ABB Ltd.

Weekly Valuation – Valutico | 28 November 2022

About ABB

ABB is a Swiss-based technology company, active in the fields of electrification, robotics, automation and motion with software. The company has now been in existence for more than 130 years and operates in over 100 countries. ABB was recently in the media spotlight for announcing a CHF 200 million private placement of their E-Mobility unit.

Recent Financial Performance

ABB has increased its sales and profits in the third quarter, while also reporting higher order intake. ABB’s order intake rose 4% to CHF 7.9 billion, the company said in its third-quarter press release. Sales rose 5% to CHF 7.1 billion while operating profit rose 16% to CHF 1.1 billion with EBIT margin increasing to 16.6% from 15.1% a year earlier. Net income, on the other hand, fell 45% to CHF 345 million due to a larger provision. This provision amounts to CHF 306 million and is the settlement for the corruption scandal of its South African power plant project Kusile which is operated by Eskom. The company already paid over CHF 100 million in settlement in this matter in 2020.

IPO of E-Mobility Division

The IPO of ABB’s E-Mobility division was planned for mid-2022 but has been delayed due to unfavorable market conditions. The intention is still to take the E-Mobility division public in the short term. In the meantime ABB has raised CHF 200 million in a private placement. Interogo Holding’s equity strategy fund, the family office Moyreal and Michael Halbherr, chairman of ABB E-Mobility, are participating in the private placement. ABB retains a 92% stake in the company. The valuation for this division could therefore amount to CHF 2.5 billion at the IPO which is now planned for the second half of 2023. The funding will be used primarily to invest in charging infrastructure for electric vehicles in Europe.

Share Price Performance

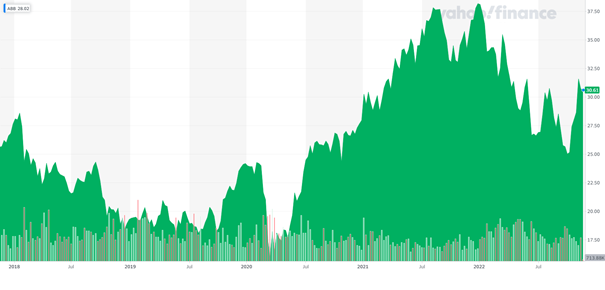

Over the last five years, the ABB share price has had its ups and downs with a five-year total performance of 22%. ABB performed particularly well in the COVID years 2020-2021, almost doubling its share price during this period. Currently the company is trading at CHF 30 per share with a market capitalization of CHF 56.1 billion. At this level the dividend yield is 2.8%.

ABB’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3tLW7TF.

Valutico Analysis

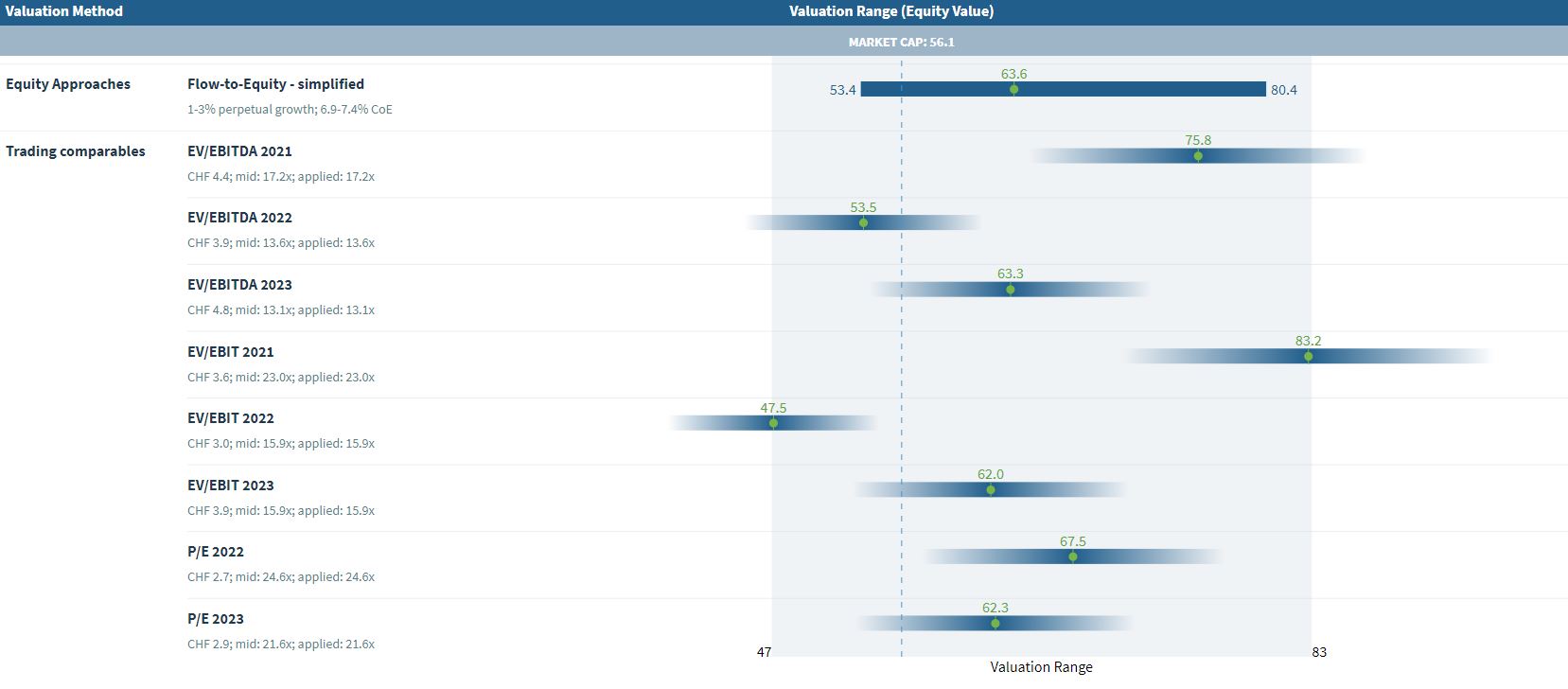

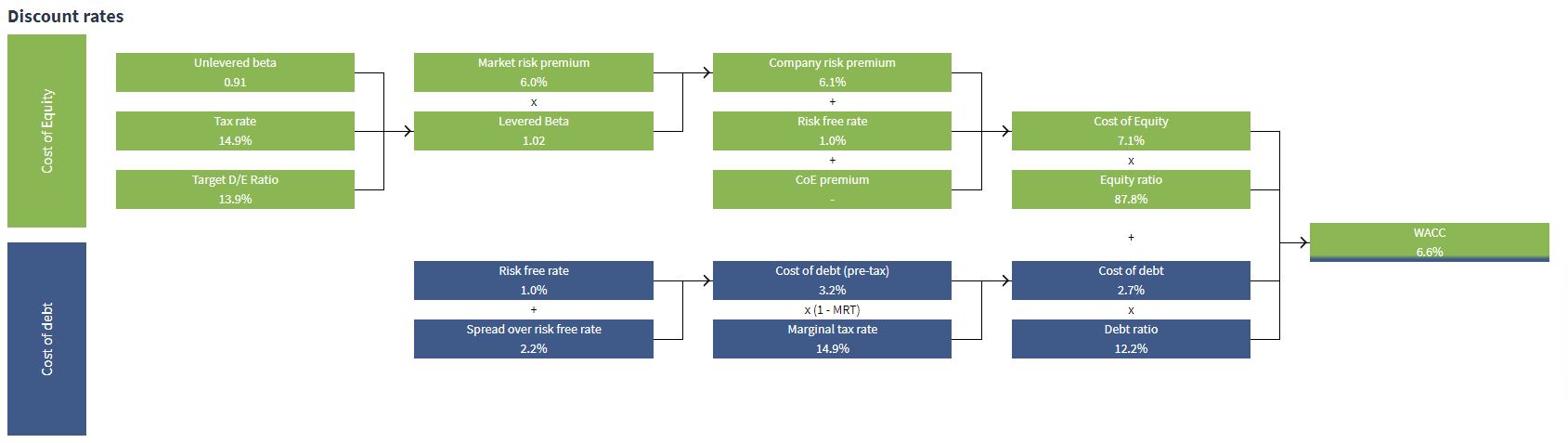

We analyzed ABB by using the Discounted Cash Flow method, specifically our Flow to Equity approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of CHF 63.6 billion using a Cost of Equity of 7.1%.

The Trading Comparables analysis resulted in a valuation range of CHF 47 to 83 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Schneider Electric and Siemens.

By combining the value of our DCF WACC and Trading Comparables analysis we produced a value range of CHF 47 billion to CHF 83 billion. In comparison to ABB’s market capitalization of CHF 56.1 billion we suggest that the company is fairly valued to slightly undervalued.

Will the IPO of the E-Mobility division unlock some value for ABB shareholders?

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.