Tencent Holdings Ltd

Weekly Valuation – Valutico | 5 January 2023

About Tencent Holding

Tencent is a multinational technology company specializing in online advertising, entertainment, and artificial intelligence. Tencent’s product portfolio includes messenger services such as WeChat and QQ, but also famous video games like PUBG, and League of Legends. The company has a strong presence in the technology sector and has made strategic investments in emerging technologies such as artificial intelligence and cloud computing.

Recent Financial Performance

Despite facing negative growth for the first time in its history, Tencent managed to keep its operating margin stable at 29% in 2022, resulting in a quarterly profit of HKD 45.8 (5.9 USD) billion in the third quarter. This was achieved despite sales falling by 3% in the second quarter and a further 2% in the third quarter, bringing total annual sales to HKD 156.8 (USD 20.1) billion.

Reopening of China

The Chinese government’s decision to lift Covid 19 restrictions in December will lead to a resurgence of tourism and a revival of the country’s economy. Supply chains and factories that were previously disrupted or closed are now up and running again, which will benefit Tencent as most of its revenue comes from China.

New Publishing Licenses for Video Games

Last week, Tencent received good news when the Chinese government released new publishing licenses for video games for the first time since April 2022. A total of 44 foreign video games were approved for import, with six of these licenses awarded to Tencent. This is the first time in 18 months that the company has been granted a license to import foreign video games. This could be a sign that restrictions on the distribution of these licenses are being loosened, which would be beneficial for Tencent as about 30% of its revenue comes from video games.

Share Price Performance

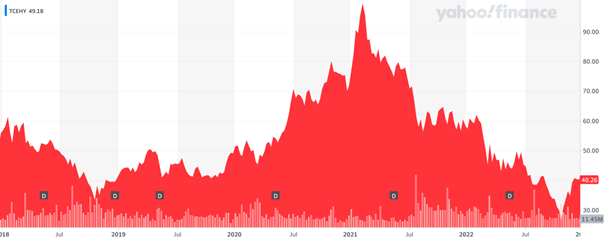

Tencent Holdings has experienced ups and downs in the stock market over the past five years. In 2020, the company reached an all-time high of USD 100 (HKD 780) per share, thanks to a net income margin of 33% and strong sales growth of 28%. However, sales growth slowed to 16% in 2021 and is expected to be -1% in 2022, contributing to a sharp decline in the share price to USD 25 (HKD 195) in October 2022. The recent receipt of new gaming licenses and the reopening of China provides hope for future growth, bolstering the share price to its current level of USD 40 (HKD 312).

Tencent’s five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3GsI5O5.

Valutico Analysis

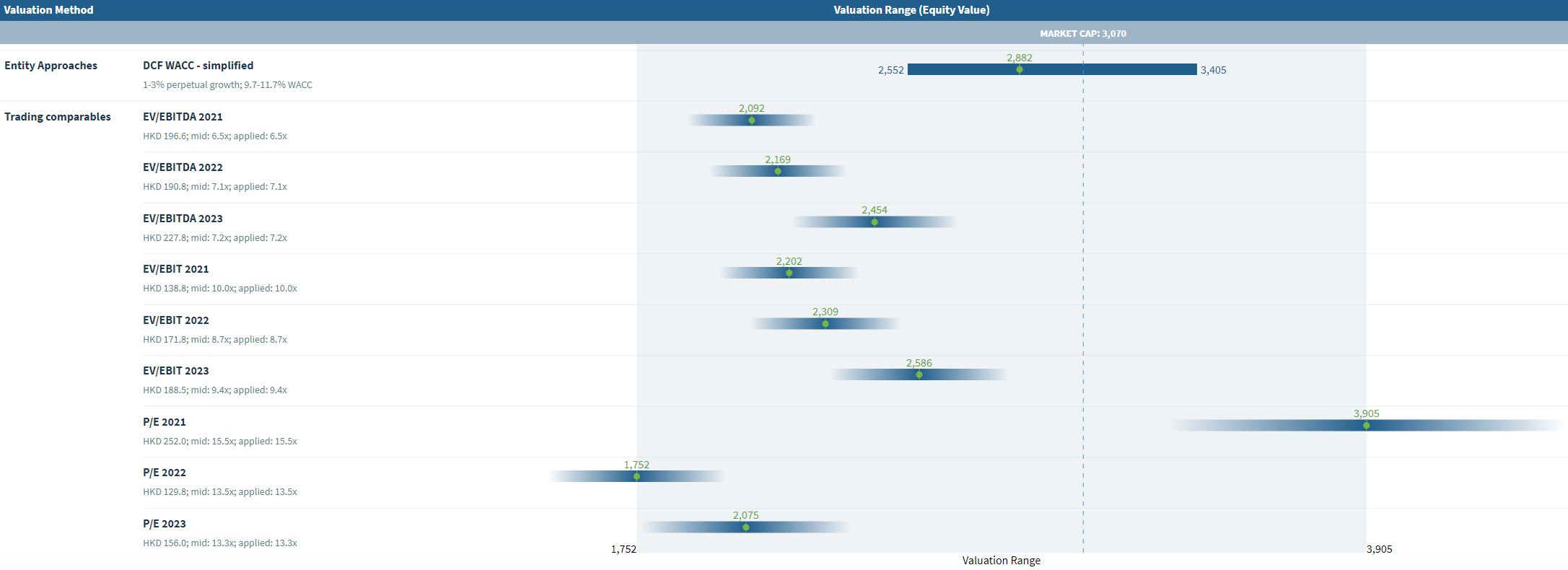

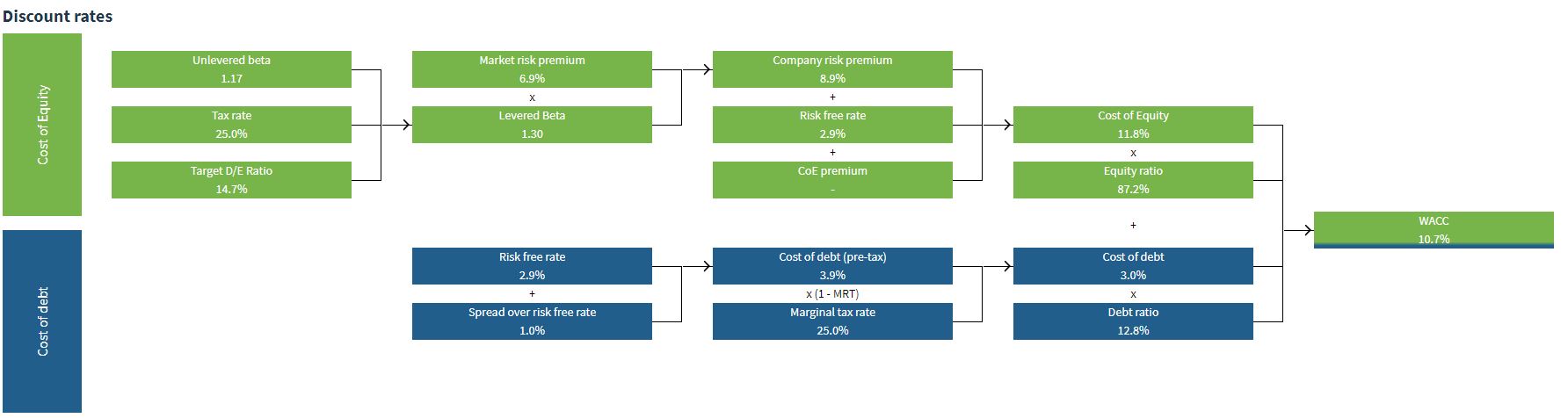

We analyzed Tencent Holdings by using the Discounted Cash Flow method, specifically our DCF WACC approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of HKD 2,882 (USD 369.8) billion using a WACC of 10.7%.

The Trading Comparables analysis resulted in a valuation range of HKD 1,752 (USD 221.5) billion to HKD 3,905 (USD 501) billion, by applying the observed trading multiples EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as Alibaba, NetEase and Meta Platforms.

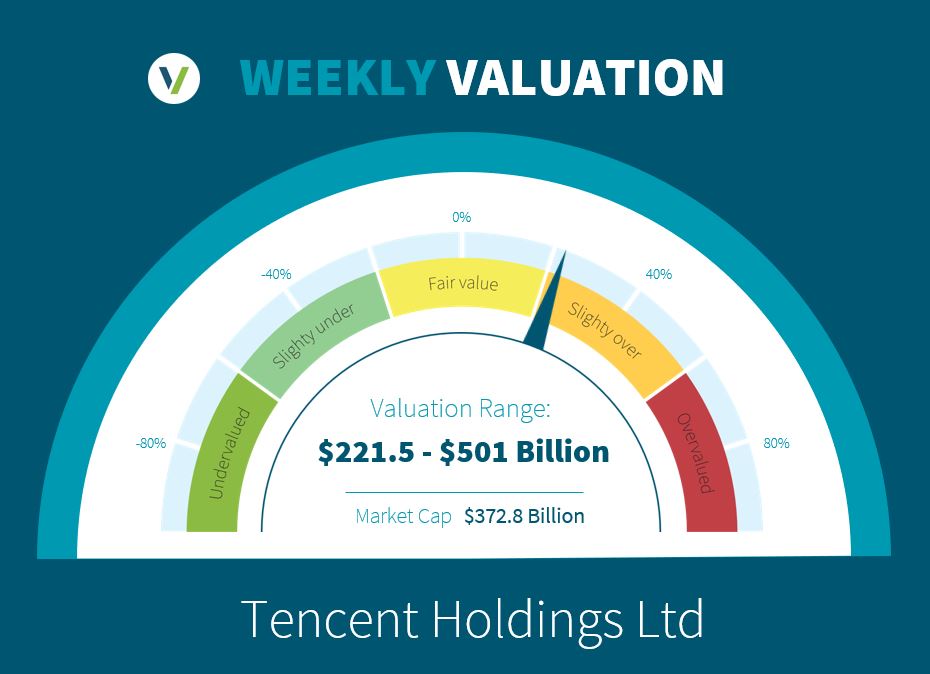

Combining the value of our DCF WACC and Trading Comparables analysis resulted in a value range of HKD 1,726 (USD 221.5) billion to HKD 3,905 (USD 501) billion. In comparison to Tencent’s market capitalization of HKD 3,070 (USD 386.6) billion we suggest that the company is slightly overvalued.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.