Kraft Heinz Company

Weekly Valuation – Valutico | April 21 2023

About the company

Incorporated in 2015, The Kraft Heinz Company (KHC) is a leading American multinational food company with co-headquarters in Chicago and Pittsburgh. It was formed by merging two renowned entities, Kraft Foods and H.J. Heinz Company. KHC stands out as the fifth-largest food and beverage company worldwide, and third-largest in North America. The company boasts eight iconic brands with revenue of more than $1 billion.

Recent M&A deals

KHC has been making headlines with strategic moves like acquiring Cerebos Pacific in 2018 and selling off assets such as its Indian nutritional beverage and Canadian natural cheese businesses in 2019. In addition, the company partnered to produce Kraft and Velveeta cheeses and sold part of its cheese business to Lactalis for $3.2 billion in 2020. While expanding its portfolio in 2021 and 2022 with acquisitions like Brazil’s Hemmer condiment and sauce company and an 85% stake in Germany’s Just Spices GmbH, the company has also recently agreed to sell its Russian baby food business to Chernogolovka. This move allows local firms to capitalize on the departure of Western brands.

Recent Financial Performance

Kraft Heinz reported a 1.7% increase in net sales to $26.5 billion, with organic net sales up 9.8% in the last year . However, volume/mix declined 3.4%, with declines in both reportable segments primarily driven by supply constraints and elasticity impacts from pricing actions. Net income increased 131.3% to $2.4 billion, driven by lower interest expense and lower non-cash impairment losses, offset by lower Adjusted EBITDA, an accrual related to the securities class action lawsuit, and higher supply chain and commodity costs. Adjusted EBITDA decreased 5.8% to $6.0 billion.

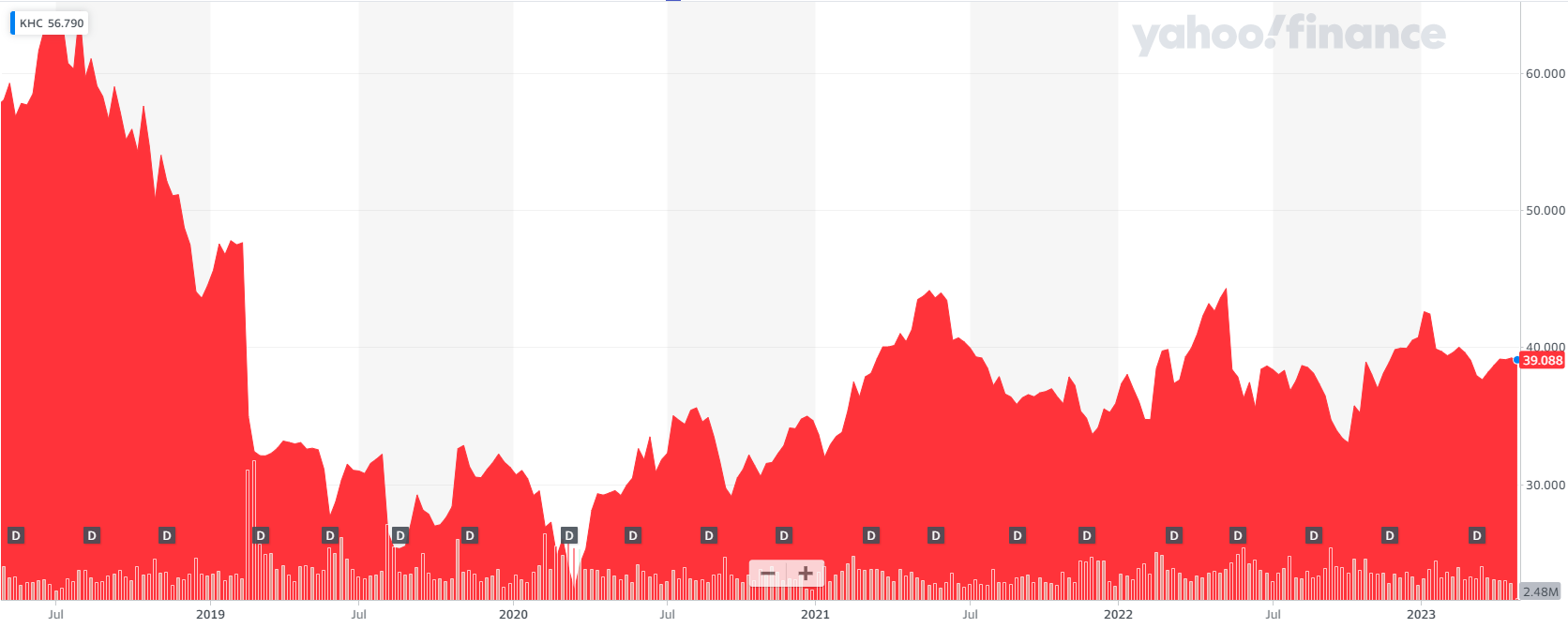

Share Price Performance

KHC’s heavy debt load following its merger in 2015 was lightened by the pandemic’s increased demand for food, lower interest costs, and opportunities for divestment. Despite a flat operating performance in 2021, the company successfully reduced its net debt to $22 billion. The company’s stock price has fluctuated between $35 and $45 over the past year, with its current trading price at $39.08 per share.

Five-year share price chart is shown below:

Source: Yahoo Finance, https://yhoo.it/3V1pfmA

Valutico Analysis

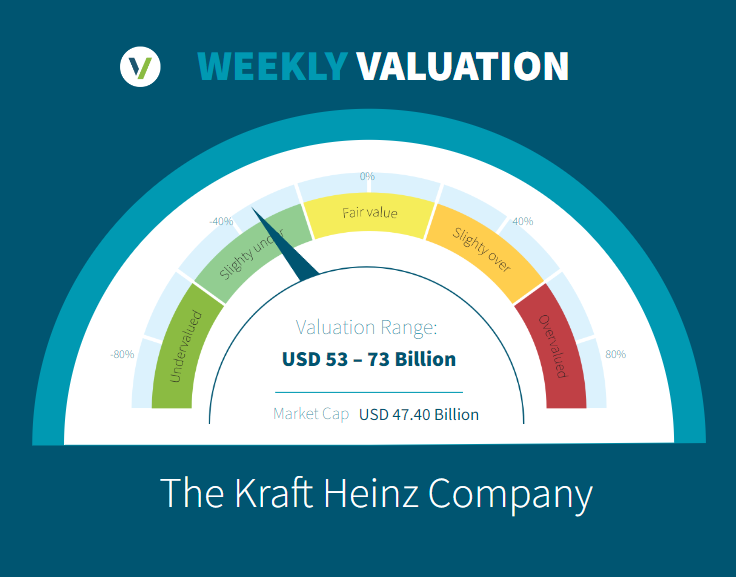

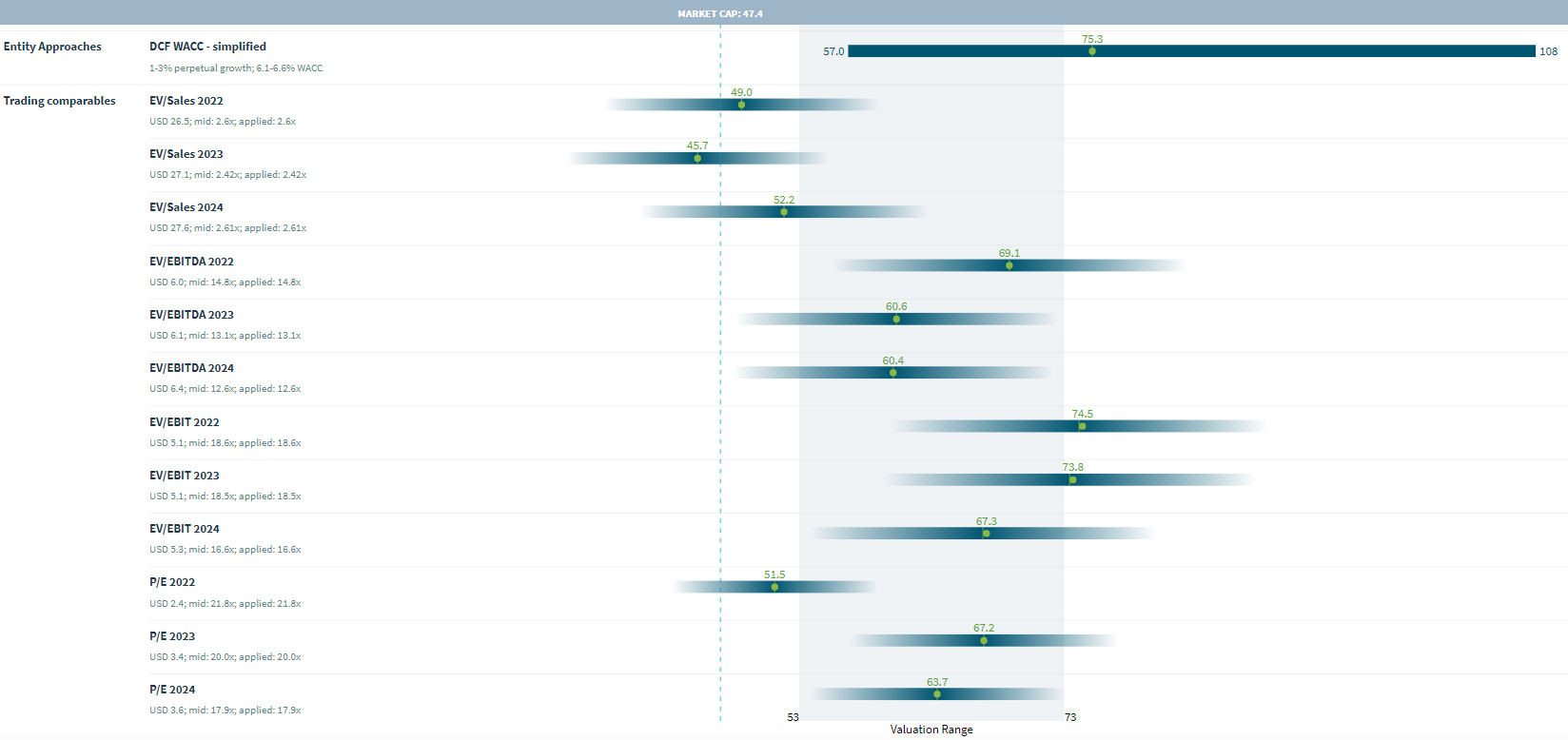

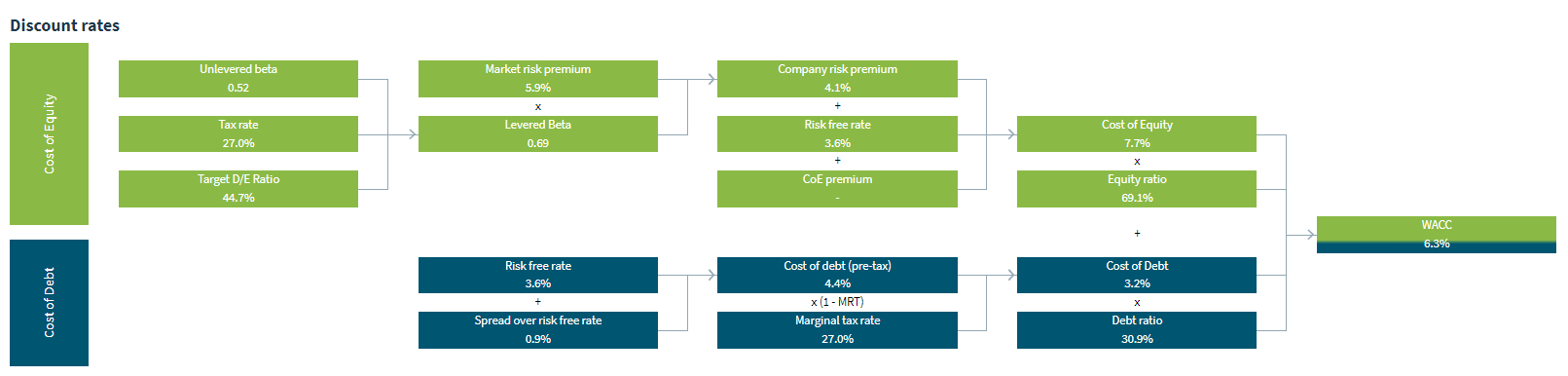

We analyzed KHC by using the Discounted Cash Flow method, specifically our DCF WACC approach, as well as a Trading Comparables analysis. The Discounted Cash Flow analysis produced a value of USD 75.3 billion using a WACC of 6.3%.

The Trading Comparables analysis resulted in a valuation range of USD 45.7 billion to USD 74.5 billion by applying the observed trading multiples EV/Sales, EV/EBITDA, EV/EBIT and P/E. For our Trading Comparables we selected similar peers such as The Hain Celestial Group, Inc., The Simply Good Foods Company and Campbell Soup Company.

Combining our DCF WACC and Trading Comparables analysis results in a valuation range of USD 53 billion to USD 73 billion. In comparison to Kraft Heinz Company market capitalization of USD 47.4 billion we suggest that the company is undervalued. Could the KHC share price break out of its recent sideways trading pattern to the upside to reflect its intrinsic valuation? Let us know in the comments.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. None of the information contained herein constitutes a solicitation, offer or recommendation to sell or buy any financial instrument.