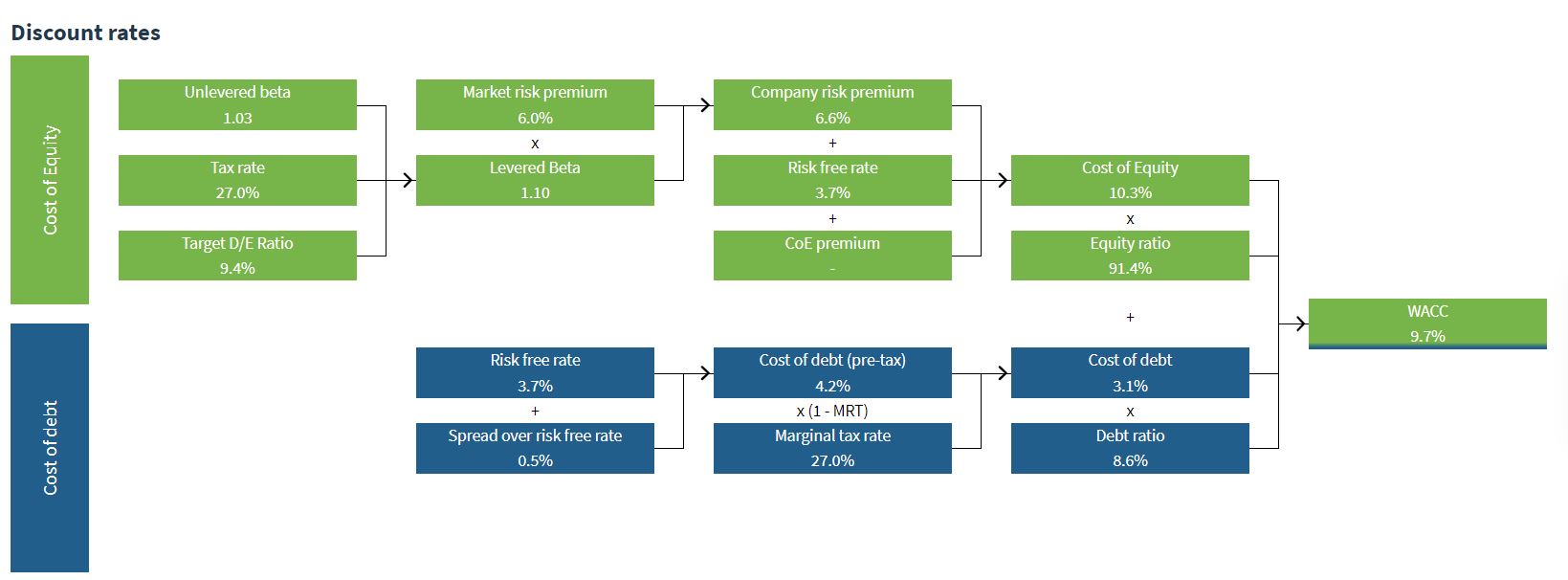

We analyzed Salesforce by using the Discounted Cash Flow method, specifically our DCF WACC approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of $99.5 billion using a WACC of 9.7%.

The Trading Comparables analysis resulted in a valuation range of $81 to $158 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as SAP and Microsoft.

Combining the value of our DCF WACC and Trading Comparables analysis resulted in a value range of $81 billion to $158 billion. In comparison to Salesforce’s market capitalization of $145 billion we suggest that the company is fairly valued.

Do you think Salesforce can reach JP Morgan’s price target or will the share price continue to decline in the near future?

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.