Oracle Corporation

Weekly Valuation – Valutico | 27 December 2022

About Oracle Corporation

Oracle Corporation is a multinational technology company that specializes in developing and marketing computer hardware systems and enterprise software products, particularly its own database management systems and cloud-engineering services. The company has grown to become one of the world’s largest technology companies, with more than 430,000 customers in over 145 countries.

Recent Financial Performance

Oracle Corporation recently announced its fiscal 2023 second quarter results, reporting total quarterly revenues of $12.3 billion, up 18% year-over-year. The company’s cloud services and license support revenues were also up 14% to $8.6 billion. Net income for the quarter was $1.7 billion. Oracle had strong overall revenue growth of 25% driven by the company’s infrastructure and applications cloud businesses, which grew 59% in constant currency.

$9 Billion Pentagon Deal

In 2019 the Pentagon gave a cloud computing contract to Microsoft. However, Amazon successfully sued the Pentagon, as it was not clear if the Trump administration favored Microsoft in the awarding of the contract and therefore it had to be re-tendered. The new bidding process was finalized at the beginning of December, and it was decided that the four tech giants Amazon, Google, Microsoft, and Oracle would be awarded up to $9 billion. This contract specifies that the Pentagon can involve an indefinite number of services for a certain period of time. No further details are known about the time period and actual scope of the work.

Share Price Performance

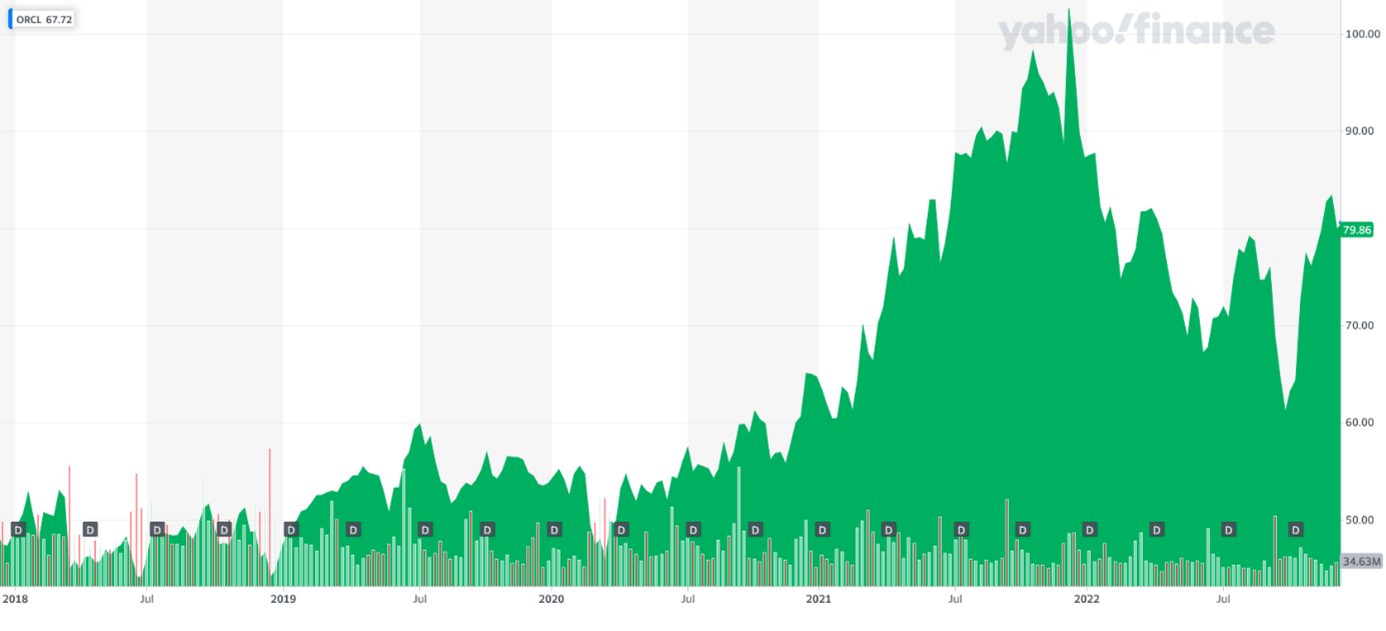

Over the past five years, Oracle Corporation has experienced strong share price growth. The company’s share price was $45 at the beginning of 2018 and has since surged by over 100% to reach an all-time high of $102 by the end of 2021. Despite a dip to $60 per share at the end of September this year, Oracle’s stock has quickly recovered on the back of strong quarterly results and is currently trading at $80 per share. This represents an annual return of 15.6% over the last five years, corresponding to a total performance of 78%.

Oracle’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3j1qMue.

Valutico Analysis

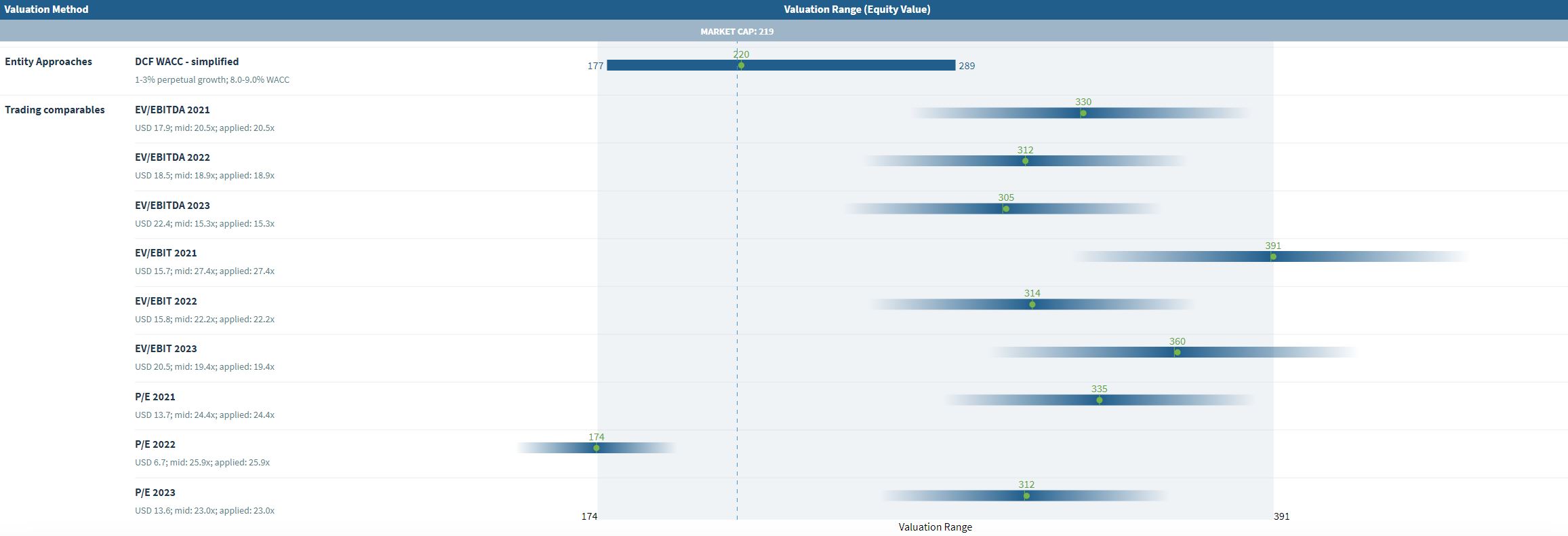

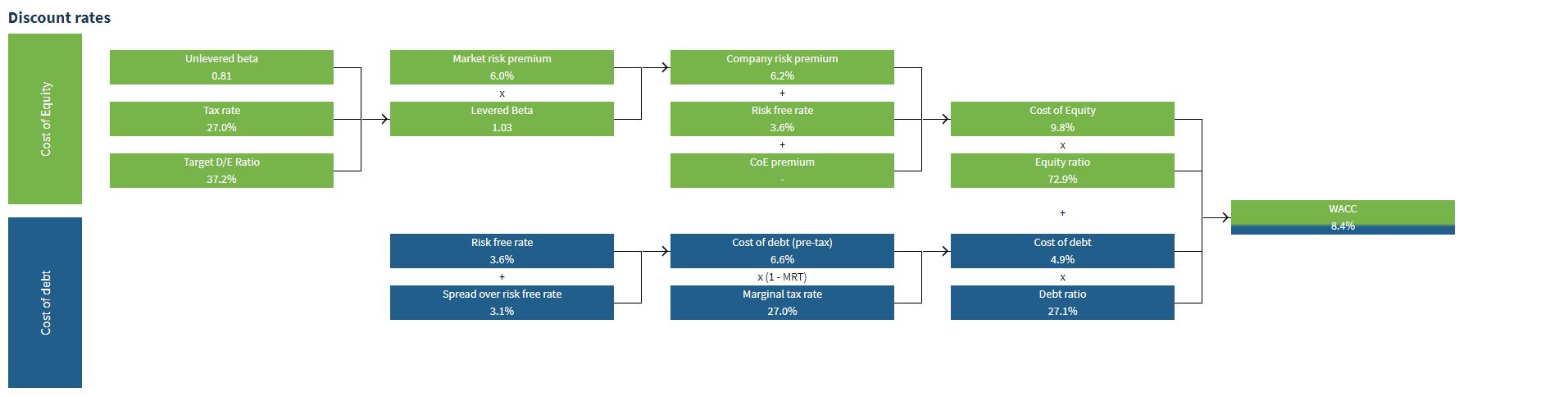

We analyzed Oracle Corporation by using the Discounted Cash Flow method, specifically our DCF WACC approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of $220 billion using a WACC of 8.4%.

The Trading Comparables analysis resulted in a valuation range of $174 billion to $391 billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Microsoft, SAP and IBM.

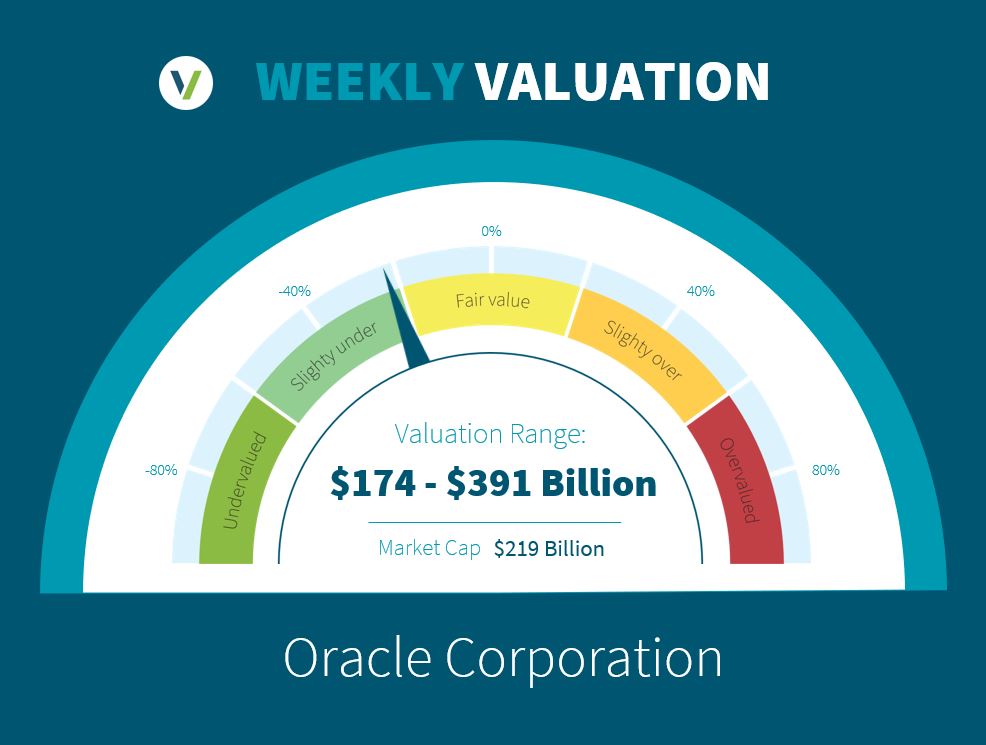

Combining the value of our DCF WACC and Trading Comparables analysis resulted in a value range of $174 billion to $391 billion. In comparison to Oracle’s market capitalization of $219 billion we suggest that the company is slightly undervalued.

The recent Pentagon contract award and strong financial performance have positioned Oracle well to potentially surpass its all-time high from last year. Do you think we will see new highs on the stock market from Oracle soon?

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.