Sea Ltd.

Weekly Valuation – Valutico | 17 January 2023

Abstract digital background. Big data code matrix. 3d

About Sea Ltd.

Sea Ltd. is a tech company from Singapore focusing on e-commerce and gaming. The company has a leading position in the Southeast Asian market with their e-commerce platform Shoppee and their gaming offers by Garena. Furthermore, under the brand of SeaMoney, the company offers a digital payment solution. Sea currently has a market capitalization of $29.8 billion, which is 86% down from its all time high of $214 billion.

Recent Financial Performance

In November 2022 Sea published their third quarter results. Revenue for the group increased by 17% to $3.2 billion compared to last year. However, the company is still not profitable as its net loss was $373.5 million which was an improvement of 34% compared to 2021’s third quarter. Revenue from the e-commerce division and SeaMoney was $1.9 billion and $327 million respectively, up 39% and 141% year-on-year. The gaming division’s revenue only increased by $8 million, but lost 51 million quarterly active users, which could be the first sign of future declining sales for Garena.

Striving for profitability

The management team around CEO Forrest Li is working on its main goal of becoming profitable soon and has even waived its salary until this point is reached. Analysts expect this to happen in the 2024 financial year. The company has made great strides towards profitability, sacrificing its high growth in Shopee along the way. However, once profitability is achieved, management intends to push growth on this platform again.

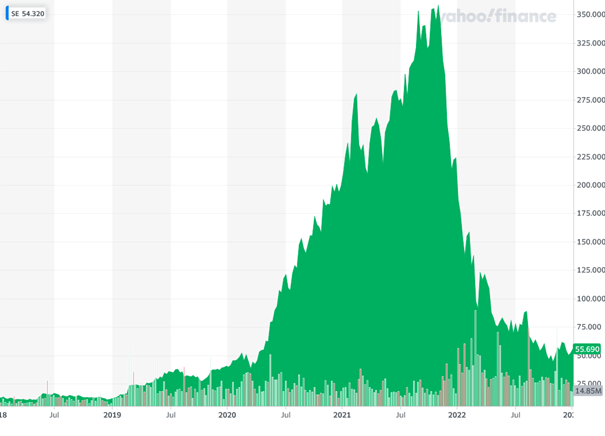

Share Price Performance

After a breathtaking performance for one and a half years starting in 2020, the company suffered a dismal few months. As market sentiment changed globally during 2022, Sea Ltd. was heavily penalized on the stock market for failing to achieve profitability while sales growth declined. The stock plunged by 86% from $360 per share to the current $50 per share.

Sea’s five-year share price chart is shown below:

Source: Yahoo Finance: https://yhoo.it/3GPOiTh

Valutico Analysis

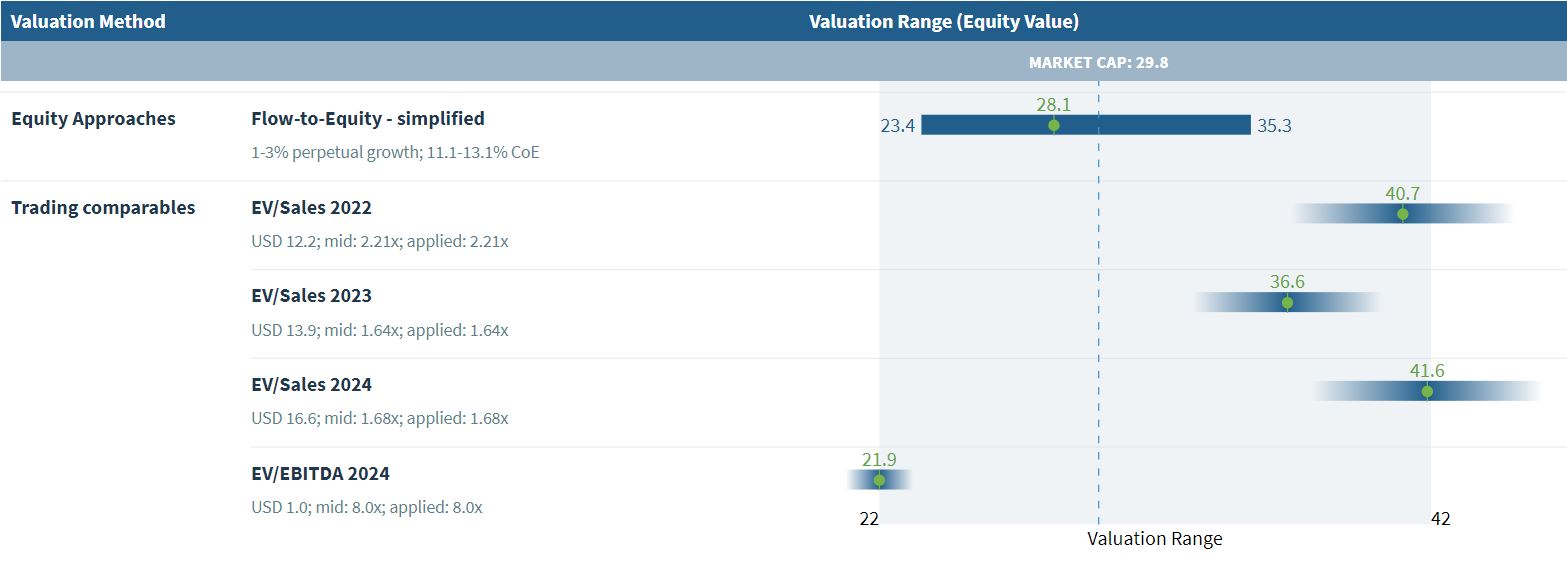

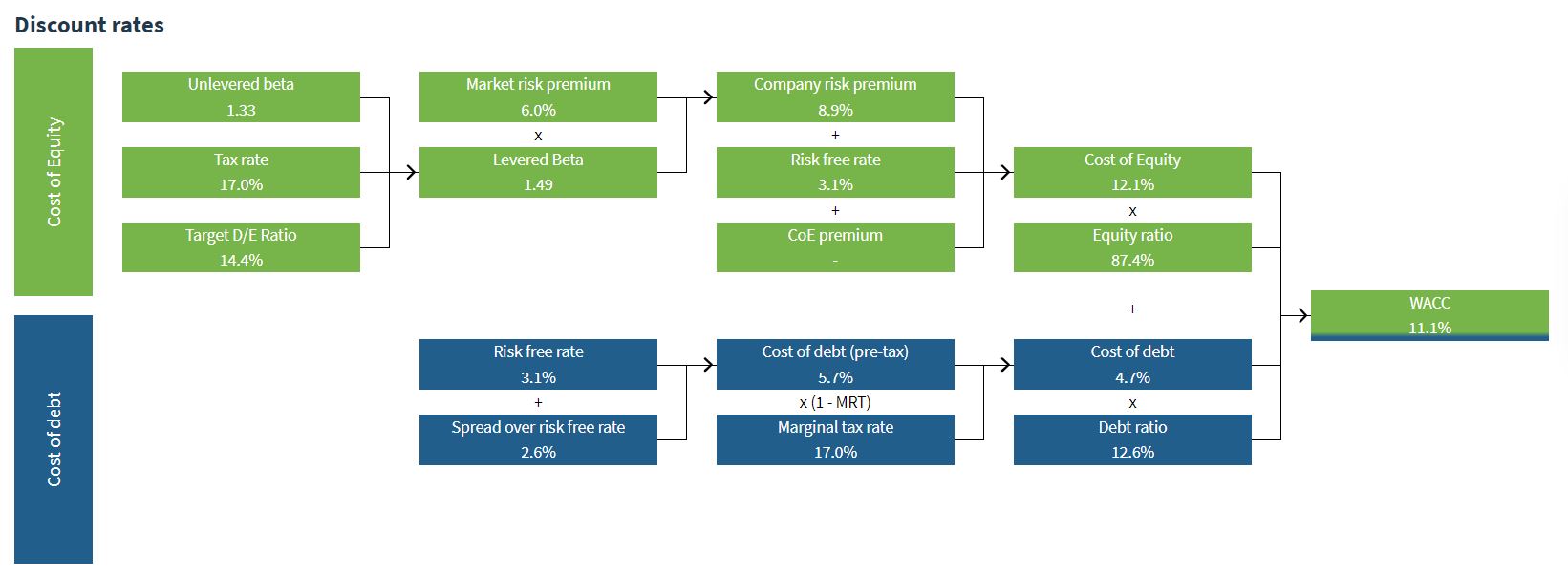

We analyzed Sea Ltd. by using the Discounted Cash Flow method, specifically our Flow-to-Equity approach, as well as a Trading Comparables analysis. The Flow-to-Equity analysis produced a value of $28.1 billion using a Cost of Equity of 12.1%.

The Trading Comparables analysis resulted in a valuation range of $21.9 billion to $41.6 billion by applying the observed multiple EV/EBITDA for 2024 and EV/Sales. Due to the company being loss-making, P/E multiples could not be applied. For our Trading Comparables we selected similar peers such as Tencent, Alibaba and NetEase.

Combining our Flow-to-Equity and Trading Comparables analysis resulted in a value range of $22 billion to $42 billion. In comparison to Sea’s market capitalization of $29.8 billion we suggest that the company is fairly valued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.